A Dead Cat Bounce in Treasury Notes

After Treasury notes and bonds took a tumble into April, sentiment soured, and inflation was on the tip of seemingly every investor's tongue.

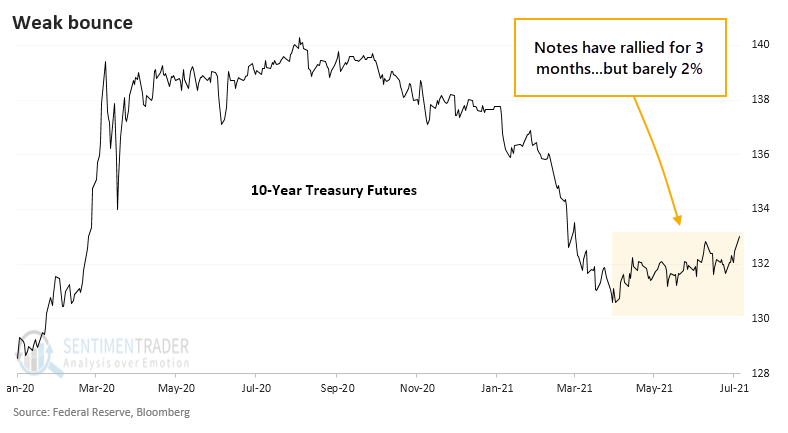

That has quieted down quite a bit in recent weeks as economic data has been mixed and yields retreated from their highs. If yields are declining, that means note and bond prices are rising.

For 10-year Treasury notes, the rally off the bottom has gone 65 days. Some old trend-following systems suggested that if a market goes this long without setting a new low, then the trend has changed.

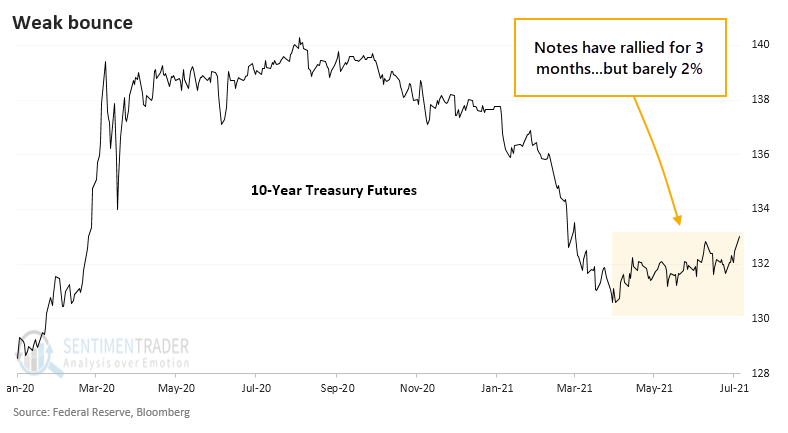

What's notable about this rally, though, is that it has a 'dead cat' feel to it. Note prices haven't even bounced 2% from the low, making it the 7th-weakest rally since futures began trading 30 years ago.

WEAK BOUNCES VS. STRONG ONES

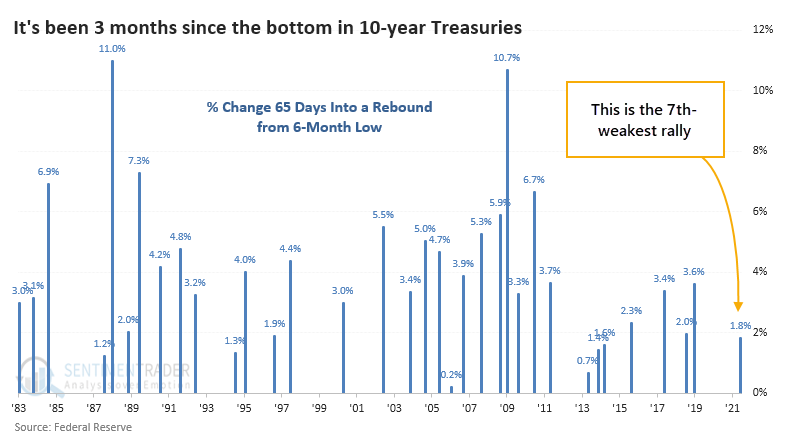

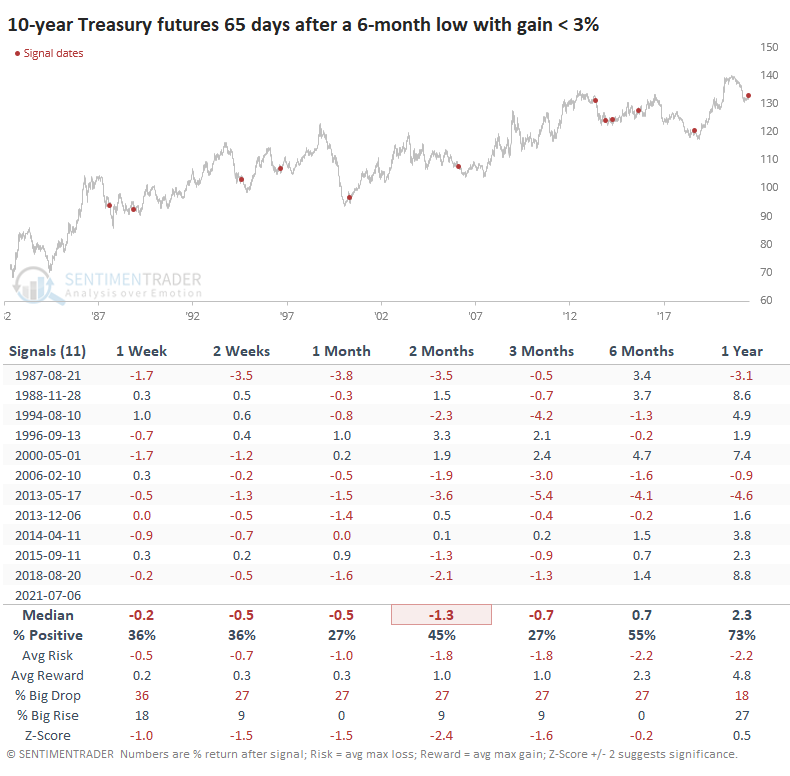

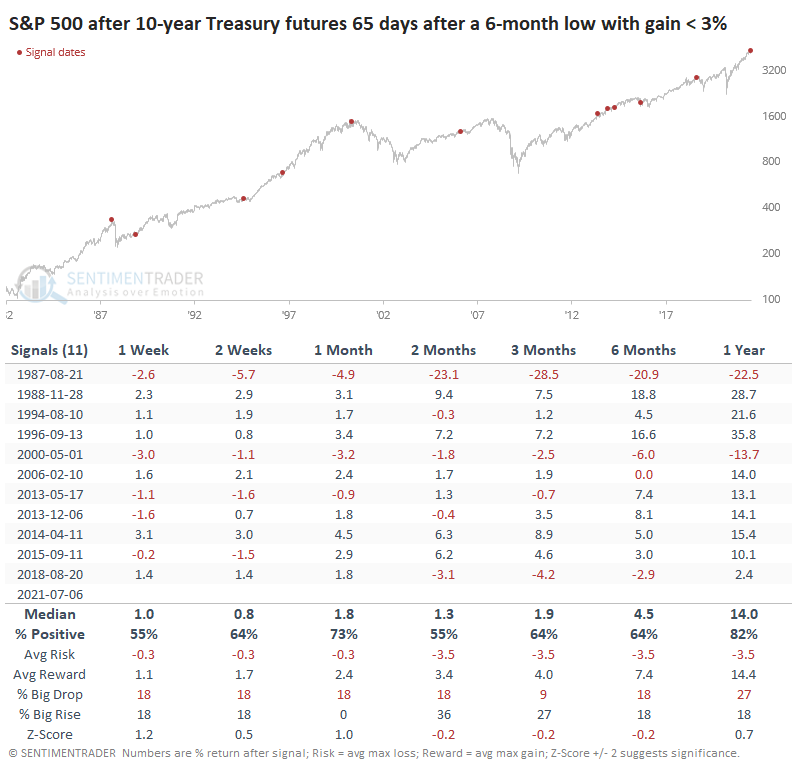

As for what this might mean, the table below shows whenever 10-year note futures rallied for 65 days off of a 6-month low, but with a price gain of less than 3%.

After these 'dead cat' bounces, there was a consistent tendency for notes to revert to a downtrend. Over the medium-term, prices continued to rally only once - May 2000 is the only signal that showed persistent and meaningful gains in 10-year Treasury futures over a multi-month time frame.

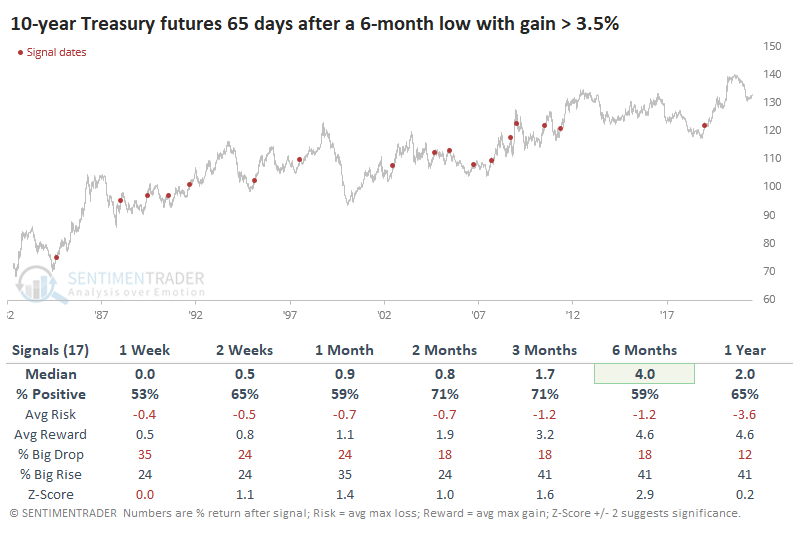

When we contrast that to times when notes had stronger rallies, at least 3.5%, then there was quite a big difference in future returns.

After these signals, 10-year notes rallied more than 70% of the time over the next 2-3 months, and the risk/reward was tilted toward reward.

IMPACT ON STOCKS, SECTORS, AND FACTORS

For stocks, weak rebounds in 10-year Treasuries didn't mean much. The S&P 500 showed mixed returns in the months ahead, with mostly positive returns but a poor risk/reward ratio over the medium-term of several months.

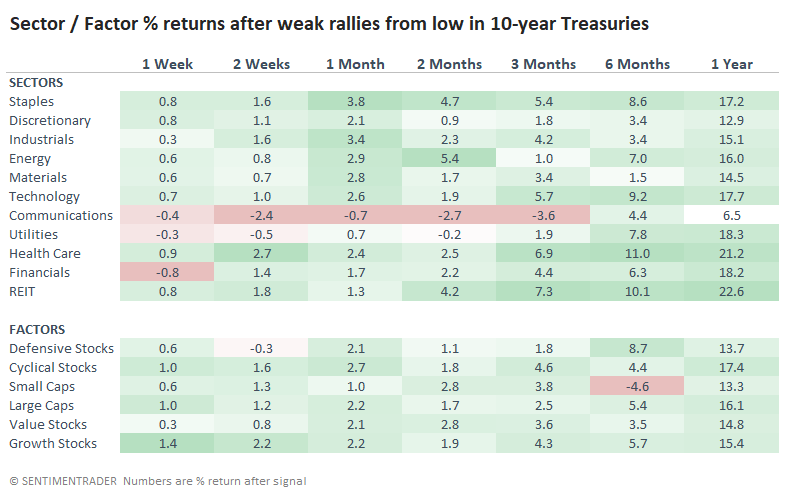

In terms of sectors, Small-Caps didn't fare well, neither did the Communications sector. Energy, Staples, Health Care, and REITs tended to show the strongest returns.

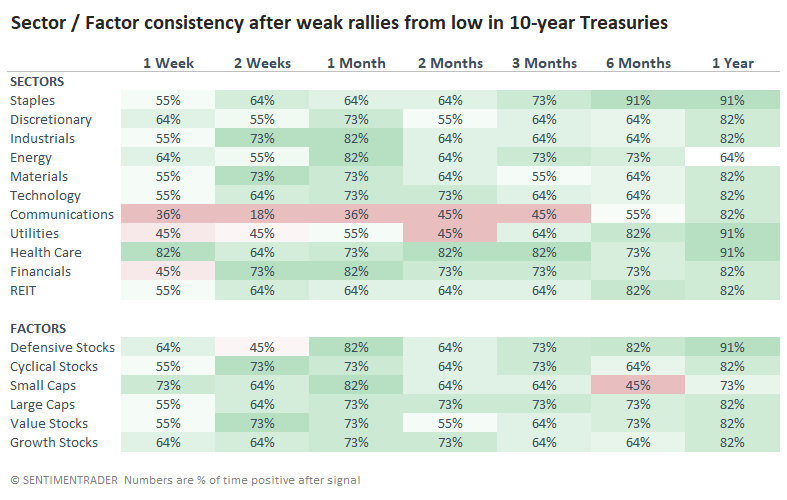

Those sectors were also among the most consistent.

There isn't a super compelling edge in future returns among sectors, but it's more telling for Treasury notes. Weak rebounds have had a strong tendency to lead to declines rather than continuations of the rallies. With sentiment on Treasuries rapidly improving, bond bulls need to hope that the 'dead cat' tendency will not play out yet again.