An August High As Option Speculation Ramps Up

This is an abridged version of our Daily Report.

Summer high

Stocks ended August at their highest monthly close in at least 36 months. A new high in August has preceded poor returns during the next 1-4 weeks as September lived up to its reputation. The S&P struggled to hold its gains, especially during the past 30 years.

A speculative week

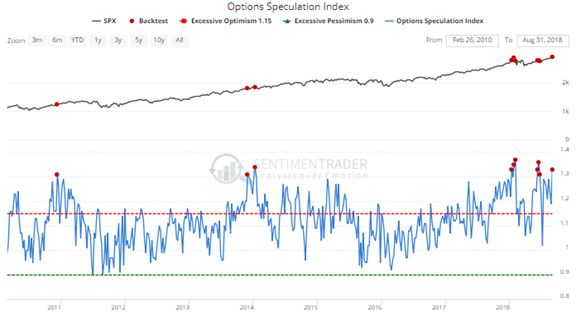

Last week, options traders focused heavily on bullish strategies. The ratio of bullish to bearish ones was one of the highest in more than 5 years, as both small and large options traders spent a large part of their volume buying call options.

Not quite panic

Gold mining stocks suffered yet another large loss and a 52-week low. That’s 6 such losses in 20 sessions, among the largest selling clusters in 25 years.

New loser

The battle for most-hated commodity seems to keep alternating between coffee and one of the grains. The record pessimism toward the former has eased a bit, leaving soybeans holding the current title for most-hated.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |