A big divergence in riskier stocks

For months, we've seen that sentiment has oscillated around extreme levels of optimism, yet stocks were holding firm. Not just the popular indexes, but most stocks, industries, sectors, even global markets.

That has started to shift in recent days.

It's too early to tell whether this can morph into something larger, but already there are splits that we haven't seen for a long time. As Bloomberg noted, around 80% of S&P 500 members are still holding above their 50-day moving averages, but within the Nasdaq Composite and Russell 2000, it is a vastly different story.

Going back more than 25 years, there has never been a day - until yesterday - when 80% of S&P 500 members were above their 50-day averages at the same time so few Nasdaq and Russell members were above their own averages. This is the widest such divergence in available history.

With Wednesday's rally, the picture didn't change much. The S&P had more than 85% of stocks above their 50-day averages, while both the Nasdaq Composite and Russell 2000 had fewer than 50% of members above their 50-day. That's never happened before.

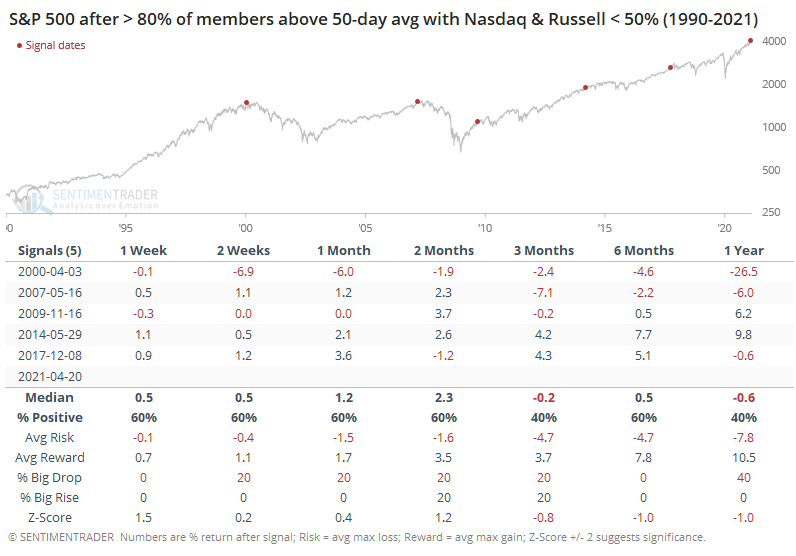

To get a larger sample size, we have to relax the parameters. The table below shows each instance when 80% or more S&P members were above their averages, while fewer than 50% of Nasdaq and Russell members were above theirs.

The overall results aren't too bad, but this is one of those times when the chart tells a better story than the numbers. It's pretty clear from the dots on the chart that these conditions wiped out any further gains in the S&P in the months. How long it took varied, from immediately to half a year, but it happened every time. Granted, the sample size is small but the message was consistent.

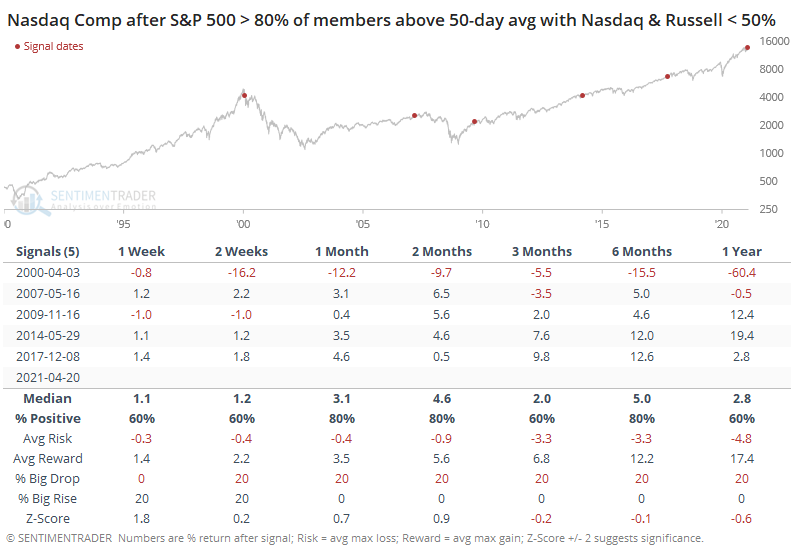

The Nasdaq Composite was a vaguely similar story, though it held up significantly better after the 2009, 2014, and 2017 signals.

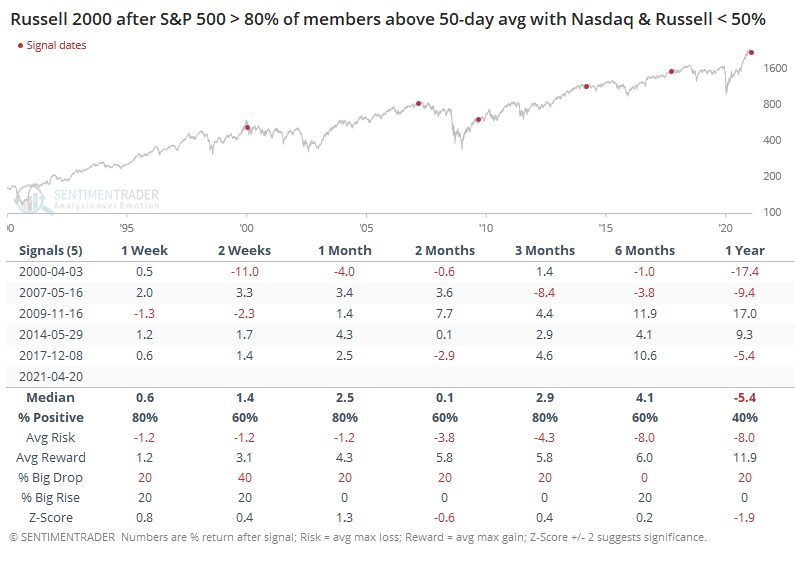

The small-cap Russell 2000 fared worse. It did manage to score sustainable gains in 2009, but the others saw some big losses.

We've been on the lookout for more sustained signs of deteriorating participation, and it's been like waiting for Godot. There have been isolated days with odd readings, usually thanks to the flood of SPACs or, lately, biotech stocks.

Shorter-term measures were about the only ones showing any kind of curious readings, and that's spreading now to some of the longer-term ones, which is more of a worry. There still haven't been widespread warning signs triggering, but if this kind of behavior continues, it's only a matter of time.