A 4th Straight Gap Up

Another morning, another gap up.

In yesterday's report, we noted the few other times S&P 500 futures had gapped up several days in a row and to a new high. Early buyers are coming in again and driving the futures to yet another gap up opening.

If we exclude the idea that stocks are trading at new highs, this kind of buying behavior is still highly unusual.

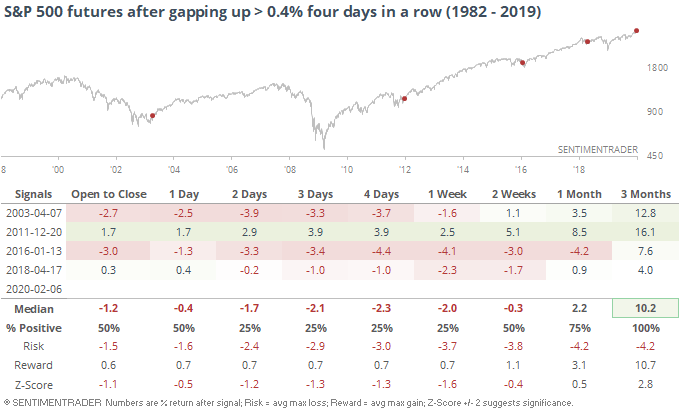

Four consecutive gaps up of at least 0.4% (about where futures are now trading) has only happened four other times since 1982. Returns in the table below are as of the open on the day of the 4th gap up open (i.e. today's open).

We can see that only one of them proved to be a "gap and go" with uninterrupted upside in the days and weeks ahead. That was coming out of a period of extreme pessimism, however, which is very much unlike what we're seeing now.

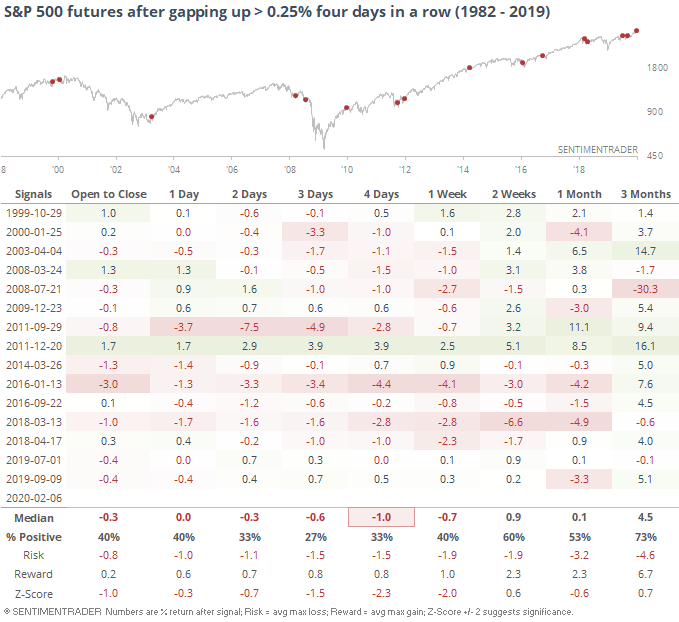

That sample size is tiny, so if we lessen the gap amount and look at four straight gaps of +0.25% or more, then we get the following.

A larger sample, but pretty much the same results. Buying into the 4th gap up open was a rare winner, and risk was high. Essentially the only time in history it proved to be a good idea was that one time in December 2011.

Markets are doing all kinds of rare things at the moment, so maybe this will add to the pile. It hasn't been a good bet, though.