A ray of hope for stocks from high yield bonds

Key Points

- High yield bonds are highly correlated with the stock market

- The High Yield New High - New Low series occasionally reaches extreme levels

- Reversals from extreme readings often give helpful information for stock traders

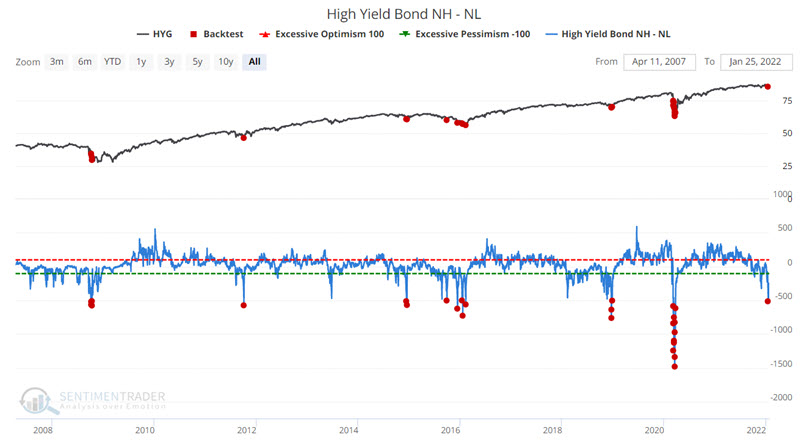

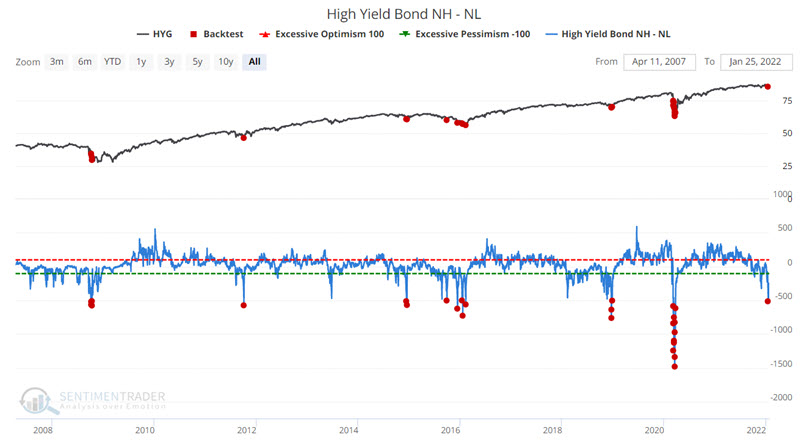

High Yield Bond NH - NL indicator

This indicator shows the net number of high-yield bonds that set a 52-week high minus those that set a 52-week low on the day, per FINRA TRACE. It can be beneficial as an overbought/oversold type of indicator.

The chart below displays HYG (iShares iBoxx $ High Yield Corporate Bond ETF), and the red dots highlight those days when the High Yield NH - NL indicator read -500 or lower.

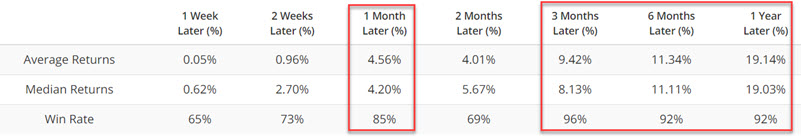

The table below displays a summary of HYG performance following all days when the indicator read -500 or lower (including overlaps). Note the high Win Rate for 1, 3, 6, and 12-month periods.

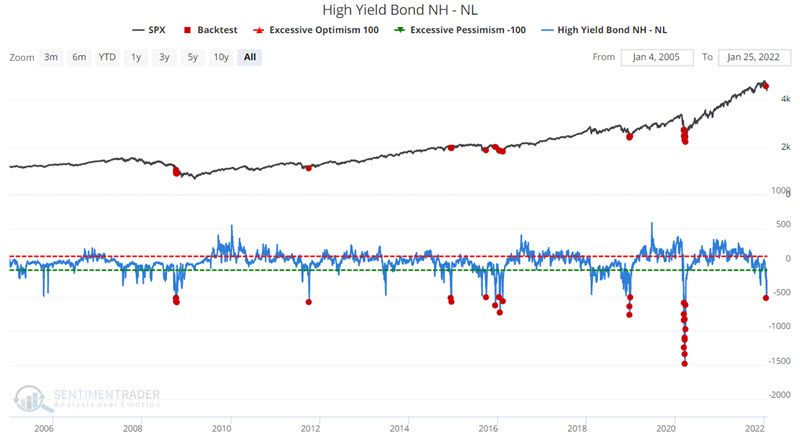

Now let's turn our attention to stocks. The chart below displays the S&P 500, and the red dots highlight those days when the High Yield NH - NL indicator read -500 or lower.

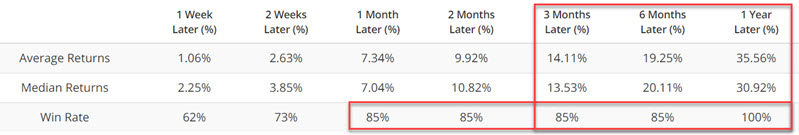

The table below displays a summary of SPX performance following all days when the indicator read -500 or lower (including overlaps). Note the high Win Rate for all periods from 1-month to 12-months. Also, note the robust returns for three months to 12 months.

As a trading signal

The results above include all days when an indicator reading of -500 or lower was in force. To better illustrate the potential usefulness of this indicator, let's consider a slightly different take.

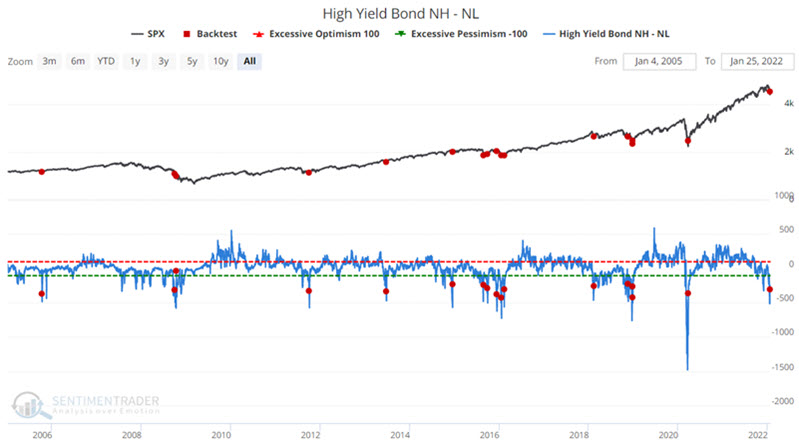

The chart below displays the S&P 500, and the red dots highlight those days when the High Yield NH - NL indicator crossed above -450. In other words, the value must drop below -450 and then cross back above that level as a sort of confirmation signal.

The table below displays a summary of SPX performance following all days when the indicator crossed above -450. The results are slightly less robust than the earlier test but still show a high degree of bullish consistency and solid rates of return.

What the research tells us…

The recent sharp decline and rebound in the High Yield NH - NL indicator qualifies as a favorable sign for stocks in the months ahead. That said, investors should consider this factor as part of an overall "weight of the evidence" approach rather than as a standalone trading model.