A Reversal Signal With a Perfect Record

Some selling pressure to start the week made sense. There were ample and increasing signs of deterioration under the surface of the indexes, and it finally caught up to them.

In yet another concerted effort to buy every dip, though, that weakness lasted all of about one day. The buying stampede on Tuesday was remarkable, and it more than reversed the selling pressure from the day before.

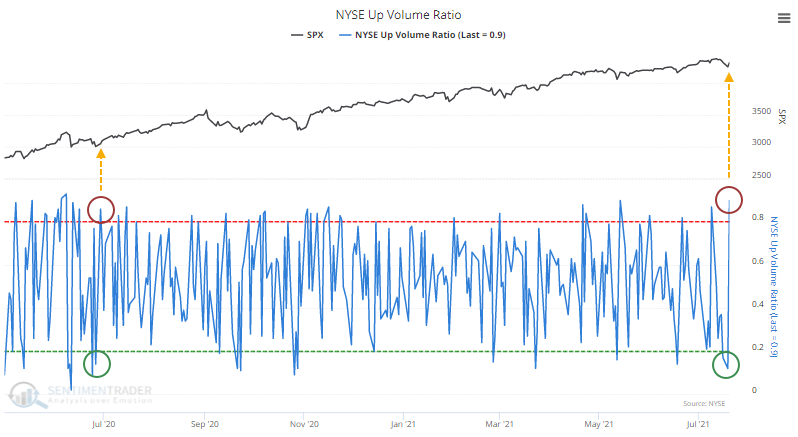

The Up Volume Ratio cycled from below 15% to above 85% in back-to-back sessions on the NYSE.

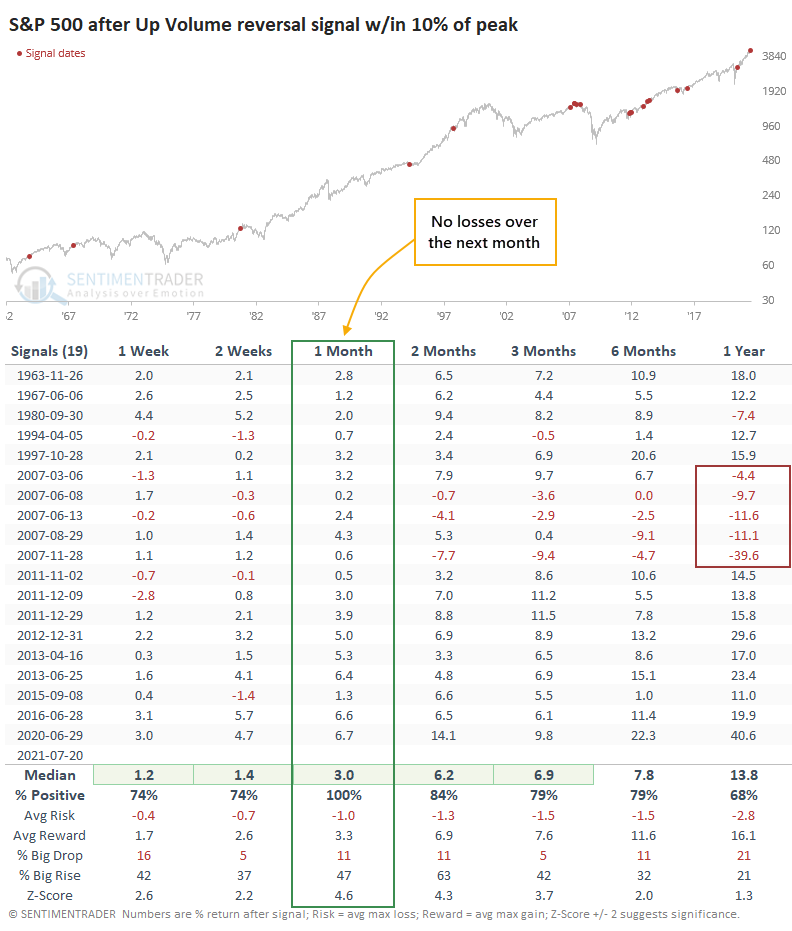

This triggered last June, and it marked the end of that little pullback, kicking off an impressive run over the next few months. That was much more the rule than the exception after a back-to-back reversal in Up Volume while the S&P 500 was within 10% of a 52-week high.

Since 1962, the S&P 500 never showed a loss in the month following similar signals. These mostly occurred during momentum markets, and buyers followed through to avoid missing out on the next bull run. A few of them did end up leading to blow-off peaks, but not until month(s) later.

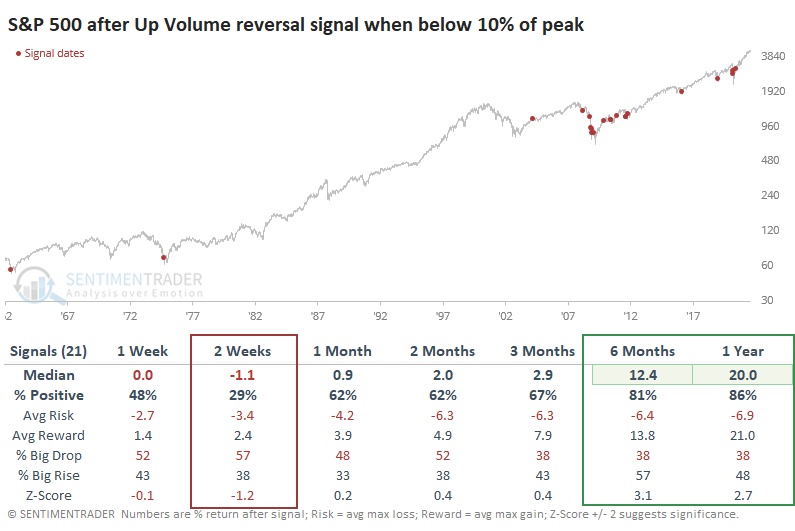

This contrasts with signals triggered when the S&P was more than 10% below its high.

While most of these triggered in the aftermath of a severe decline, with impressive long-term returns, there was much more of a tendency to see stocks fall back in the next couple of weeks.

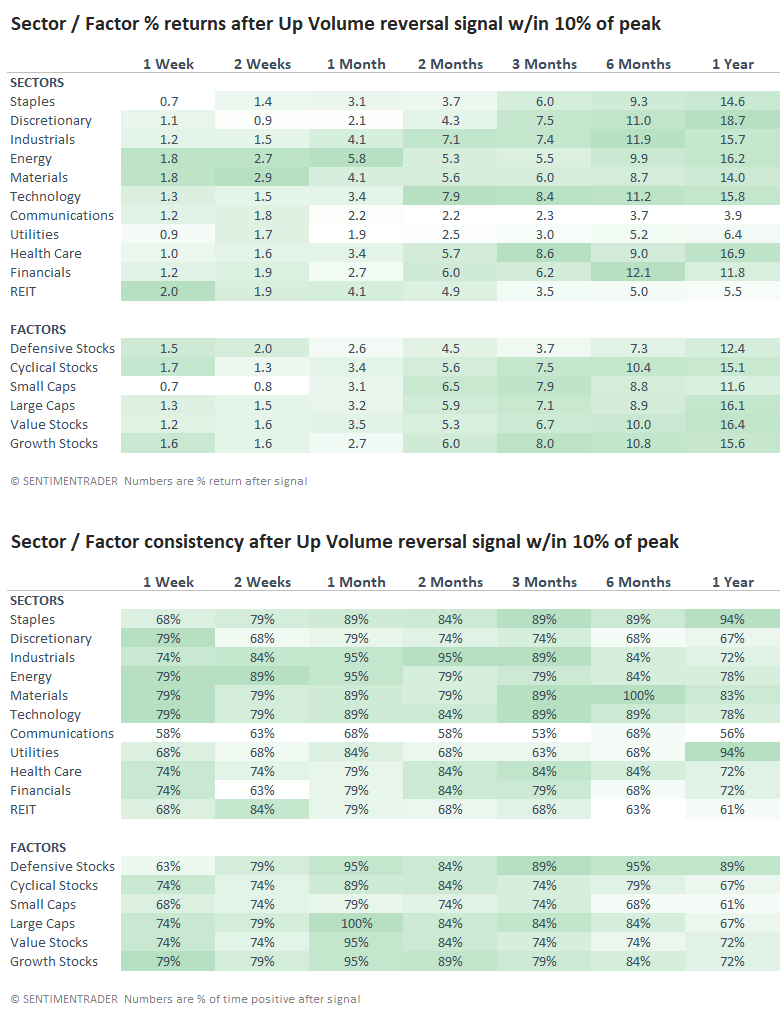

For sectors and factors, these volume reversals preceded a sea of green.

The selling on Monday was "comfortable" in that it made sense given the pressures that had been building under the surface. While some specific sectors showed some decent oversold signals, for the market as a whole, most of what we looked at suggested that it would be more likely to see further selling pressure in the weeks ahead. More and more risk-off signals were triggering, and those have a good history of preceding weak markets.

It's iffy to put a ton of weight on a single session, and Tuesday didn't make up for all the worries that have been building. At the same time, it's tough to ignore the implications of similar back-to-back volume reversals. It seemed like things were finally starting to move in bears' favor, but after Tuesday, it's hard to have much faith in that, either.