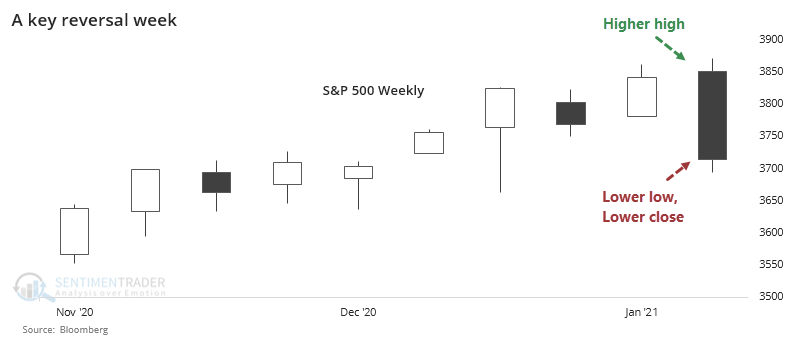

A key reversal pushes trends to important junctures

It's been a couple of days since the dust settled on last week, and stocks managed to rebound strongly.

This is a little bit unusual since last week was a negative Key Reversal Week, with a higher high, but lower low and lower close.

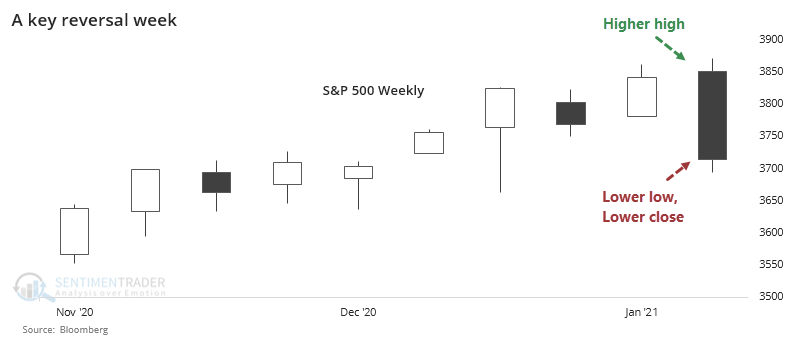

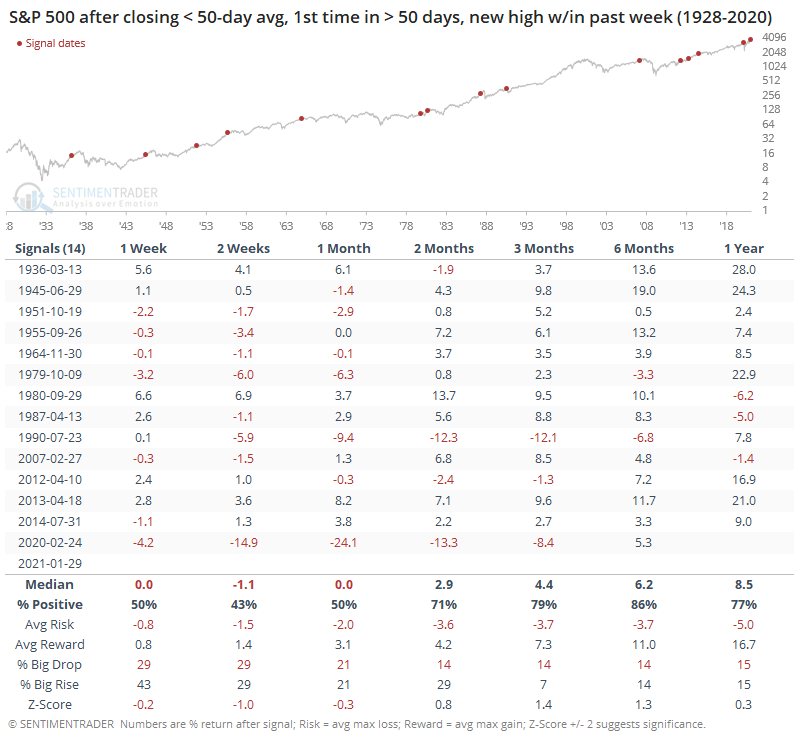

A week like that has had consistently negative overtones for the weeks ahead when the closing loss was more than 2% for the week.

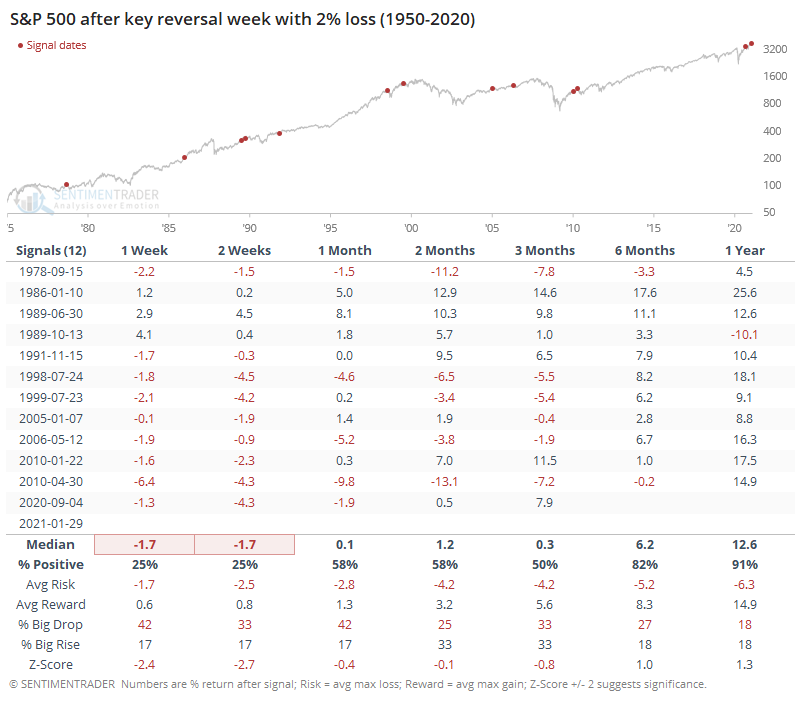

In the process, the S&P 500 lost its 50-day moving average. That's the first time it had been below its 50-day in more than 50 sessions, a relatively long streak when occurring after what had just been a 52-week high. Other times its medium-term trend shifted like this, the index struggled in the shorter-term but it was not a consistent longer-term sell signal.

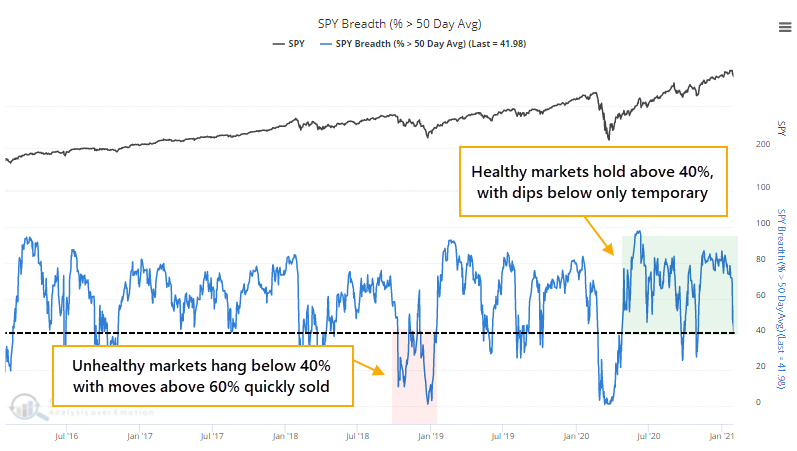

As we saw last week, there was a quick and substantial pullback in the percentage of stocks within the S&P that were above their own 50-day moving averages. That corrected further on Friday, and stopped right around the 40% level. In healthy market environments, this is about where it tends to stop as buyers tend to step in quickly and that's about it for the pullbacks. It appears the same thing happened this time, though it's still too early to tell.

During unhealthy environments, we consistently see fewer than 40% of stocks above their averages, and moves above 60% tend to bring sellers in quickly. So far, this still looks healthy.

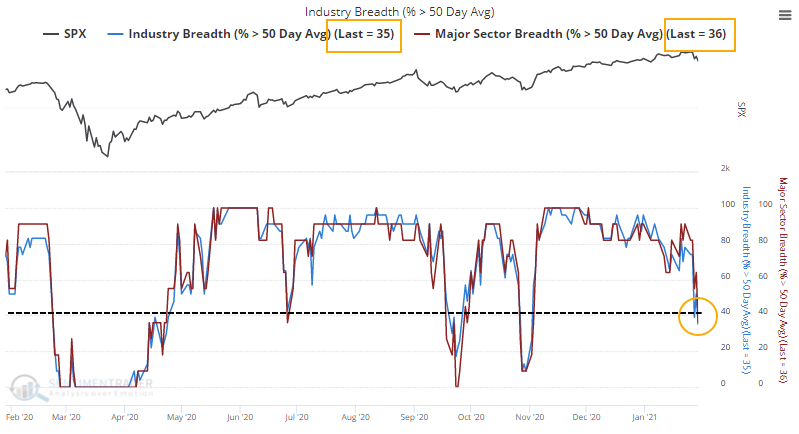

The percentage of industries and sectors above their 50-day averages both plunged below 40%, so that bears watching. More than 40% of countries are still above their average, so that's a bit of a positive.

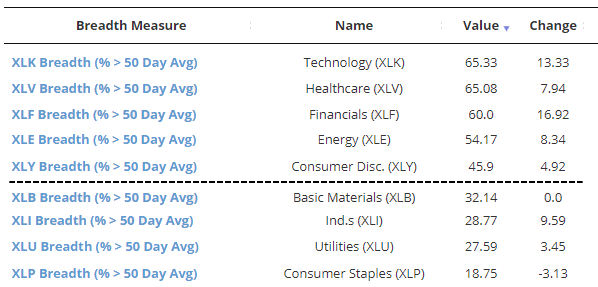

Among sectors, it's mostly the defensive ones that are seeing the fewest stocks above their 50-day averages, so there is still evidence of a risk-on mentality.

So far, there isn't much evidence that this is anything other than a pullback within a healthy environment. Some cracks are starting to show, and certainly the sentiment backdrop means the market is on shaky footing. But we need to see measures like this hold below key levels to have more confidence that there has been a true change in character.