A KOLD-blooded approach to trading

Key Points

- Natural gas tends to show weakness early in the calendar year

- Ticker KOLD, a leveraged inverse ETF that tracks natural gas futures, gives speculators the potential to profit from a decline in natural gas

- From a real-world trading perspective, the key for traders is to decide if and when to enter a trade

Natural gas early in the year

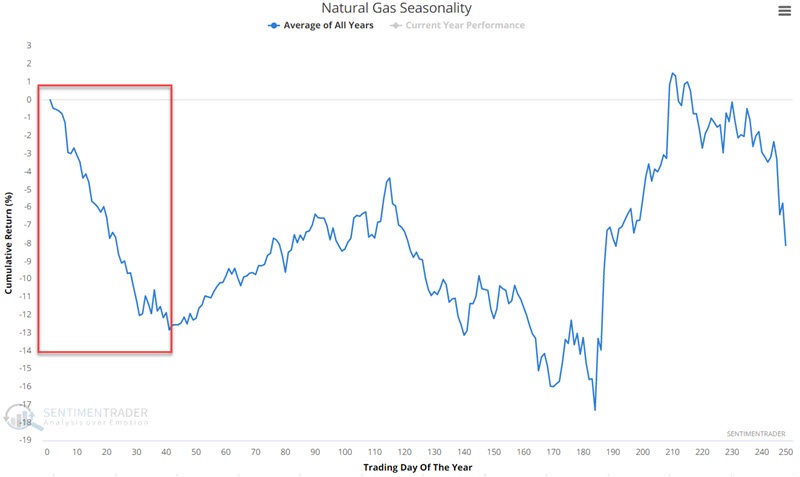

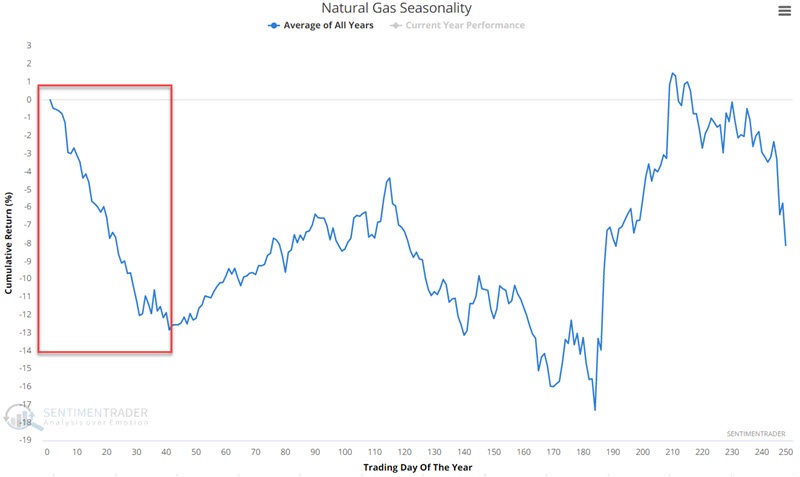

The chart below displays the annual seasonal trend for natural gas futures. Between the start of the year and trading day of the year (TDY) #41, this market tends to show weakness.

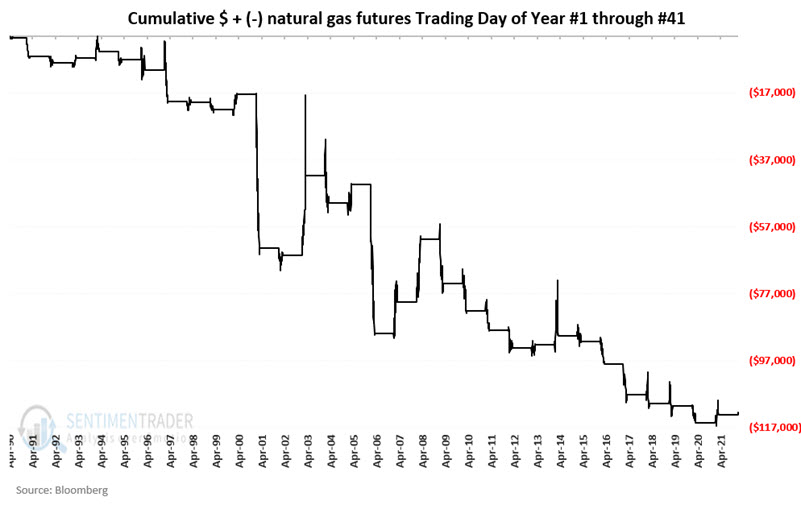

It is always important to remember that seasonality charts are not roadmaps. In other words, they tell you what has happened in the past, not what will happen the next time around. The chart below displays the cumulative $ +(-) from holding long a natural gas futures contract for the first 41 trading days each year since 1991.

The bottom line is that the steep early year decline in the natural gas seasonal chart:

- Does represent a potential opportunity

- Does not guarantee that natural gas is necessarily headed lower from here

The current state of natural gas

The chart below displays the price action of March 2022 natural gas futures. We can notice a brief consolidation with fairly easily identifiable support and resistance levels.

This period of price consolidation sets up several different possibilities for a trader. Before diving into the options and the various considerations for each, let's flip the script just a bit. The reality is that most traders will never (and in many cases probably should never) trade natural gas futures. Trading natural gas futures is a highly leveraged game that requires a particular level of capitalization and attention that many traders cannot sustain.

So, let's turn our attention to an alternative for aggressive traders - ticker KOLD (ProShares UltraShort Bloomberg Natural Gas).

KOLD as an alternative for bearish natural gas traders

KOLD is a triple-leveraged inverse ETF. KOLD is designed to track inverse daily performance for natural gas futures three times. In theory, if natural gas futures declined 1% in value today, KOLD should gain roughly +3%. Traders can buy shares of KOLD just as they would buy shares of stock. Any triple-leveraged, inverse ETF can experience tremendous volatility and should be considered a highly speculative and risky vehicle. Nevertheless, unlike trading futures contracts, there is no risk of unlimited loss.

I wrote about KOLD recently here and here.

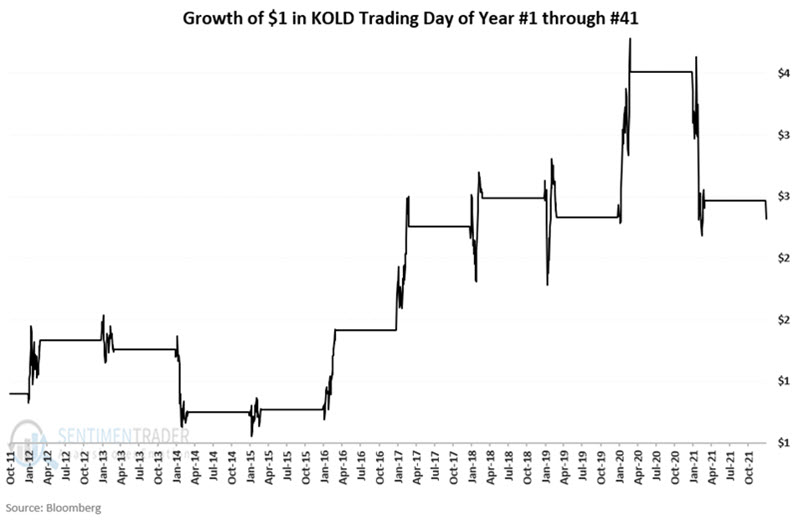

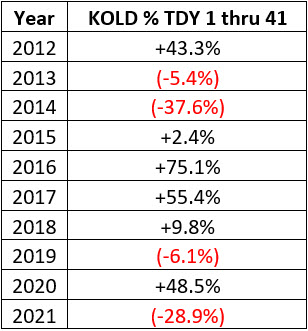

The chart below displays the cumulative growth of $1 invested in KOLD during the first 41 trading days of the year since 2012.

The year-by-year performance results for KOLD during the first 41 trading days of the year highlight a high-risk, high-reward situation.

The chart below displays a chart of KOLD.

So, the first question for a trader is whether or not to trade KOLD?

If the answer to that question is "Yes," then the follow-up questions are:

- When to buy? (Timing)

- How much to buy? (Money management)

- How to manage risk? (Risk management)

Let's consider the advantages and disadvantages of several possible trading scenarios.

Trading scenarios

Scenario #1: Buy KOLD, immediately, place a stop below recent support

KOLD is trading at $11.54 a share as this is written. A trader could buy shares at that price and set a stop-loss order below the current support level, at, say, $10.70 a share. This represents a risk of -7.3%.

The advantage is that the trader is onboard if natural gas follows its long-term tendency and falls in the weeks ahead (resulting in a rally for shares of KOLD).

The downside is that KOLD is presently stuck in a trading range, and there is no guarantee that an uptrend will occur.

Scenario #2: Buy KOLD on a breakout to new highs, place a stop below recent support

Many traders like to buy on a breakout. The belief is that the breakout in price can signal the start of a new upleg. In many cases, this works out, and in other cases, it does not.

The advantage is that a trader commits no money until KOLD shows some tangible sign that it is preparing to make a serious move higher.

The downside is that if a trader buys just above the recent high - at say $13.78 a share - and places a stop-loss below the current support level, at say, $10.70, the downside risk is over -22%.

Scenario #3: Buy KOLD on a pullback to support, place a stop below recent support

A trader looking to minimize downside risk might consider waiting for KOLD to pull back towards recent support before buying. For example, a trader might decide to wait to buy until KOLD drops to say $11.05 a share and then place a stop-loss at, say, $10.70.

The advantage is that the trader's risk would be only roughly -3.2%.

The disadvantage is that KOLD might not pull back to $11.05 before staging its next rally.

What the research tells us…

Natural gas tends to decline in price early in the year. A trader wishing to play the short side of natural gas can either sell short natural gas futures or buy shares of KOLD.

The adage states that "Decisions are Destiny." Nowhere is this truer than in the arena of trading. When (or even if) a trade is made, the size of the position taken and how risk is managed is what will ultimately decide a trader's success, both on a trade-by-trade basis and over time.