A "Small" Split As Investors Pull Back

This is an abridged version of our Daily Report.

A “small” split

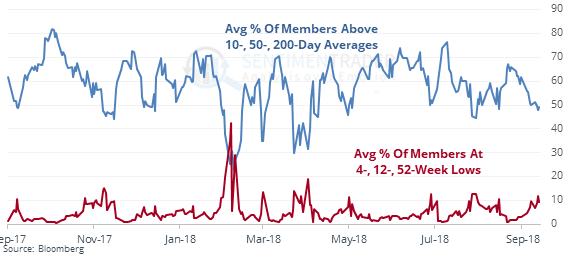

The Russell 2000 is near its highs, but relatively few of its stocks are trading above their moving averages. There has also been an uptick in its stocks hitting multi-month lows.

The only other times this has happened to this degree were in 2000 and 2007.

Back to bearish

For the first time in a month, despite a rising market, investors have turned bearish, with more bears than bulls in the AAII survey of individual investors. Stocks have struggled in the short-term after similar setups but were okay after.

The latest Commitments of Traders report was released, covering positions through Tuesday

According to the 3-Year Min/Max Screen, there were no new multi-year extremes this week, as hedgers mostly reduced their exposure. Notes from prior weeks remain in effect as hedgers continue to hold near-record positions in metals and ag contracts, while being heavily short the dollar.

Another one

Due to a still-high number of securities sinking to 52-week lows, another Hindenburg Omen was triggered on Friday. That makes 7 out of 9 days, not including 4 days on the Nasdaq.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |