Aggregate model goes negative

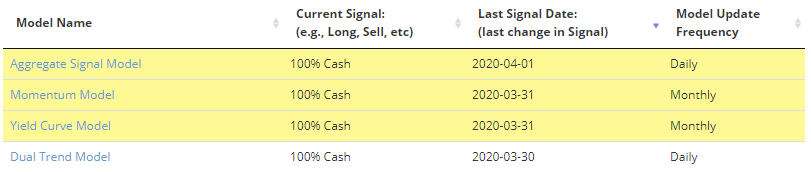

In recent days, several of the Buy/Sell Signals have flipped to cash, from being invested in either SPY or QQQ.

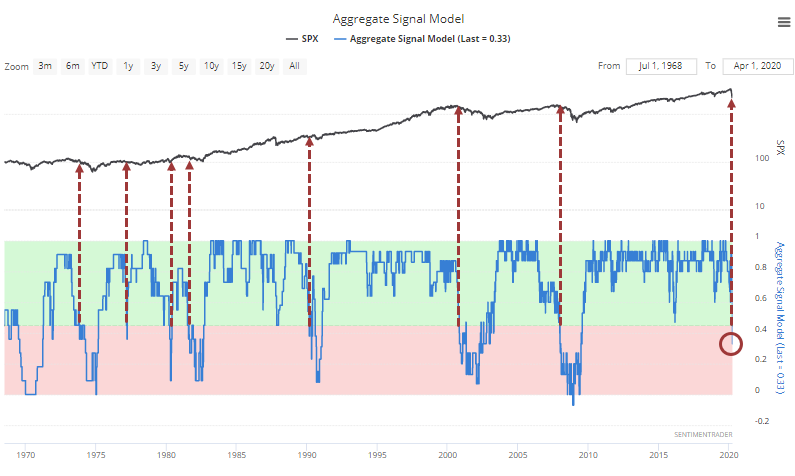

In response, the Aggregate Signal Model, which sums up the percentage of models currently on a buy signal, dropped below the 45% threshold. In healthy markets, it usually stays well above that level.

Many of the models include economic data which are subject to revision, but we only include real-time data that one can use at the time of release. And economic data released recently is more likely to be revised down, not up.

A model reading this low this has not been a good sign.

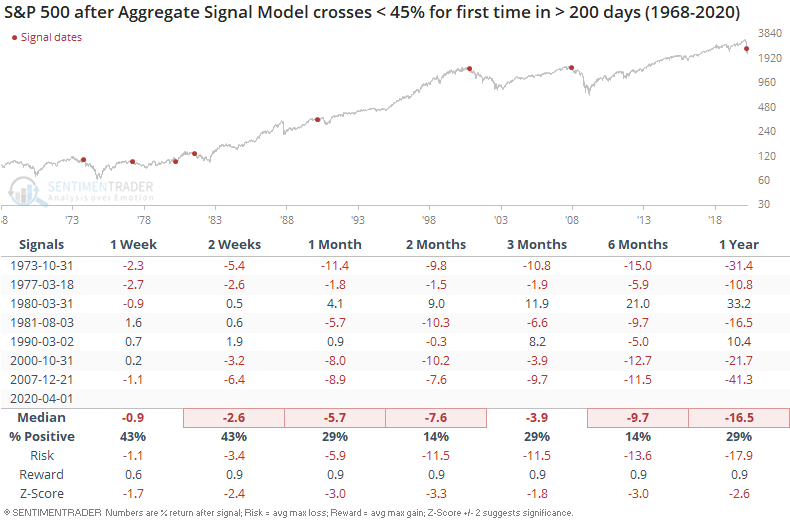

There are some extenuating circumstances:

- The Aggregate now includes more daily models, which could make the signal nosier than it was historically, so we might see it quickly jump back above 45% if buyers return in force

- This sell signal triggered after the quickest, most severe decline in history (in some respects), not a slow-rolling one like most of the others

- We've already seen the kind of panic and subsequent buying thrust that have typically occurred well after the other signals turned negative

If we see stocks continue to recover, then the model could flip back above 45% in the coming weeks. That would be unusual - the only other times it did so were in 1977 and 1990 - but if it did, it would be "less bad." Those were two of the more mild signals.

The biggest trouble came when the model stayed below 45% for weeks and months at a time. Again, most of the other signals triggered when stocks were closer to their highs than now, so perhaps the worst of the losses have already happened. It's just that it would be a better sign if the model was able to rebound as opposed to staying below 45%.