A Dow Theory Sell Signal

For the first time in over a year, one of the oldest forms of technical analysis has triggered a sell signal.

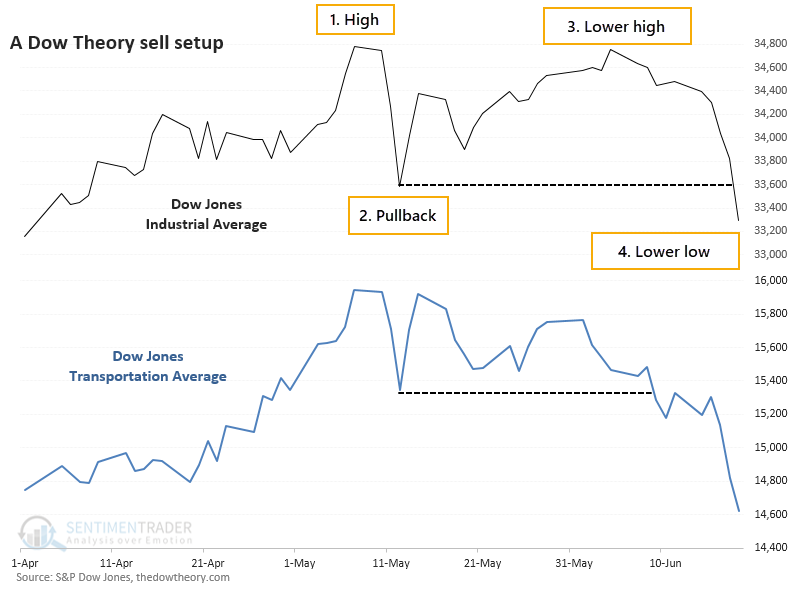

There is no "official" record of buys and sells according to Dow Theory, but the basic setup is fairly standard.

"The Dow theory is a financial theory that says the market is in an upward trend if one of its averages (i.e. industrials or transportation) advances above a previous important high and is accompanied or followed by a similar advance in the other average.

A reversal in the primary trend is signaled when the market is unable to create another successive peak and trough in the direction of the primary trend. For an uptrend, a reversal would be signaled by an inability to reach a new high followed by the inability to reach a higher low. In this situation, the market has gone from a period of successively higher highs and lows to successively lower highs and lows, which are the components of a downward primary trend." - Investopedia

TRIGGER CONDITIONS

When we've looked at this in the past, we've used the historical record of buy and sell signals from TheDowTheory.com, a site specializing in analyzing these signals. It's unknown whether they consider Friday's moves in the Dow Industrials and Transportation averages to be a sell signal. Still, it does meet the criteria, or if not, it's close enough to consider. Trying to split hairs based on arbitrary rules is silly - it's the concept that counts.

For a sell signal, both averages should:

- Set a new high

- Pull back in a reaction against those new highs

- Rebound by 3% or more but without setting a higher high

- Decline below the pullback low

That pretty much sums up the past two months in the averages.

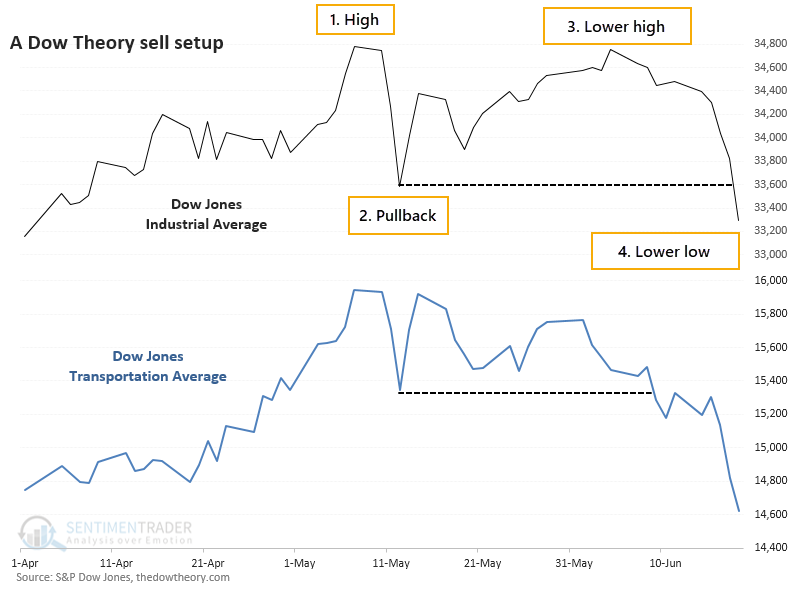

FUTURE RETURNS WERE TERRIBLE...BUT

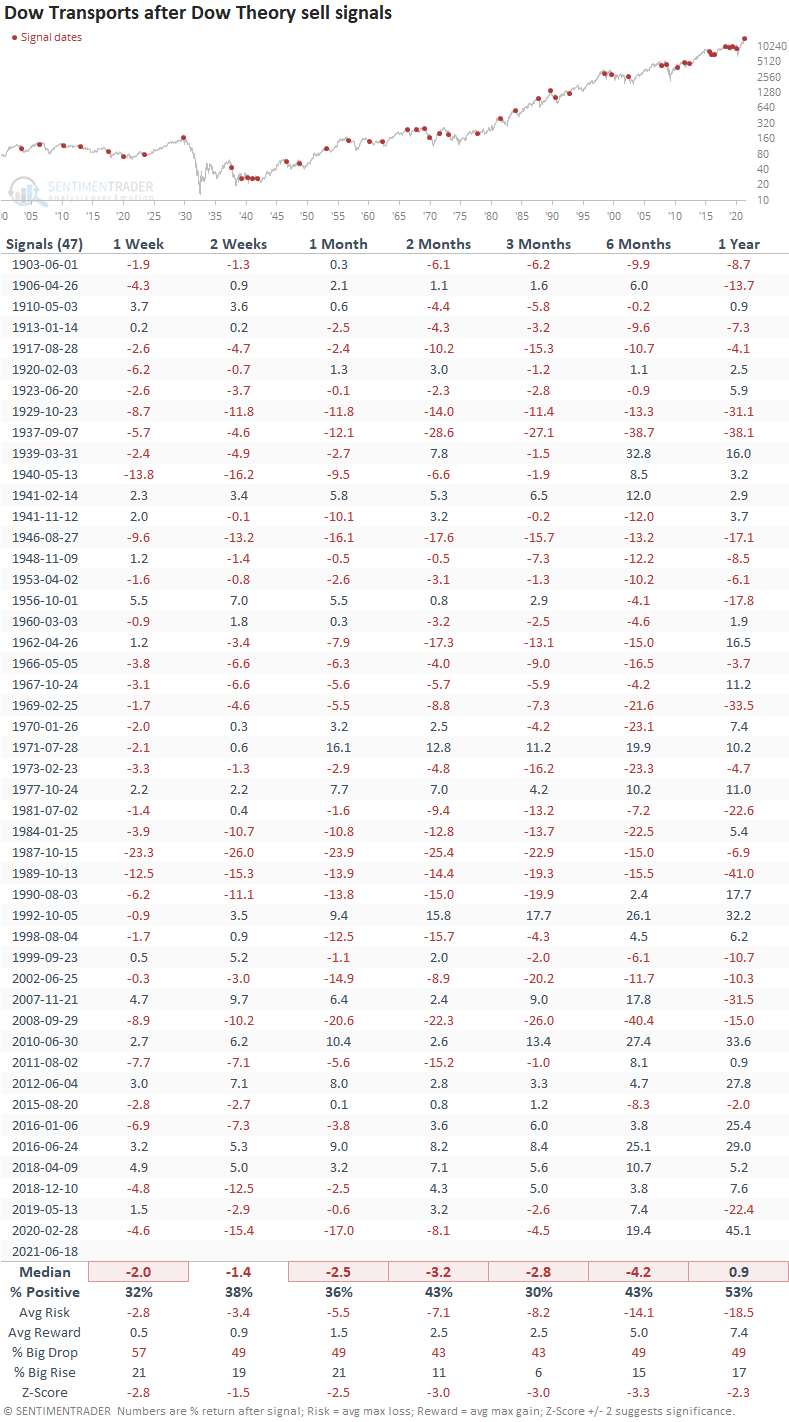

Since the year 1900, there have been 47 prior sell signals. Not surprisingly, the Dow Industrials have not responded well.

Over the next three months, the Dow managed to rally only 34% of the time. Across all time frames, the risk/reward was skewed toward "risk" and the Dow's median return was at least 2 standard deviations below random.

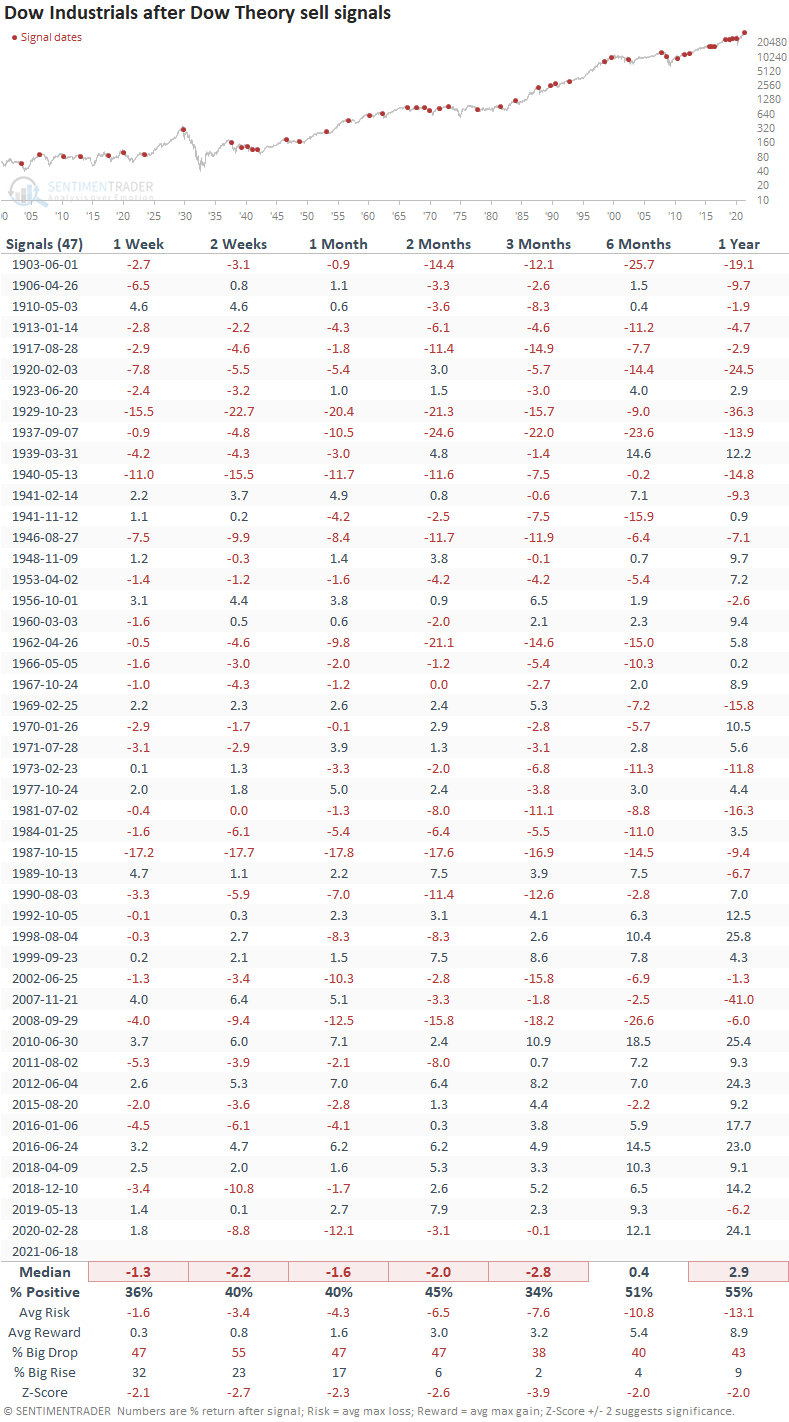

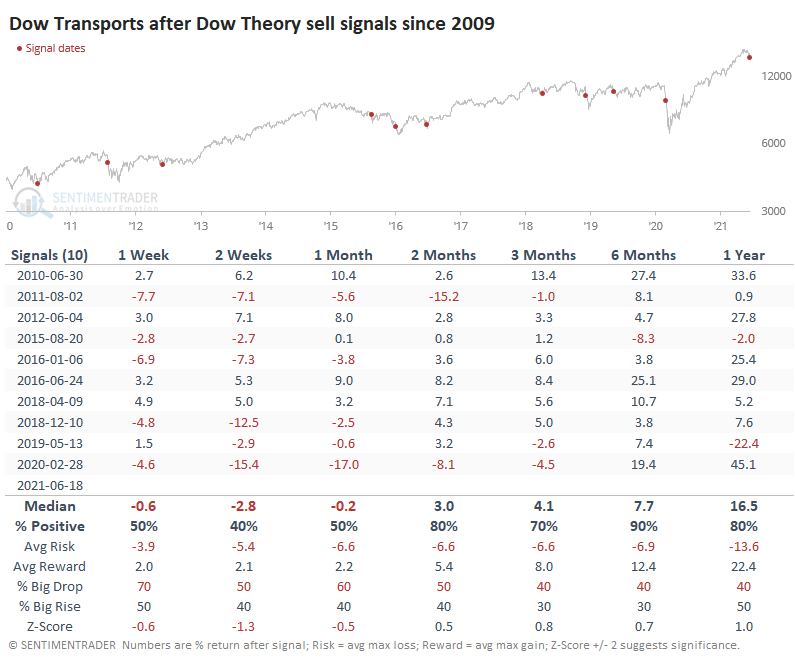

If there's any solace here for investors, it's that sell signals since the end of the financial crisis have mostly been terrible. They would have prevented some uncomfortable losses in 2011, 2018, and 2020, and a few other modest ones. But all were brief and ended up leading to gains during the next 3-6 months.

For the Dow Transports, these sell signals were equally painful.

Again, however, over the past decade or so, any pain was mostly temporary.

LITTLE SOLACE AMONG SECTORS

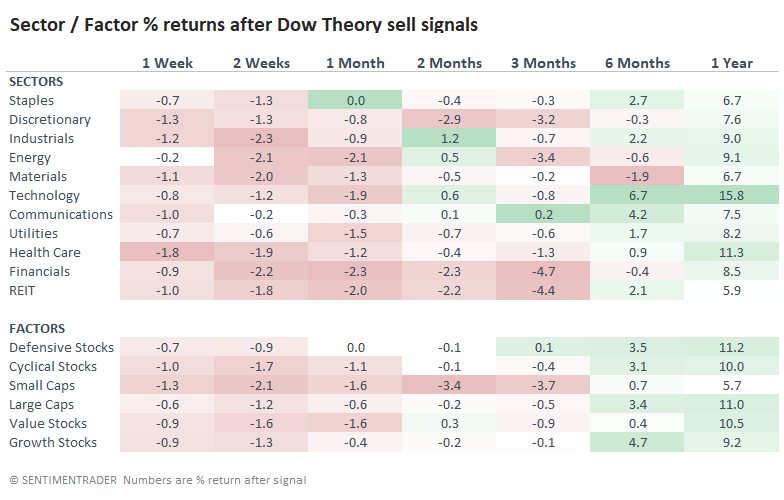

When we look at sector and factor returns, there was a mixed bag. We could reasonably expect Defensive sectors to hold up best, and for the most part they did, but it was not definitive. Staples held up relatively well, but so did Technology, which is not what we'd expect.

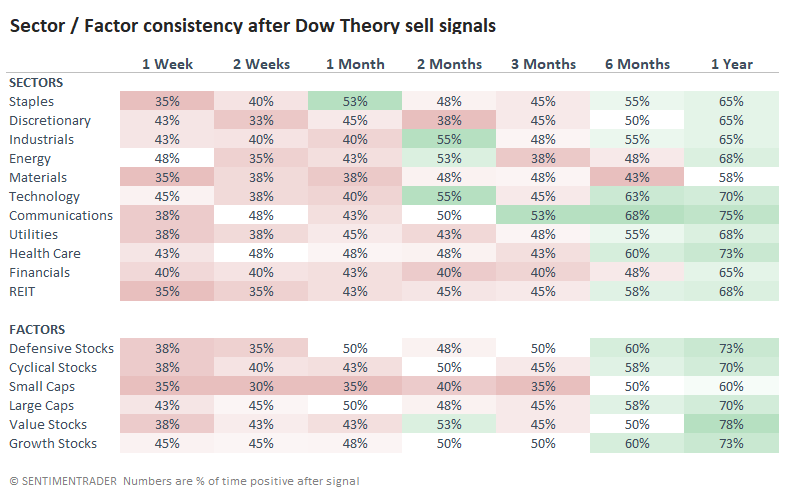

In terms of consistency, there was quite a bit of back-and-forth over the next 1-3 months, with few clear winners. Financial and Discretionary stocks were among the most persistent losers.

We tend to place more weight on recent occurrences, so this is a caveat against becoming too pessimistic based on this one theory. Also, there is an argument to be made that these two indexes no longer properly reflect the U.S. economy.

With those concerns, we're not placing a whole lot of weight on Friday's potential Dow Theory sell signal. It's a worry, to be sure, especially since it's occurring after another surge in speculative activity and other warnings.