A "Bearish" Pattern As Traders Flee Dollar Funds

This is an abridged version of our Daily Report.

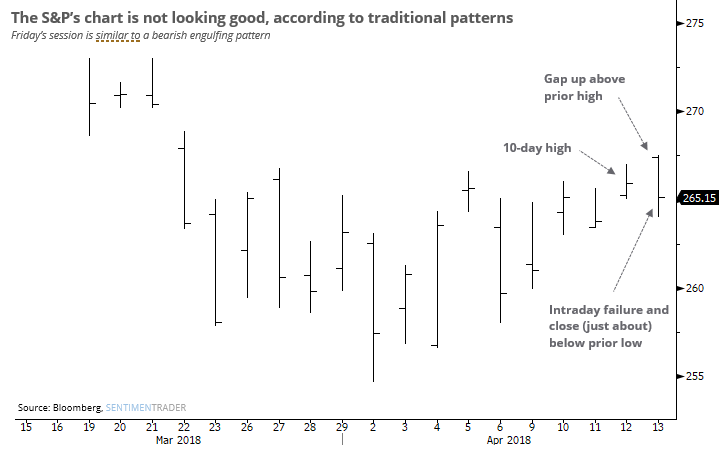

“Bearish” engulfing

The price pattern in the S&P does not look promising, according to textbook technical analysis. Friday arguably was a bearish engulfing pattern that suggests weak buying interest and eager sellers.

It has not been a successful reason to sell, with stocks rising over the next two weeks essentially every time.).

Dollar apathy

Investors have fled mutual and exchange-traded funds that bet on, or hedge against, a rising dollar. Assets in the funds are trading at or near a 7-year low. Traders have also fled currency-hedged ETFs that bet on the performance of other countries while hedging against a rise in the buck.

Big bank bust

Among the most positive knee-jerk reactions to earnings was JP Morgan, which gapped up above its prior high and looked ready to challenge its 52-week high.

The latest Commitments of Traders report was released, covering positions through Tuesday.

Most contracts saw “smart money” hedgers reducing previous extremes. The 3-year Max/Min Screen shows a new 3-year extreme in hedgers’ short exposure in the British pound and VIX futures.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |