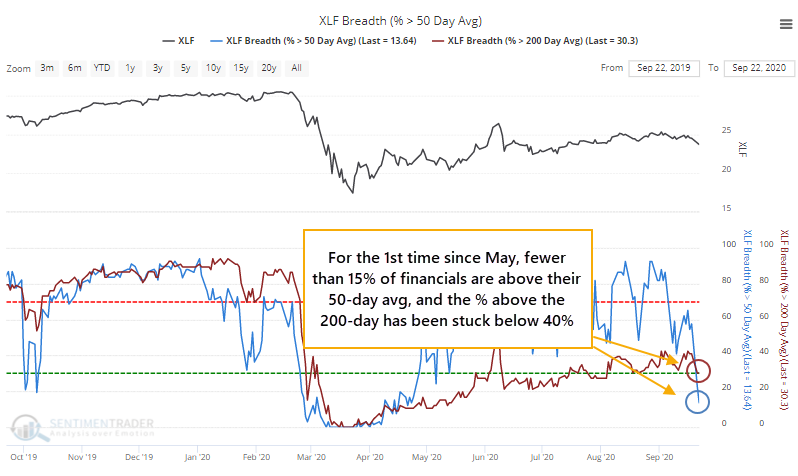

Almost all financial stocks are below their medium-term averages

Financial stocks have been among the laggards and still haven't been able to get out of their own way.

When they fell on Tuesday, they really fell, and it dragged most of them below their medium-term averages. For the first time since May, fewer than 15% of financials were able to hold above their 50-day averages. That comes during an environment where fewer than 40% of them even made it above their 200-day averages.

This ended a streak of more than 100 days with more than 15% of financials above their 50-day averages. In the broader market, when a long streak of positive momentum (or at least "not negative" momentum) ends, it often precedes positive returns, as those who missed the rally see their first real opportunity to get in.

With financials, these opportunities seemed heavily dependent on the larger market environment. When these streaks ended and more than 50% of financials were above their 200-day averages, forward returns were excellent, both in that sector and the broader market. When fewer than 50% were above their long-term averages, then not so much.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A full look at streaks in the % above their 50-day averages in financials

- Other breadth metrics for financials show a poor market environment

- But at least insiders had been buying

- What happens when the Russell 2000 is the 1st of the 'big four' indexes to drop below its 200-day moving average

- Returns after new homes sales, starts, and building permits spike higher