A rally that's powered while traders sleep

It seems like every day, stocks jump overnight, only to see gains evaporate, or at least moderate, during the day session. That's frustrating for many traders who can't take advantage of overnight hours.

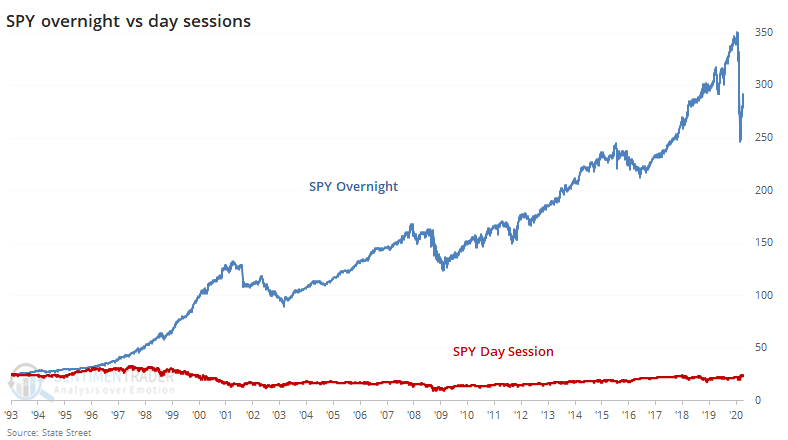

It's not a new phenomenon, though. Most of the gains in SPY since its inception have come while domestic traders are sleeping.

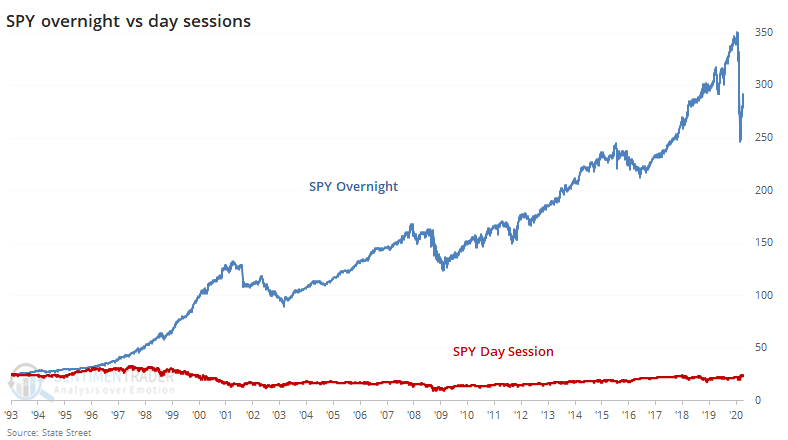

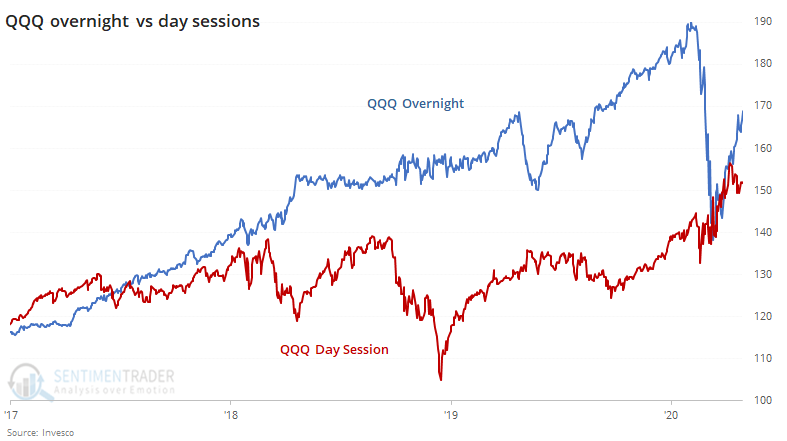

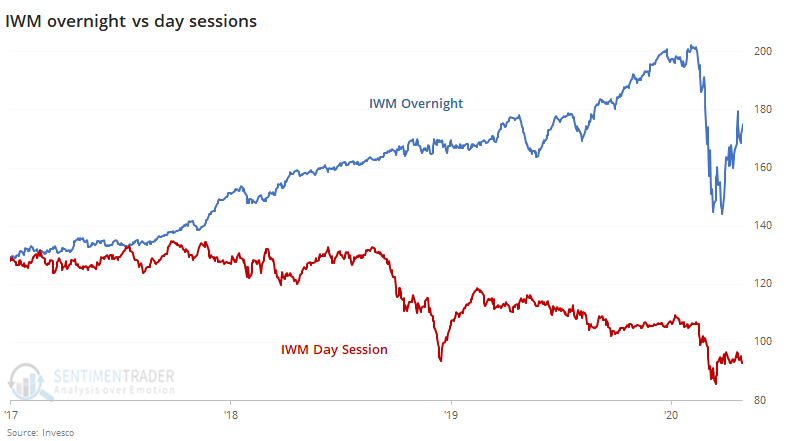

Over the past few years, while stocks soared, we can see that the overnight vs day session divergence was just as stark.

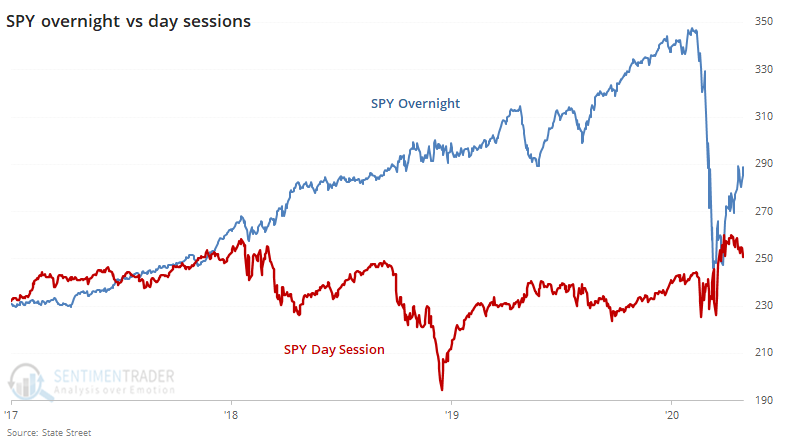

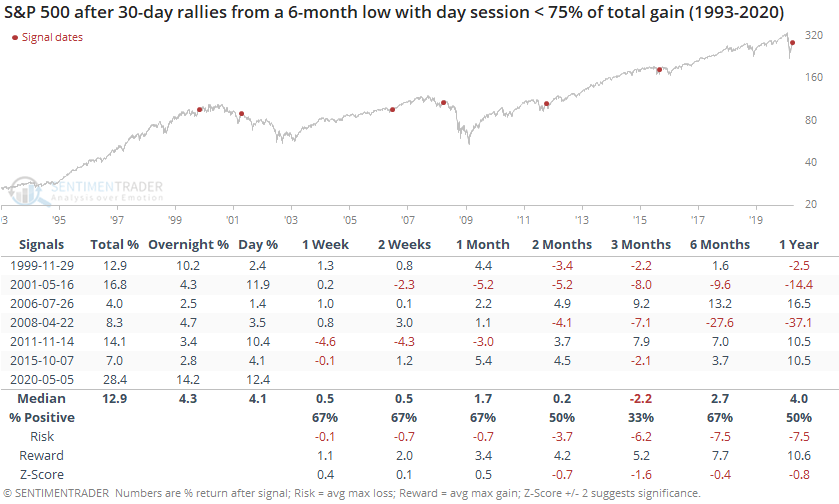

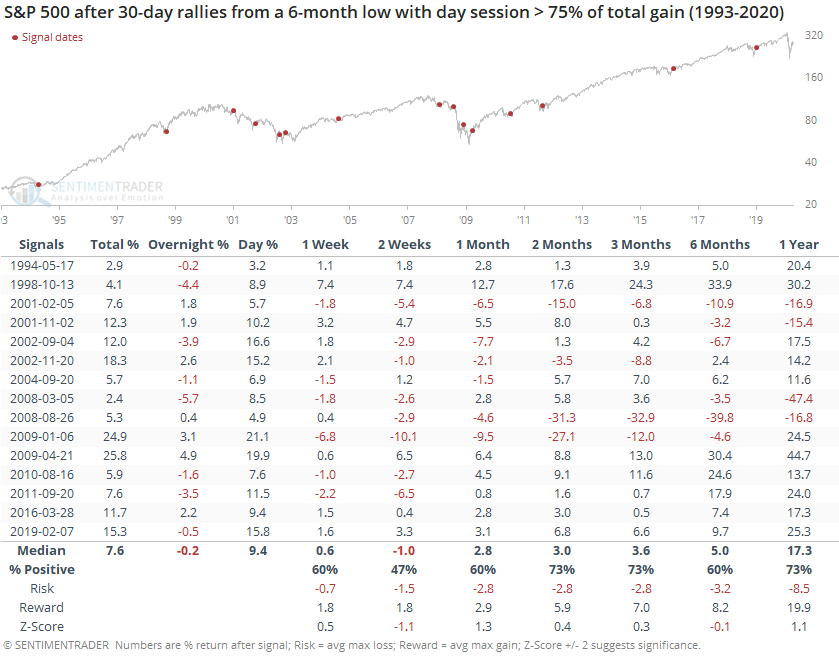

In the 30 days following the March 23 low, most of SPY's gains have come overnight. While that's not a surprise to anyone who's been watching the markets lately, it is an unusual pattern. During most 30-day rallies off of at least a 6-month low, the day session has accounted for less than 75% of total gains only a handful of times.

When the overnight session accounted for a significant part of the gains, the next few months proved to be a tough row to hoe, with SPY adding to its gains twice and losing four times. And one of those saw a pretty hefty drawdown first.

Contrast that with times when the bulk of total gains during the initial 30 days of a rally occurred during the day.

In these cases, the S&P suffered a bit more shorter-term but had more sustainable gains longer-term. Over the next three months, SPY returned an average of +3.6% (versus -2.2% when the overnight session powered more of the total gains) and was positive 73% of the time (versus 33% of the time).

This is not just a SPY thing. The overnight session has driven most of the gains in the big-tech QQQ fund, too.

It's been especially prevalent in the small-cap IWM fund.

Every time stocks gap up big in the morning and then sell off, there is a round of conspiracy talk about who's fleecing whom. No doubt, some of it is due to games being played by large market participants, taking advantage of a pattern when they can. It's not a new thing; it's been going on for decades.

As to whether it means anything, that's not clear. There is a bit of evidence that rallies off a low that saw much of the gains driven by overnight trading were more likely to fall back in the months ahead than were the rallies driven more by "natural" gains during the day session. The edge is relatively weak given the small sample sizes, so the suggestion is that it's more of a "hmmm..." kind of warning as opposed to an outright signal to sell.