A near record month for Value vs Growth

Even though there is a reversal of the trend today, there has been a momentous shift in momentum over the past month. Former highflyers lost altitude while stocks that had been left behind stormed back.

We saw this in the extreme movements between Technology and Financials, and on Monday, Dean noted the incredible thrust in Energy.

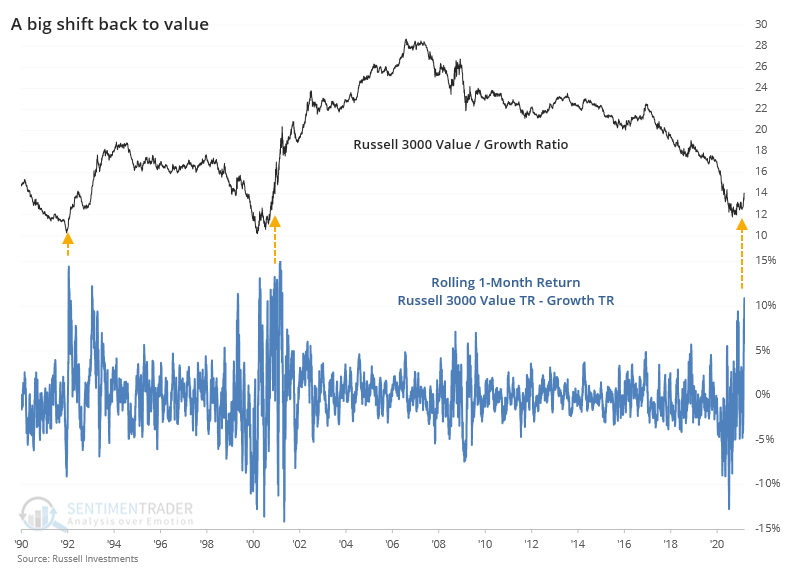

All of these shifts have triggered a massive move in Value stocks relative to Growth. Over a rolling 1-month period, the total return on value is more than 10% greater than the total return on growth, one of the largest spreads in 30 years.

The last two shifts were notable, because they marked the ends of long periods of Value stock under-performance. In the years following those thrusts, Value stocks crushed Growth stocks.

It turns out that's more the rule than the exception.

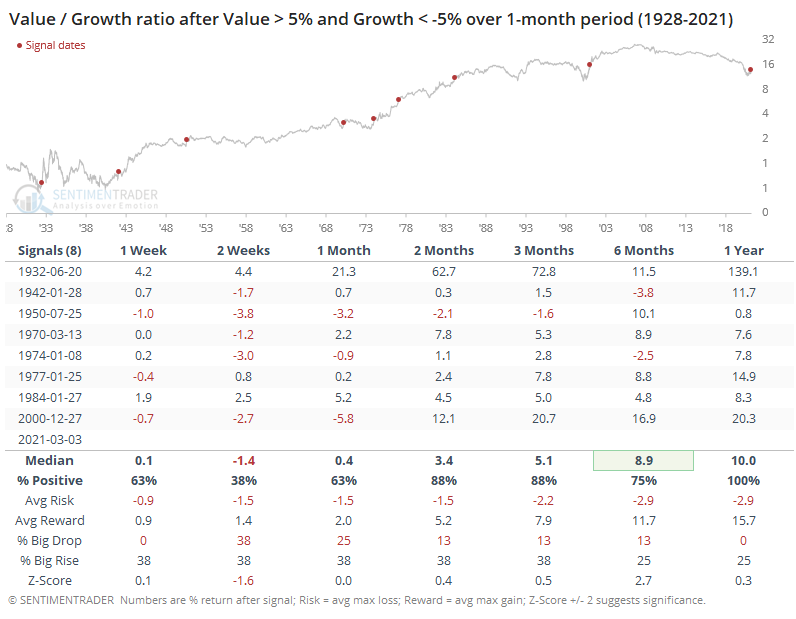

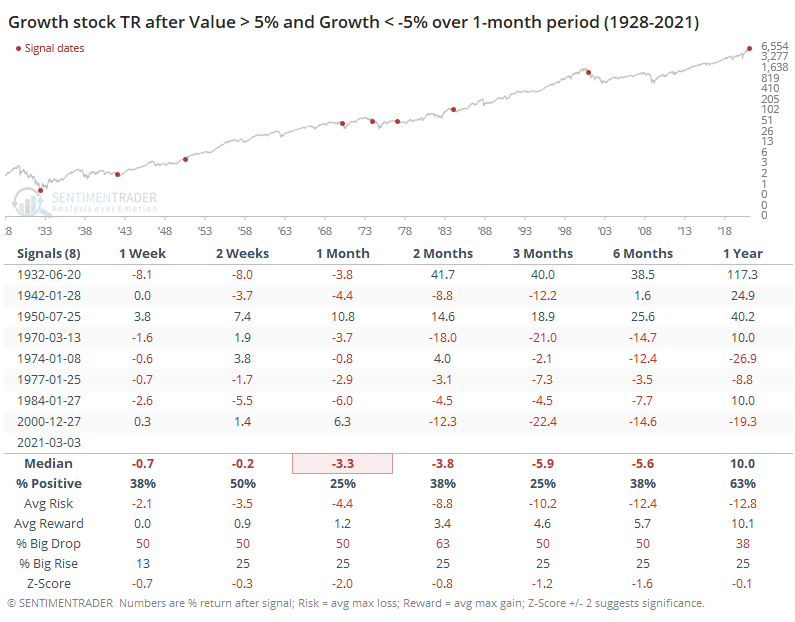

The table below shows every time since 1928 when the total return on Value stocks over a rolling 21-day period was more than +5%, while the total return on Growth stocks was less than -5%.

There was some back-and-forth in the shorter-term, and Value under-performed Growth over the next couple of weeks. Other than that, there was a clear and increasing bias toward Value. By a year later, Value had out-performed Growth every time. The returns were especially stark when emerging from multiple years of under-performance like now.

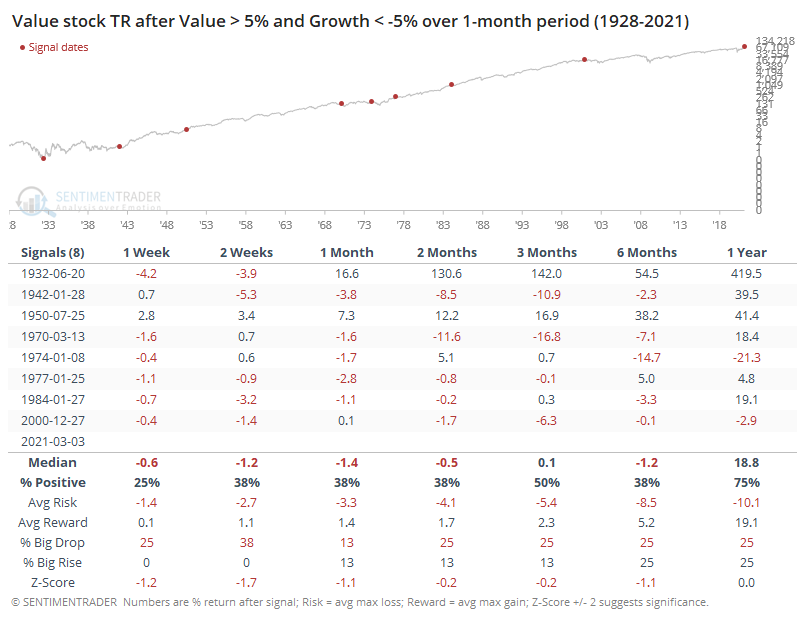

In terms of actual returns, they weren't all that impressive. The total return on Value was negative across most time frames.

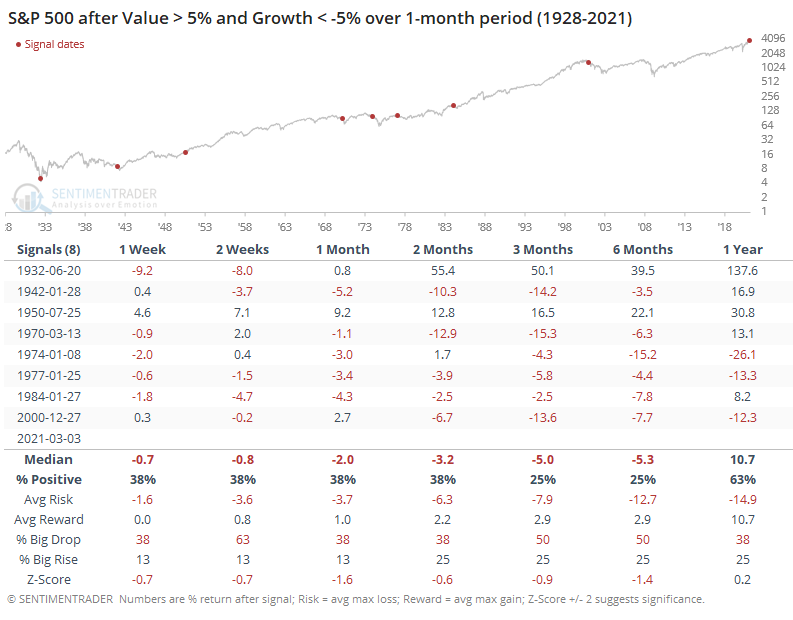

We know that Value tended to out-perform Growth, so this means that returns on Growth stocks must have been even worse. Indeed.

Because of the S&P 500's general bias toward Growth stocks, this means that the most widely benchmarked index in the world tended to perform pretty poorly after these signals.

There have been a lot of false starts for Value in recent years, every time beaten back by a resurgence in momentum stocks. Maybe the next round of stimulus payments, a decent portion of which seems destined for the stock market, will cause that to happen again. Historically, though, the surge in Value relative to Growth has been stark enough that it has ended other prolonged bouts of under-performance. And that's been a warning for the broader market.