AAII survey shows pessimism despite rising stocks and seasonality

Key points:

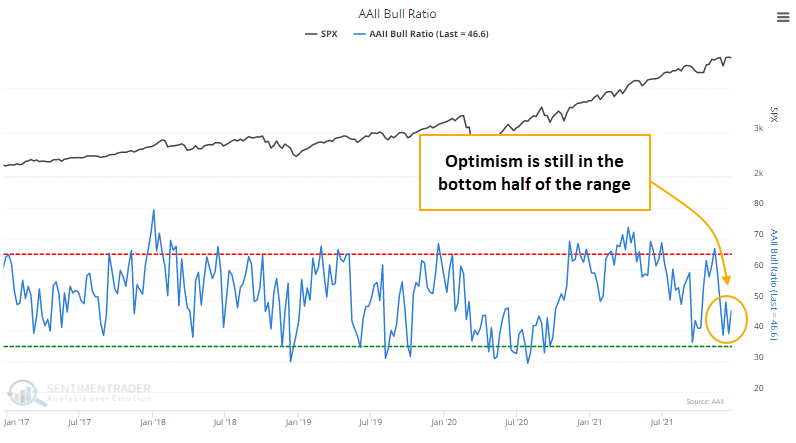

- Despite a rising market, the AAII Bull Ratio has been low for 5 weeks

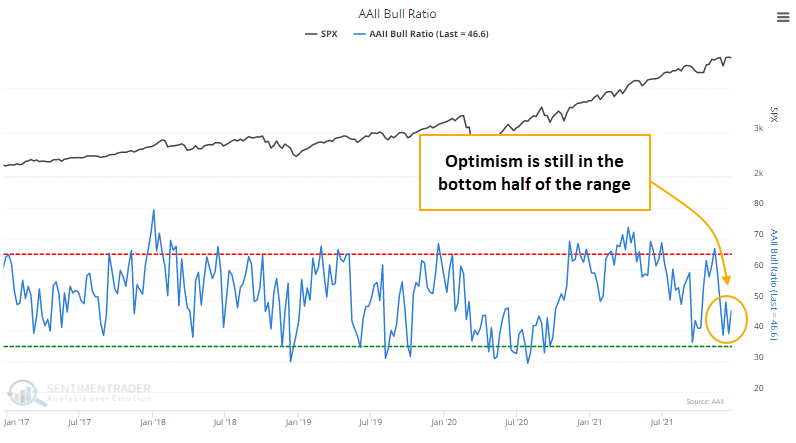

- Pessimism during an uptrend has preceded positive 3-month returns 91% of the time

- It's been less reliable, but still positive, when investors were pessimistic in December

Despite a good market, individuals are pessimistic

Sentiment toward stocks reached its peak soon after the beginning of the year. The speculative orgy heading into February coincided with a peak in some higher-risk assets but not the major indexes.

Even as those indexes have trudged higher, sentiment hasn't become as optimistic as it was early in the year. In particular, the crabby old folks who frequent the surveys from the American Association of Individual Investors have been faithful to their nature. The AAII Bull Ratio has held below 50% for 5 straight weeks.

When the 5-week average Bull Ratio is below 45% while the S&P 500 is above its rising 50-week moving average, the Backtest Engine shows that the S&P gained 91% of the time, 123 out of 135 weeks, over the next 3 months. There was a nasty loss during the 2008 financial crisis, but other than that, returns were mostly pristine.

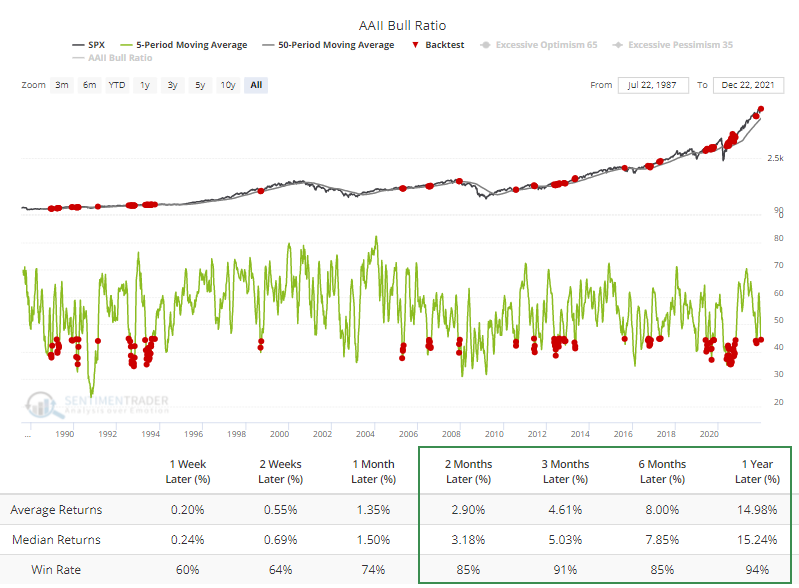

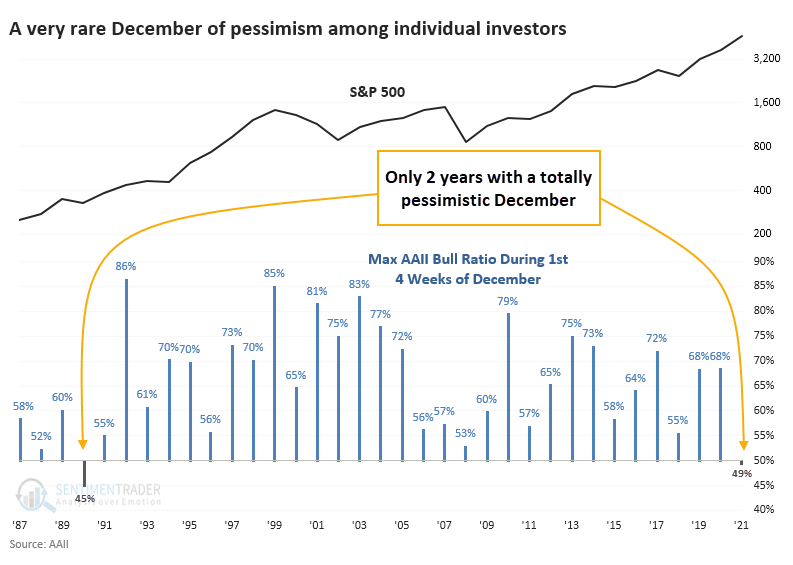

This is only the 2nd year with December pessimism

Not only is it unusual to see this behavior when the S&P 500 is holding near all-time highs, but even crabby people tend to turn more optimistic during the holidays. Not this year - this is only the 2nd year time the inception of the AAII survey that the Bull Ratio was negative for the first 4 weeks of December. The other was the recessionary year of 1990.

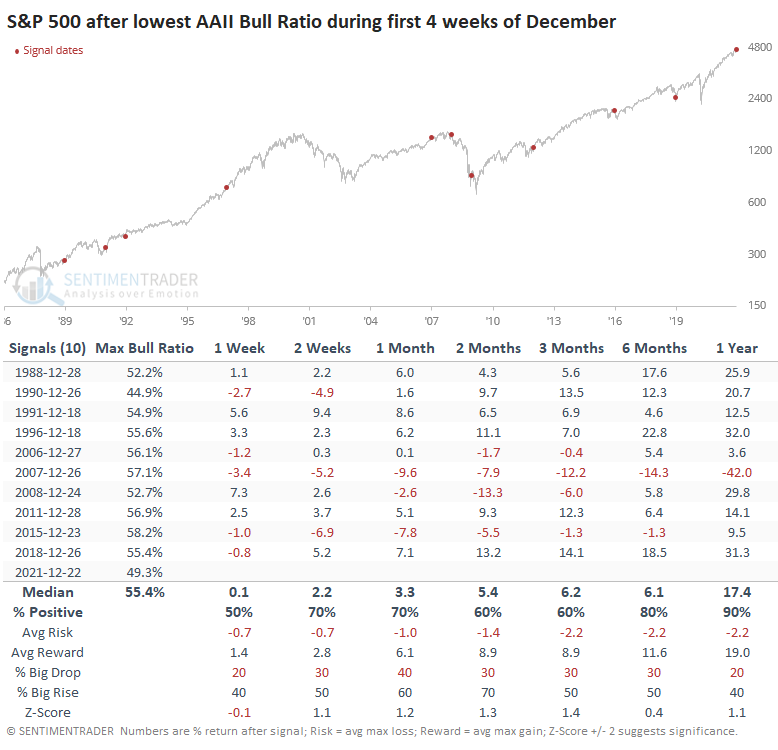

After the Decembers with the least optimistic investors, the S&P 500 performed well. Stocks stumbled following the 1990 bout of pessimism, then soared. Short-term returns were mixed, but over the next 6-12 months, the S&P only showed a rare loss.

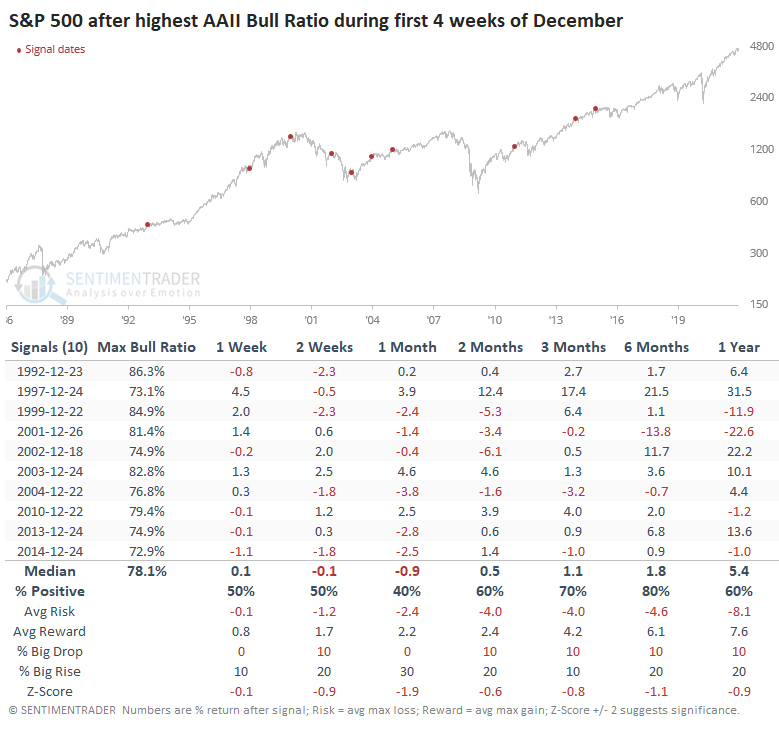

Returns were significantly more muted following Decembers with the most optimism.

They're buying stocks despite their pessimism

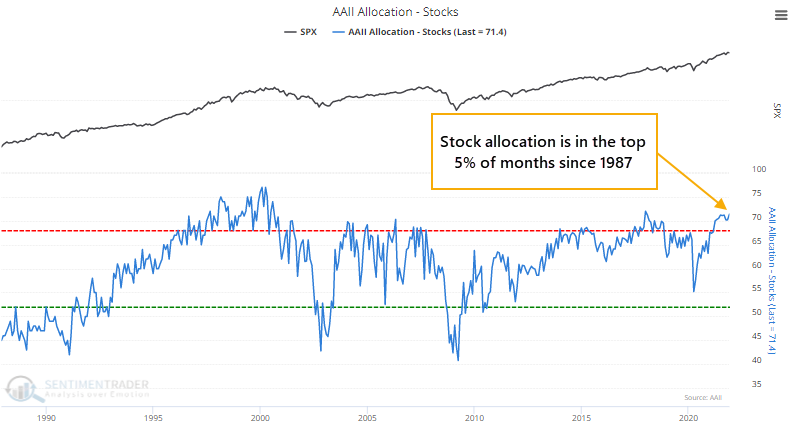

There is often a disconnect between what these folks say and what they do. Despite tepid optimism in recent months, their stock allocation is near all-time highs. Go figure.

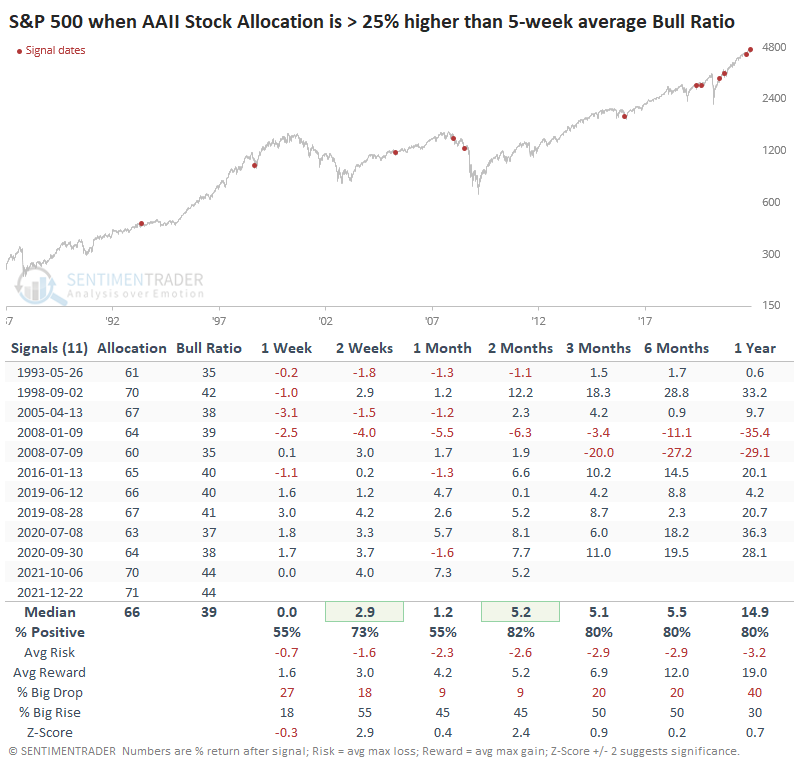

Their monthly allocation to assets tends to get stuck at extremes for extended periods, and using it as a guide to future returns is tricky. When there was a wide disparity between their allocation and their opinion, it favored their allocation. Besides the financial crisis, their high stock allocation was rewarded more than their pessimism.

What the research tells us...

It's sketchy to rely on the AAII survey as representing "sentiment." It's a niche poll of a relatively homogenous group, with noisy gyrations that have little correlation to past or future market movements. Moving averages of the data have been more helpful, and low levels of optimism like we see now have had a good record at preceding good returns in stocks. The current low optimism given a mostly healthy market environment, especially during this time of year, suggests higher prices.