All 'Bout That 'Mo

The Nasdaq has rallied 9 out of 11 months, and the MACD indicator is about to turn up.

Momentum

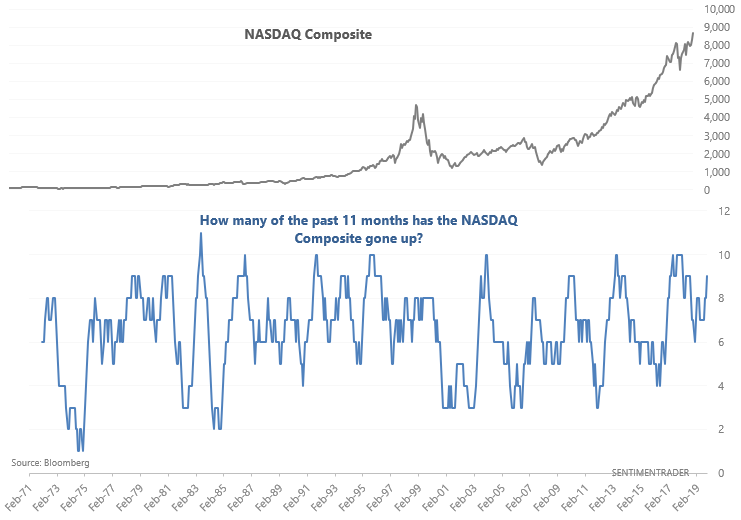

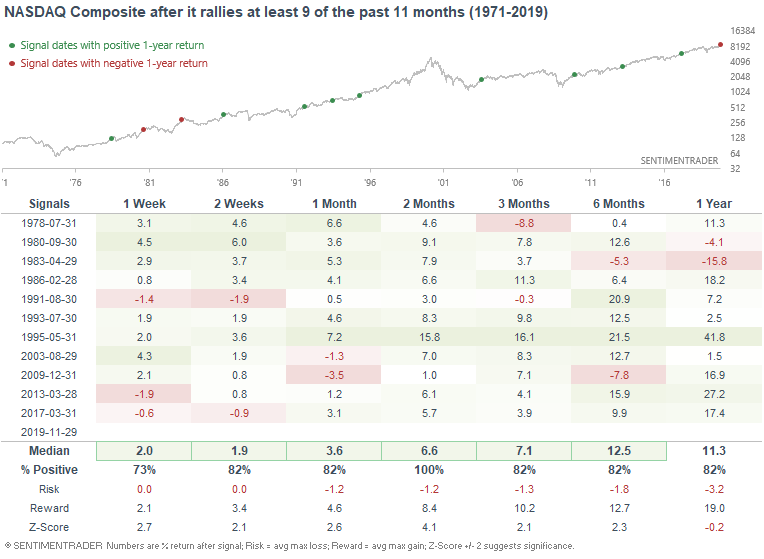

With just one month left this year, U.S. equities have rallied significantly year-to-date. U.S. equity indices like the NASDAQ Composite have gone up 9 of the past 11 months.

As is the case with most momentum studies, this has been typically bullish for stocks over the coming months:

That doesn't necessarily fit with some of the warning signs we're seeing out there, but those are mostly shorter-term.

More momentum: MACD

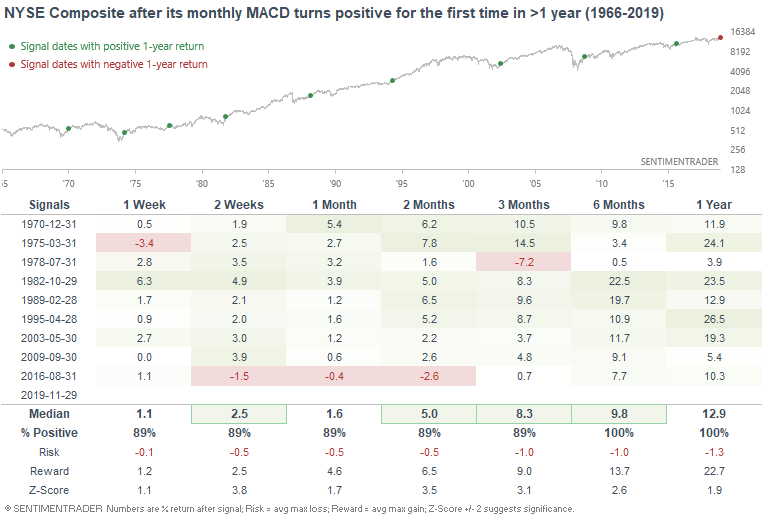

Various U.S. stock market indices' monthly MACD histograms have turned positive for the first time in months. This includes the NASDAQ Composite (which we touched on last week), and now the Dow Jones Industrial Average and NYSE Composite.

Like the Nasdaq, the NYSE Composite's monthly MACD has turned positive for the first time in > 1 year.

Extreme momentum usually does not simply stop on a dime.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Our medium-term Risk Level is extremely high

- What the persistently low Goldman Current Activity Indicator might mean

- More looks at price momentum