Average True Range Reversal Buy Signal Concept - Part 2

In my note on Thursday, 8/5/21, I shared a trading signal that uses a derivative of the average true range indicator from J. Welles Wilder. For more details on the concept, please click here.

Because the ATR spread signal thrives on volatility, we want to ensure that we trade ETFs that provide opportunities. i.e., an ETF like Consumer Staples (XLP) is not on my radar.

Today's note aims to share additional information for some of the most actively traded ETFs I follow.

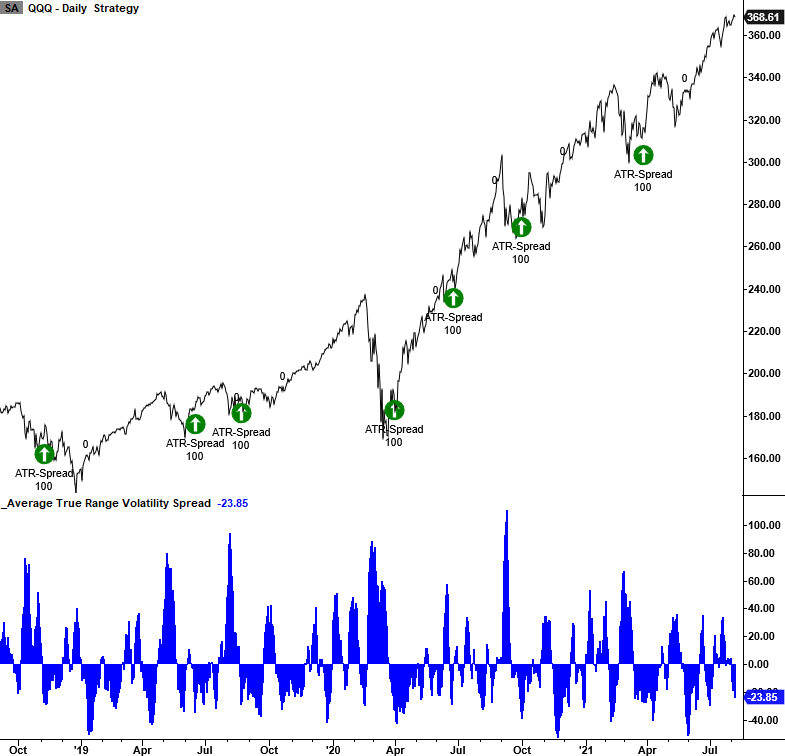

CURRENT DAY CHART - NASDAQ 100 ETF (QQQ)

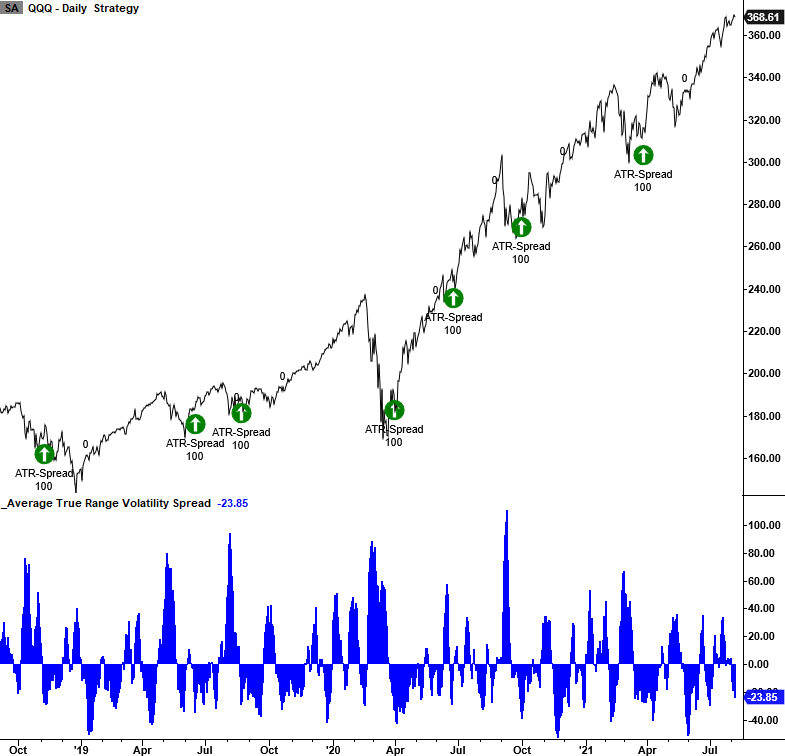

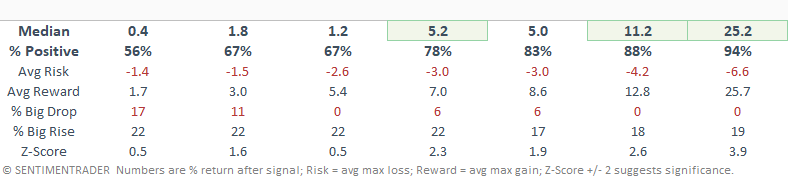

HOW THE SIGNALS PERFORMED - NASDAQ 100 ETF (QQQ)

In case you were wondering, I included the optimal spread brackets in the statistics table. So, for a QQQ signal to occur, the ATR spread must first cross above 55%. Once that condition is confirmed, the ATR spread must then cross below -25.5%. The brackets are labeled reset and buy level, and you will find them in each table.

The intermediate to long-term performance looks good, and the model did an excellent job of avoiding trouble in the 2000-02 bear market. The days since a reset to buy level count and rate of change conditions are critical factors in reducing unfavorable signals in bear markets.

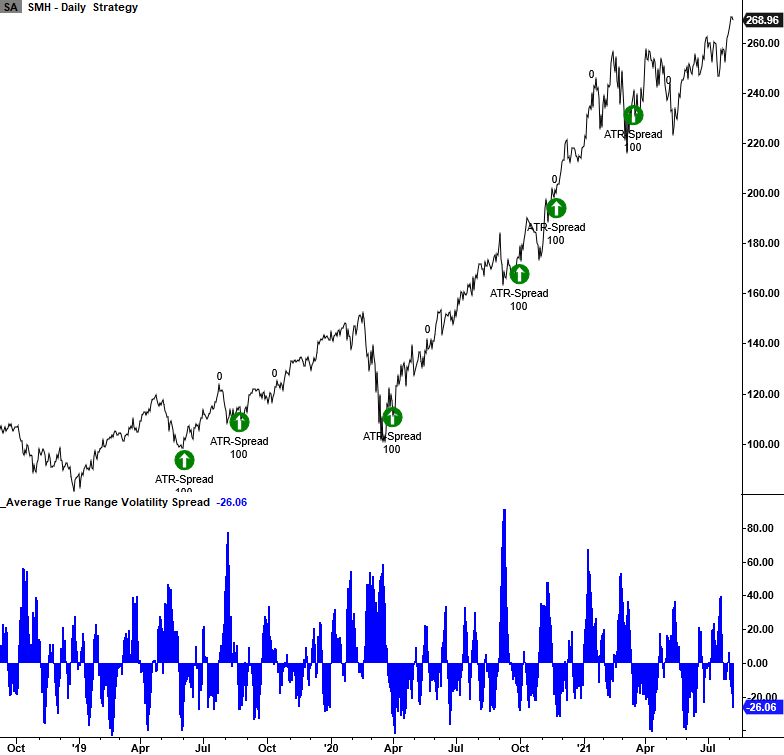

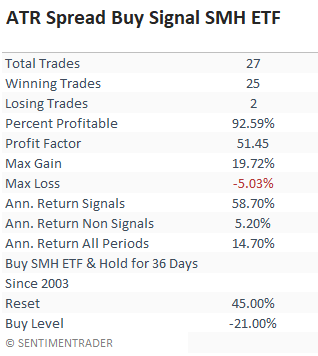

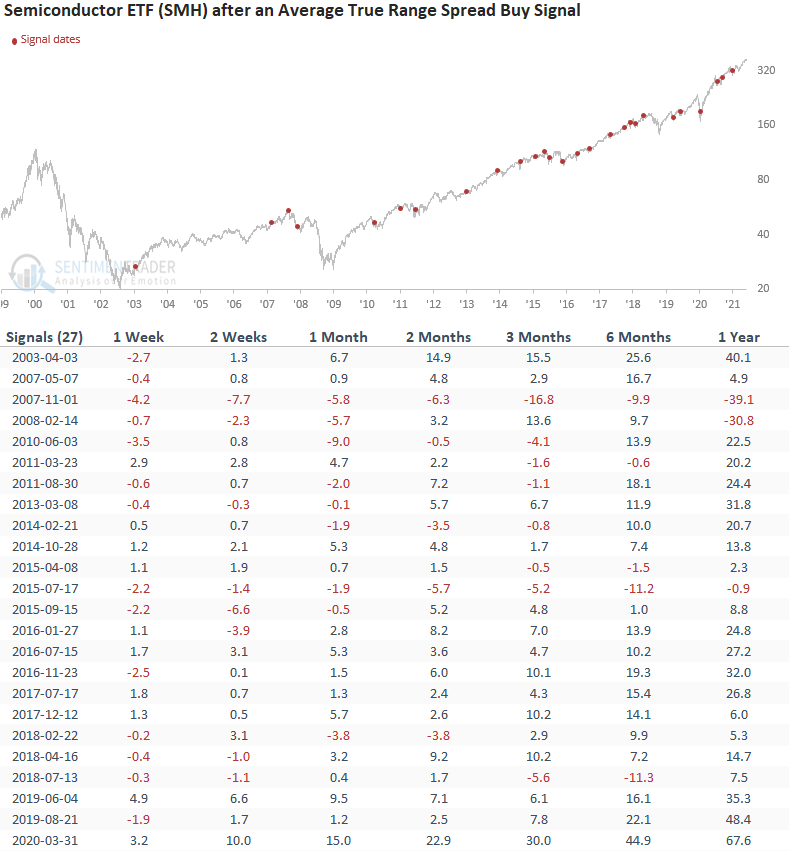

CURRENT DAY CHART - SEMICONDUCTOR ETF (SMH)

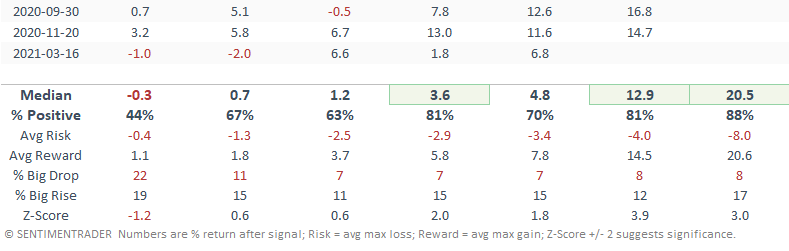

HOW THE SIGNALS PERFORMED - SEMICONDUCTOR ETF (SMH)

Besides the 1-week timeframe, performance looks good, especially in the 2-12 month window.

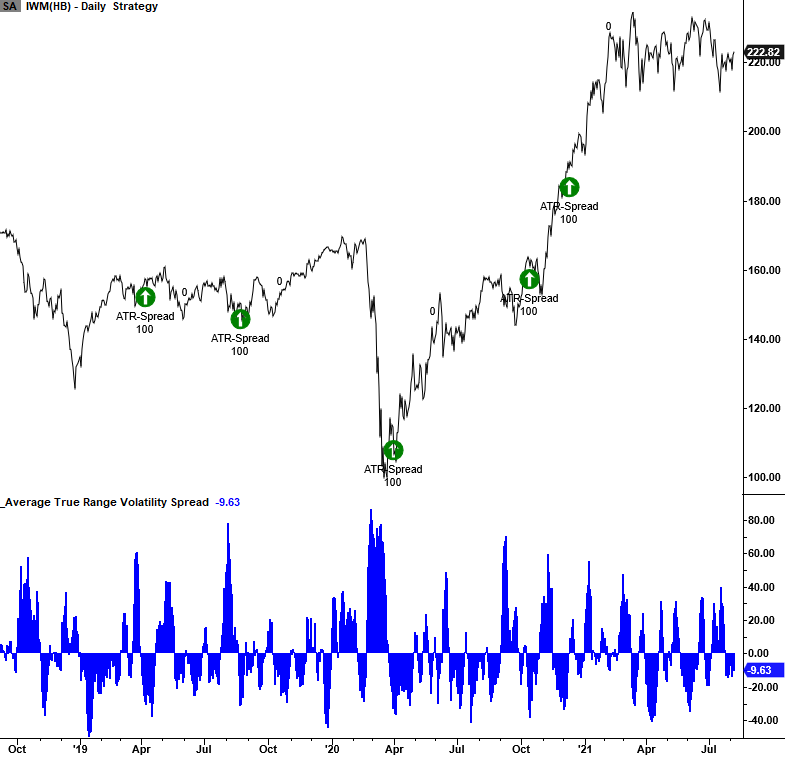

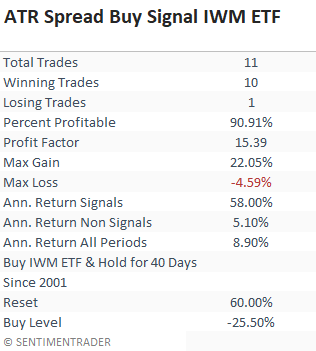

CURRENT DAY CHART - RUSSELL 2000 ETF (IWM)

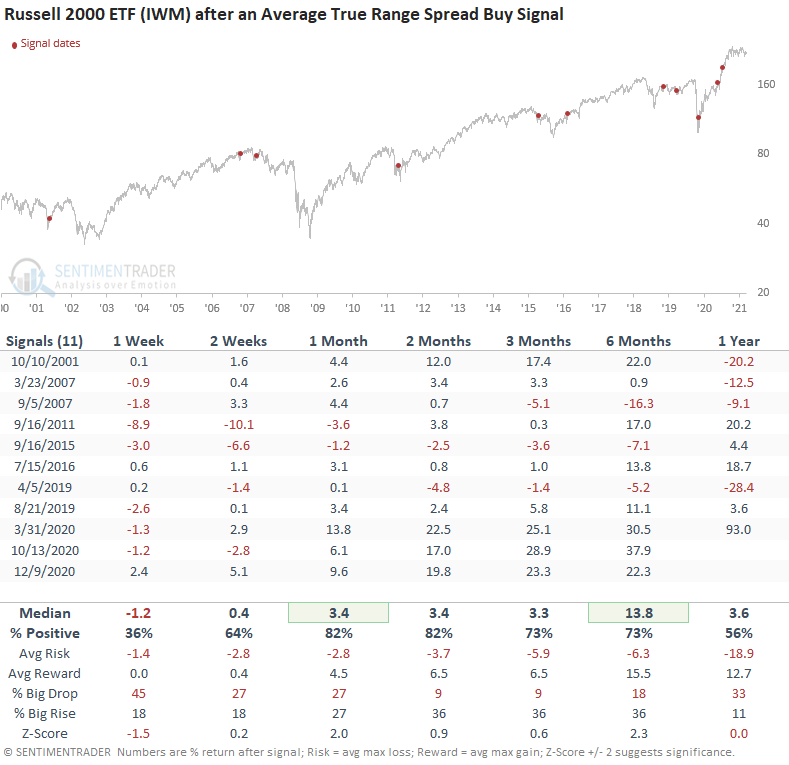

HOW THE SIGNALS PERFORMED - RUSSELL 2000 ETF (IWM)

Besides the 1-week timeframe, performance looks good, especially in the 1-6 month window.

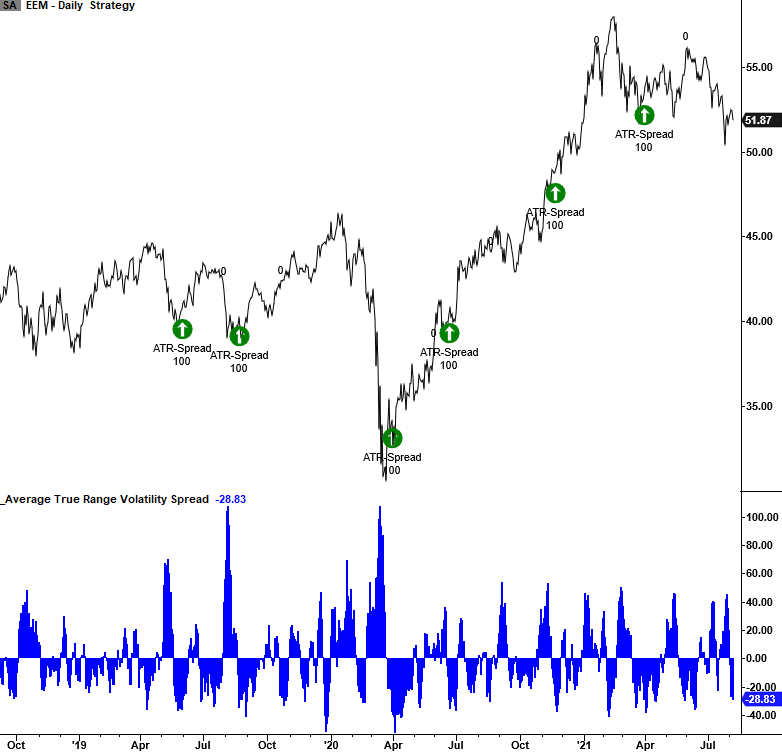

CURRENT DAY CHART - EMERGING MARKETS ETF (EEM)

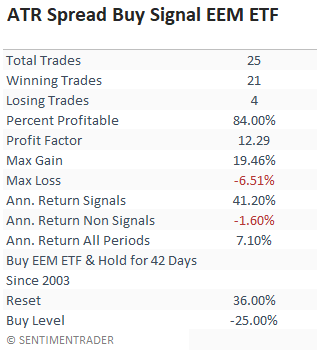

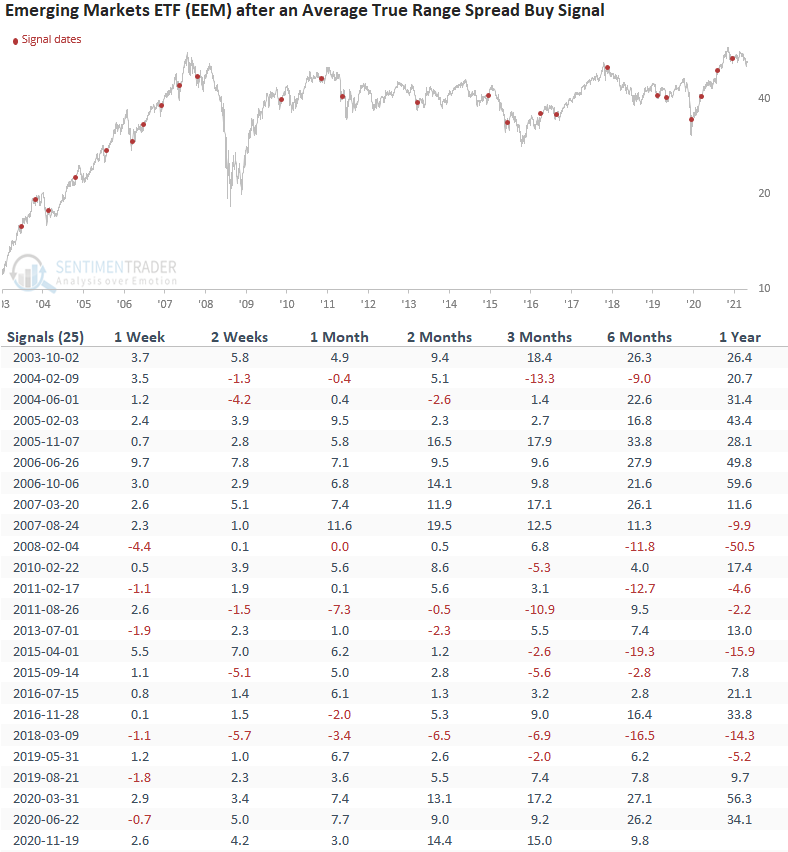

HOW THE SIGNALS PERFORMED - EMERGING MARKETS ETF (EEM)

HOW THE SIGNALS PERFORMED - EMERGING MARKETS ETF (EEM)

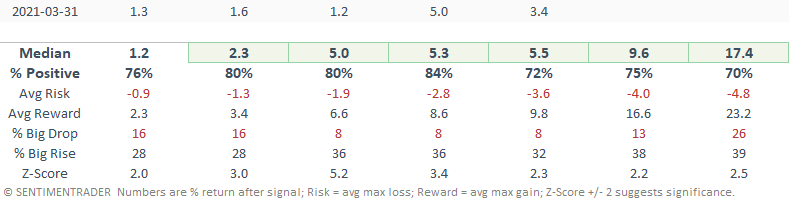

The EEM ETF has a higher hurdle rate for the 5-day rate of change condition. It uses a threshold level of 2%, whereas most other ETFs only require a rate of change greater than zero.

The emerging markets ETF performance results look fantastic, with a solid risk/reward profile in 6/7 timeframes.

As I stated in my note on Thursday, the threshold levels for a signal may vary depending on the asset class. One can also adjust the levels to either increase or decrease the number of instances. i.e., if we wanted fewer signals that represented a more profoundly oversold market condition, one could raise the reset level from, say, 50% to 75%.