A month after initial surge, energy stocks show record gain

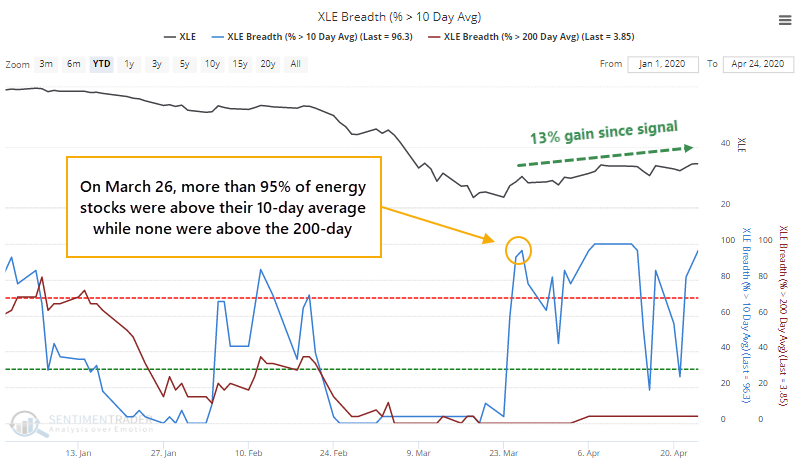

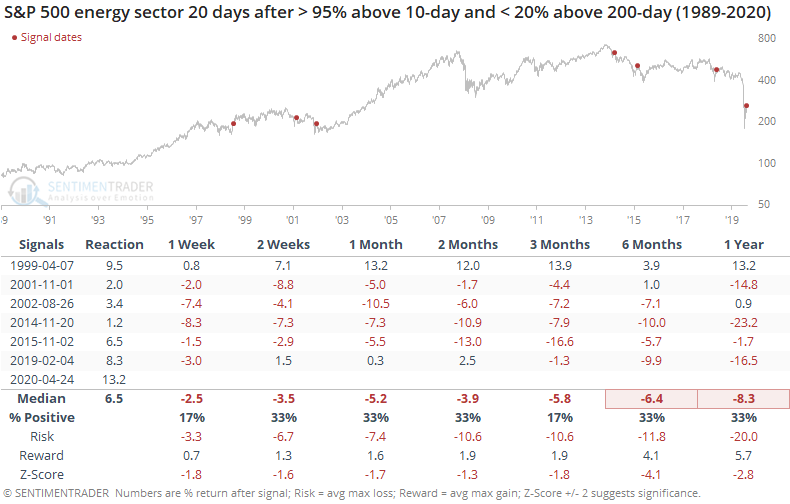

On March 26, there was enough of a surge in energy stocks that more than 95% of the ones in the S&P 500 Energy sector managed to close above their 10-day moving averages. But because of the longer-term devastation, none of them had yet managed to climb above their long-term 200-day averages.

That has signaled "dead cat bounce" more often than not in the past. Not this time - the sector climbed more than 13% in the 20 days since then and the percentage of stocks above their short-term averages popped above 95% again on Friday.

This 13% gain in the month following the initial surge is the best we've ever seen after a surge like that. Once we get to the one-month point following a jump like this, the risk/reward turned quite negative.

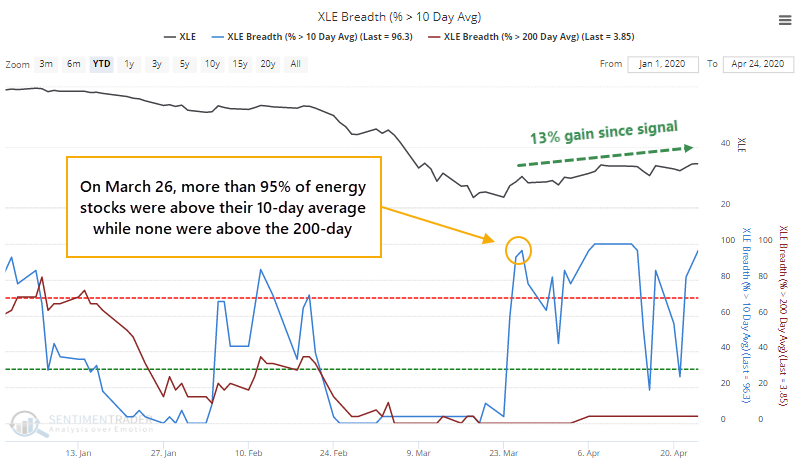

In the "Reaction" column, we see the return in the sector in the month following the initial surge (when more than 95% of stocks in the sector traded above their 10-day averages while fewer than 20% were above their 200-day averages). The current one, at 13.2%, is by far the best out of any of them.

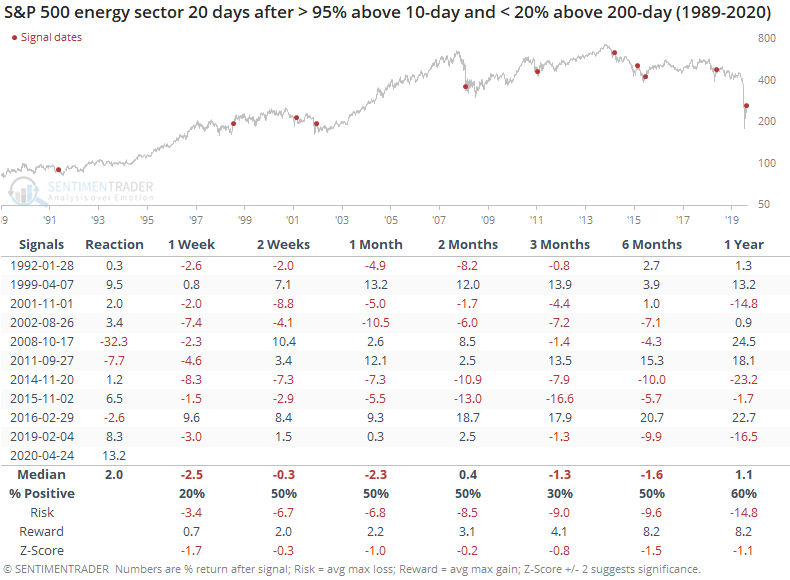

If we filter the table to only include the best reactions, then we get the following.

In 1999, energy stocks continued to soar over the next few weeks, then went nowhere, eventually giving back all the gains and then some as the broad market suffered from the dotcom collapse.

The last two signals both peaked almost immediately or at least enjoyed only relatively small upside in the weeks and months ahead.

If we expand the sample to include any gain of more than 1% in the month following the initial surge, then the returns were quite poor.

After these, the only gainer continued to be that signal from April 1999. All the others showed losses even up to three months later.

We've seen a lot of unprecedented action over the past month, especially in energy stocks. That might mean we can't rely as much on historical behavior. From what we can see, though, the upside has been limited at best when the sector showed a gain a month following its initial surge in poor markets.