A rare short-term breadth signal

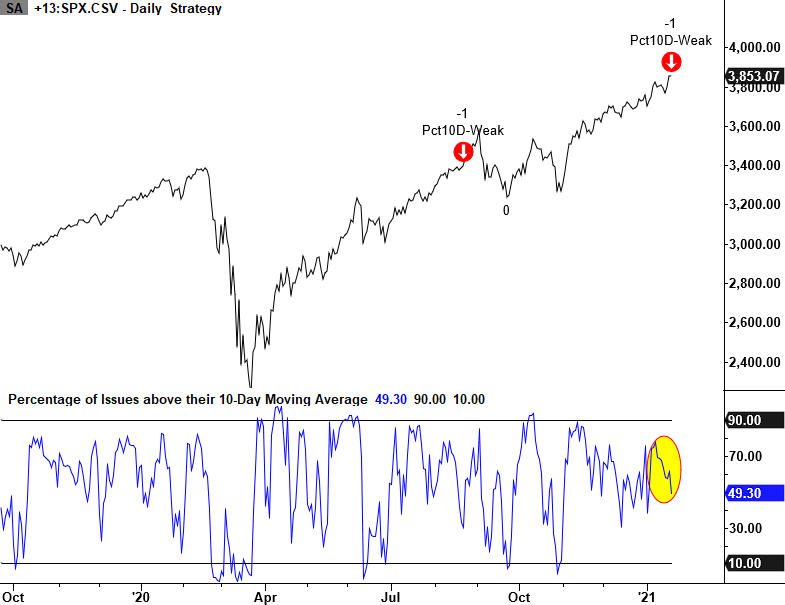

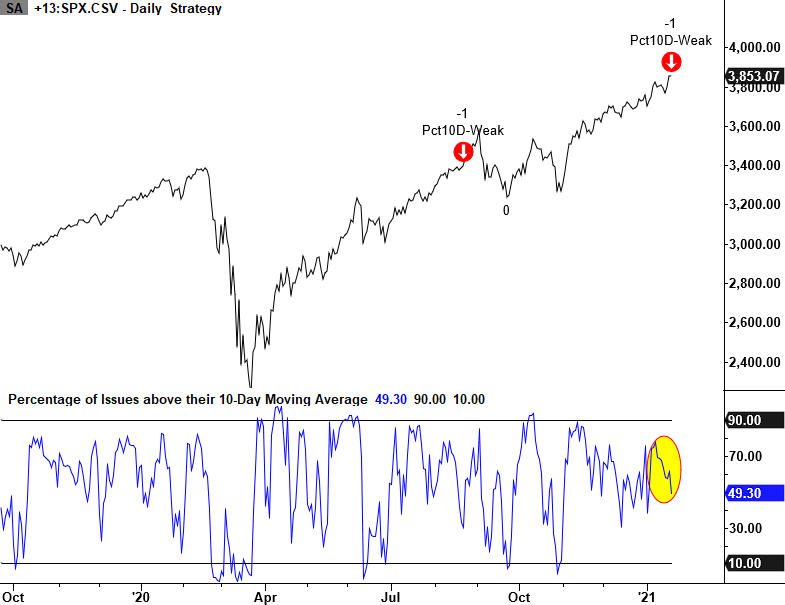

As Jason and I have noted in several studies of late, the big picture backdrop for the market remains constructive as several intermediate to long-term market breadth measures continue to track a bullish recovery phase. However, in the last few days, one short-term breadth measure for the S&P 500 softened as the market advanced to new highs. The number of S&P 500 members above their respective 10-day moving average registered a less than 50% reading as the S&P 500 closed at a new high.

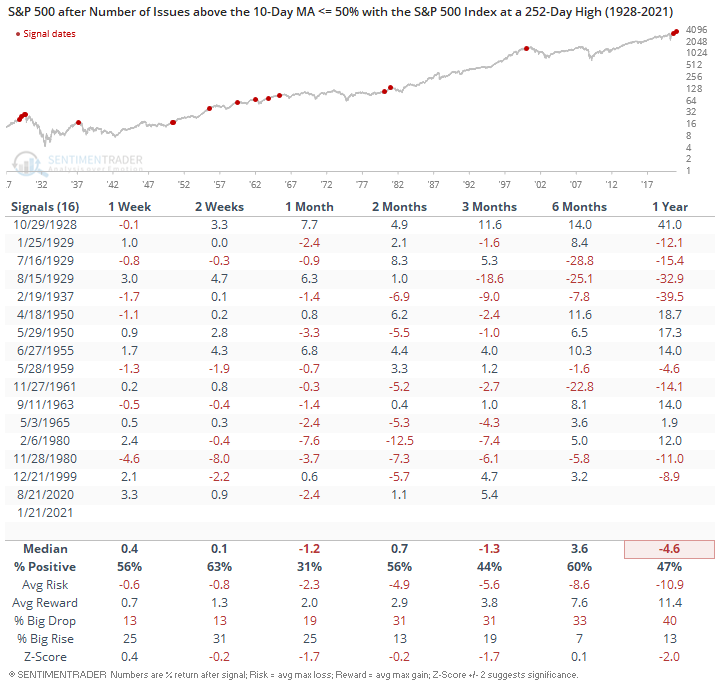

Let's take a look at all other instances since 1928.

Current Chart and Signal

Historical Signal Performance

While the sample size is small, the forward returns out 1-month are weak.

Conclusion: The intermediate to long-term backdrop remains constructive, and one short-term signal does not make a trend. As a risk manager, I'm always monitoring the market for new developments that run counter to my outlook.