5 Signs Of Anxiety

Anxiety signal

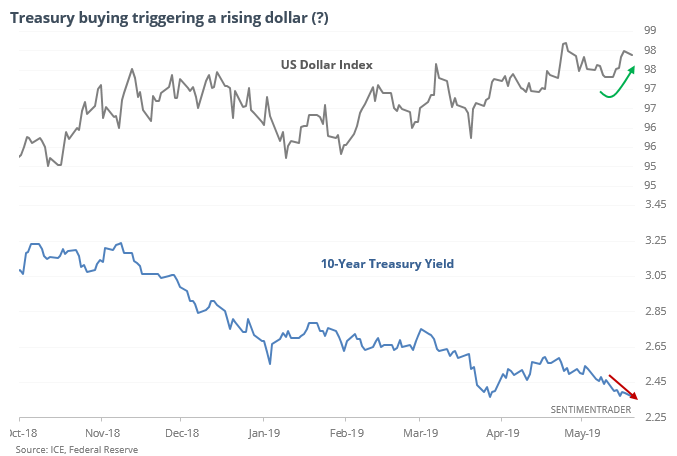

While stocks have struggled, bonds and the dollar have both been rising. Whether one is helping the other is beside the point – primarily it suggests nervousness on the part of investors.

When those two markets have behaved like this over the past 40+ years, stocks have usually enjoyed above-average returns, as did bonds. The dollar did not.

Anxiety part deux

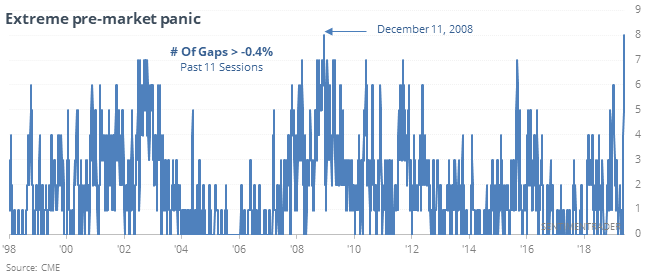

Futures traders continue to sell stocks outside regular trading hours, creating the most concentrated cluster of large negative opens in history, tied for December 2008.

Relative to what investors have become used to over the past year, it’s showing a near-record level of anxiety. Anxiety is also evident in VIX “fear gauge” options activity. Traders have turned over more than 1 million contracts per day. Most impressive was the low risk for stocks in the months ahead. The futures didn’t lose more than 6.7% at any point in the next three months, while gaining more than that 10 times.

Lower speculation

The Options Speculation Index took a big dive last week as the smallest of options traders increased their put buying. Per the Backtest Engine, when small traders spent 24% or more of their volume buying put options, the S&P rallied over the next month 83% of the time, averaging 3.6%.

Planting seeds

Optimism on corn has been extremely low, but the grain has since cycled from a 6-month low to a 6-month high in only 6 sessions, by far the fastest ever. Three other times it did so within three weeks, two leading to 20% gains within 2 months.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.