A Big Gap To Start The Week

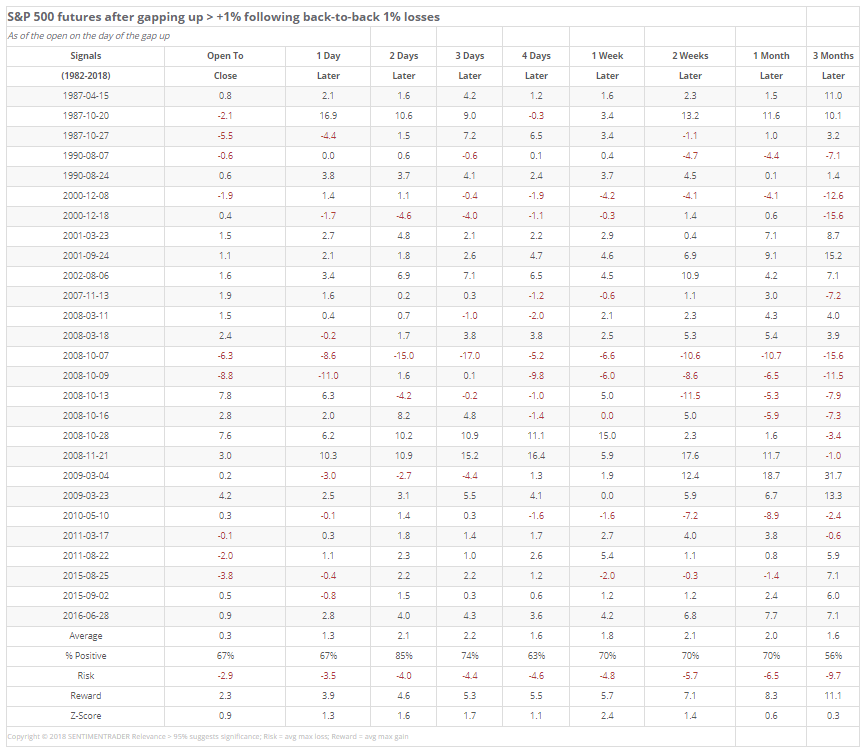

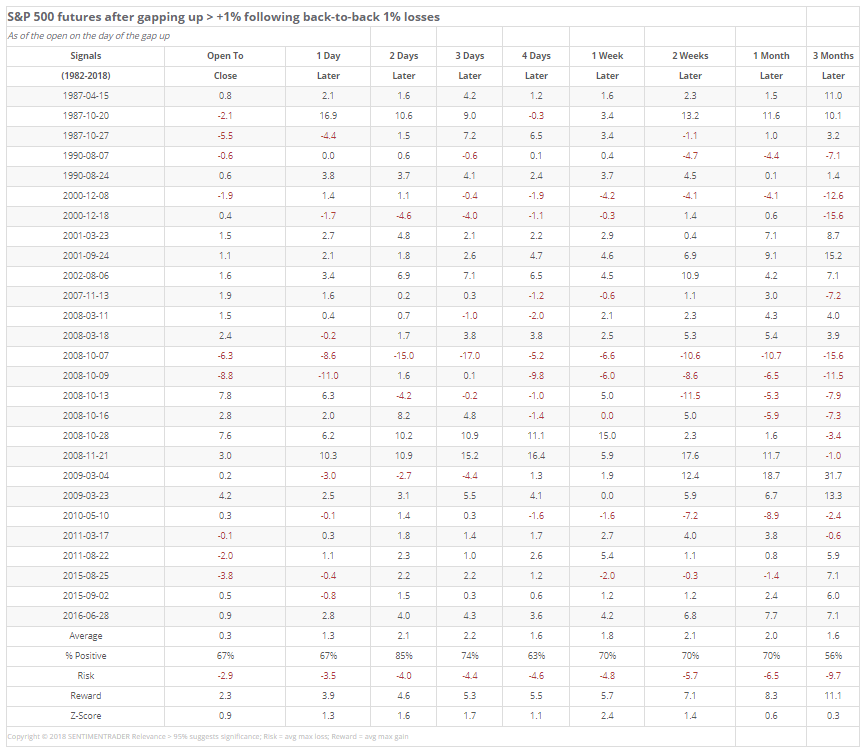

Futures are indicated to gap up strong on Monday following a couple of nasty losses. Since the inception of the futures, such gaps have tended to continue to lead to upside, especially over the next two days, but even longer in most cases. Risk was high, however, due to several days during the last two bear markets.

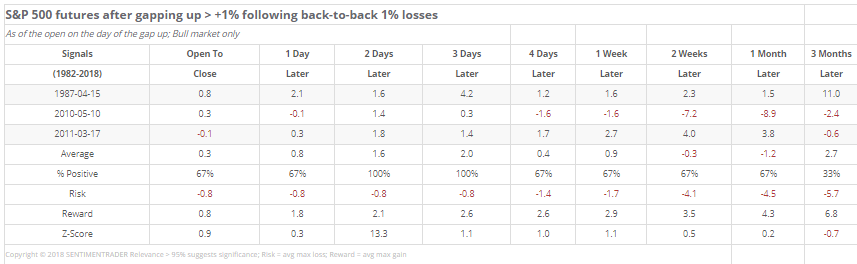

If we restrict the study to only those that occurred during a bull market, the sample size drops to a lowly size of three. All of which continued to rally in the days ahead.

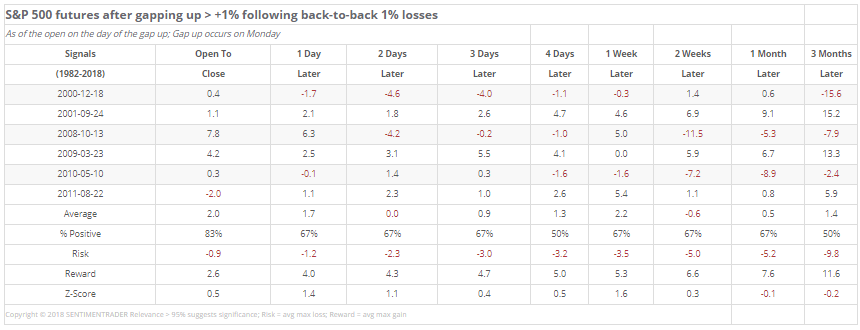

If we ignore the bull market rule and instead focus on day of the week, then there were 6 times we've seen behavior like this to start a new week. Again, mostly upside follow-through in the very short-term, though there was the large loss in 2000 and temporary one in 2008.

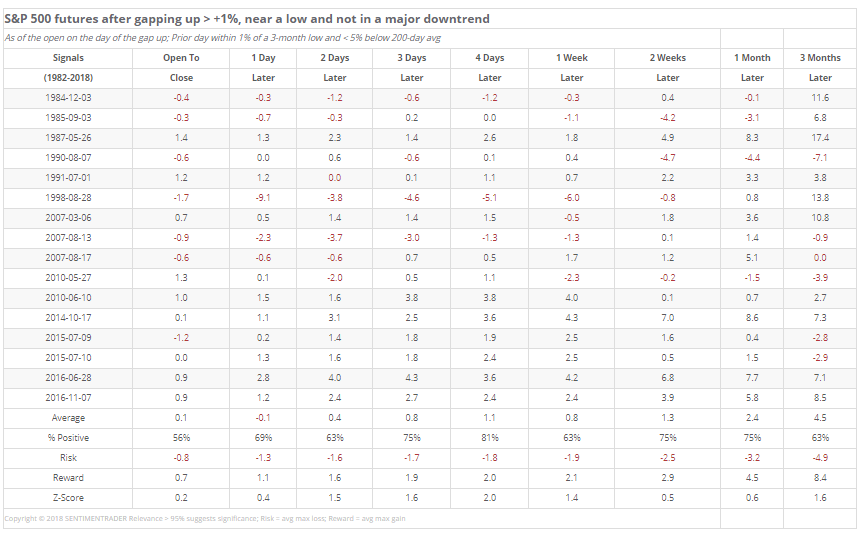

If we relax the parameters to look for times when stocks had simply been near a multi-month low and at least not in a major downtrend, then we can expand the sample size. The following table looks at times the futures gapped up after being within 1% of a 3-month low and the S&P was no more than 5% below its 200-day average.

Again, mostly positive returns when looking out over the next several days. While the severe moves in recent days appear to be related to headlines over tariffs, and that can make them vulnerable to quick reversals based on the latest news, the overall bias is for still-higher prices even after the large gap up, at least over the next couple of days. The risk/reward isn't as positive as I'd prefer to see, so that's a caveat.

There isn't much of a longer-term bias to most of these, and with such short-term movements I wouldn't read much into it even if there were, so this is strictly a shorter-term upside edge.