An unequal rally

The rally off the March lows has been impressive, historic even. There's quite a bit to like about it, namely the retracement of the decline and multiple breadth thrusts.

There's a lot not to like, too, which we don't usually see when enjoying a powerful move like this. Outside of the stock market, signs of a thaw have been hit-or-miss, and there's been a lot of odd activity. That can happen when relatively few stocks are driving the market.

That seems like an odd thing to say since there have been multiple days with 90% of more of securities advancing. But the biggest stocks have had a major impact on indexes like the S&P 500.

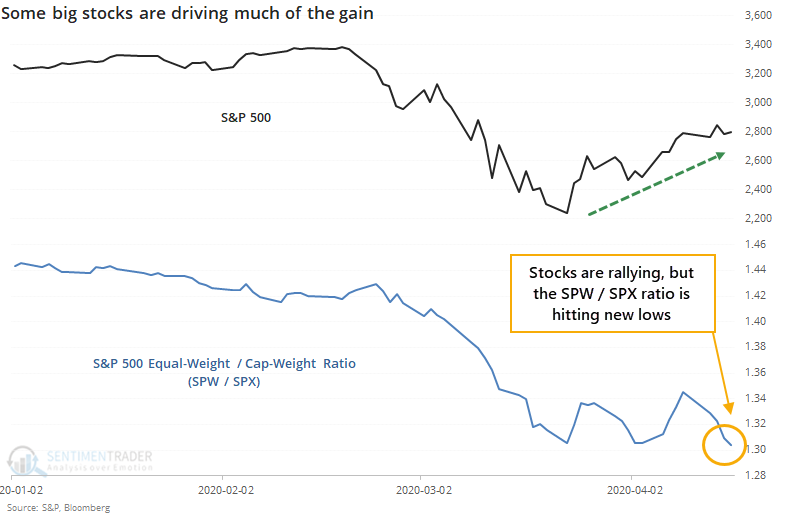

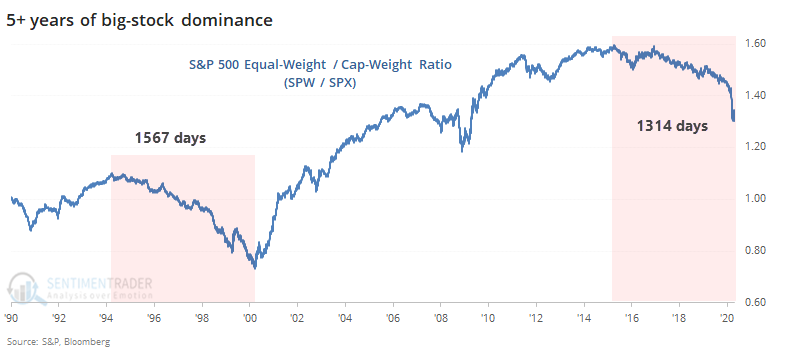

Multiple people have pointed out that even while the S&P 500 index that everyone watches hit its highest level in a month, the equal-weight version of the index hasn't quite kept up. The ratio between the two just hit a new low.

We looked at this in January. While there were some major reasons to be worried about stocks, this ratio was not one of them. About the only consistent thing it suggested was that the equal-weight version of the index should keep under-performing.

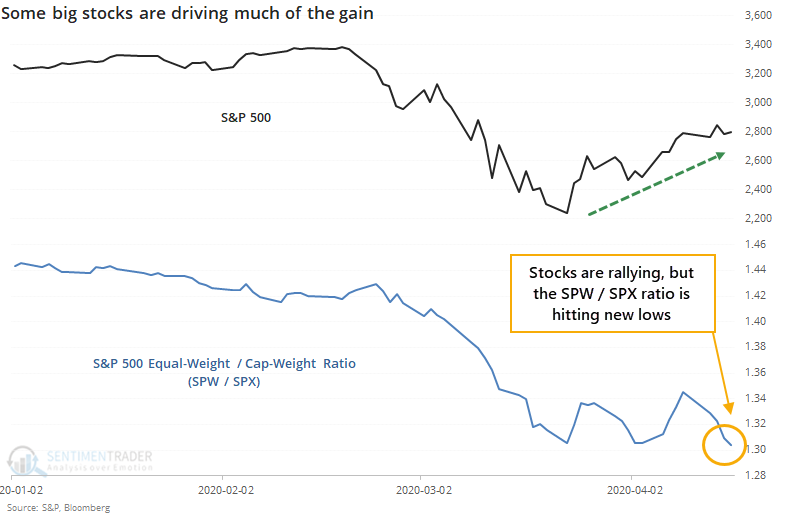

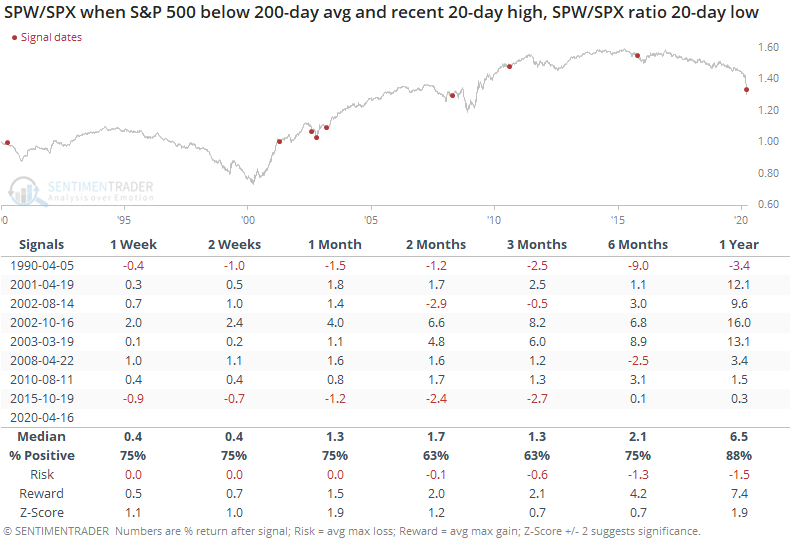

Below, we can see the times most similar to now, when the S&P 500 cap-weighted index was trading below its 200-day average but hit a 20-day high in the past three sessions, and the ratio between the equal-weight (SPW) and cap-weight (SPX) indexes hit a 20-day low.

Not much to go on there, with mixed returns across time frames. Maybe a bit weak longer-term.

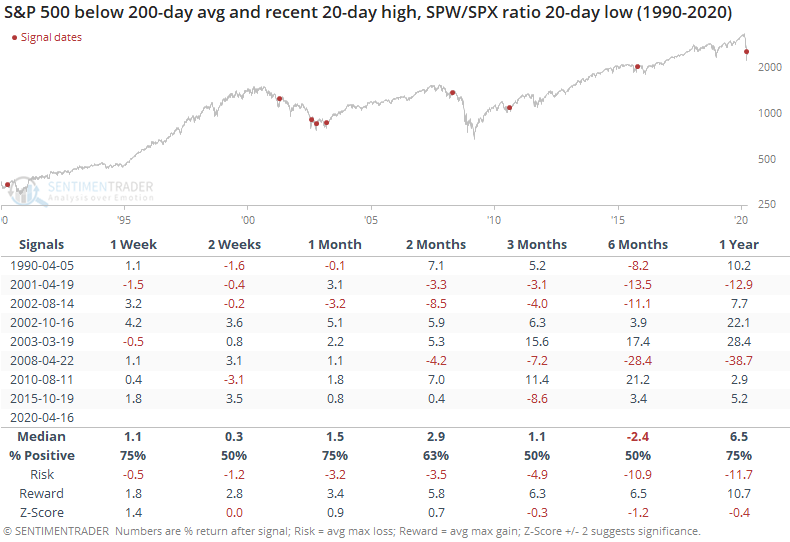

For the equal-weight index, it was about the same story.

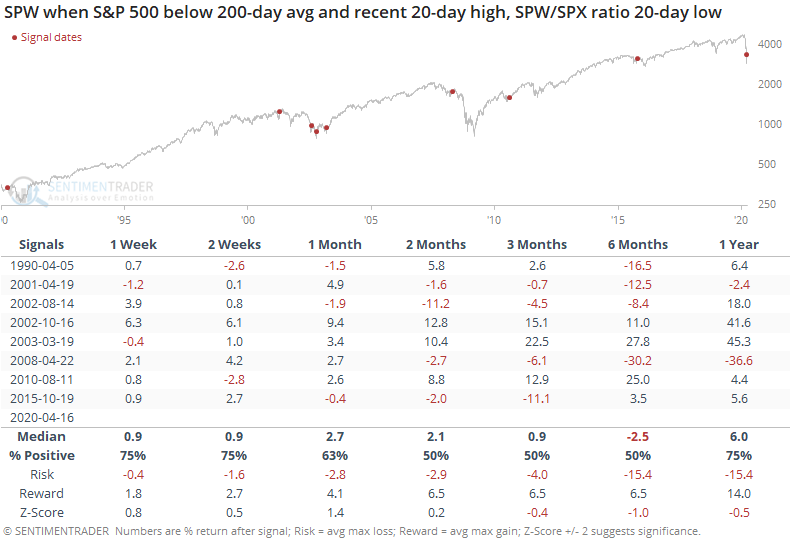

For the ratio, though, it was more positive. It was positive across most time frames, meaning the equal-weight index performed better than the capitalization-weight index.

Investors have been looking for this series to mean-revert for a long time. The equal-weight index has under-performed for about 5 years, nearing the previous record from the late 1990s.

There isn't much of a catalyst for it to start now, though some of the "trillion-dollar stock club" fetishes from the start of this year are a compelling anecdotal sign. Usually, when we look at ratios like this, they tend to favor an extension of the trend, but that wasn't the case this time. Maybe that 5-year trend is finally nearing some exhaustion.