Backtest Engine Scans I Have Known and Loved - The-14-Day RSI Edition (Part I)

Most traders learn the conventional wisdom concepts of "overbought is bad" and "oversold is good" pretty early on. On the other hand, it usually takes some time to learn the counter-intuitive lesson that, at times, overbought can be just as favorable as oversold. To illustrate these concepts, we will use two separate Backtest Engine scans, both using the 14-day RSI on the stocks in the S&P 1500 Index.

OVERSOLD

In classic technical analysis, traders look for selling to become overdone as a sign that a bottom might soon be in place. Let's look at one scan that fits this role.

By clicking this link and then clicking "Run Backtest" you can run the following test:

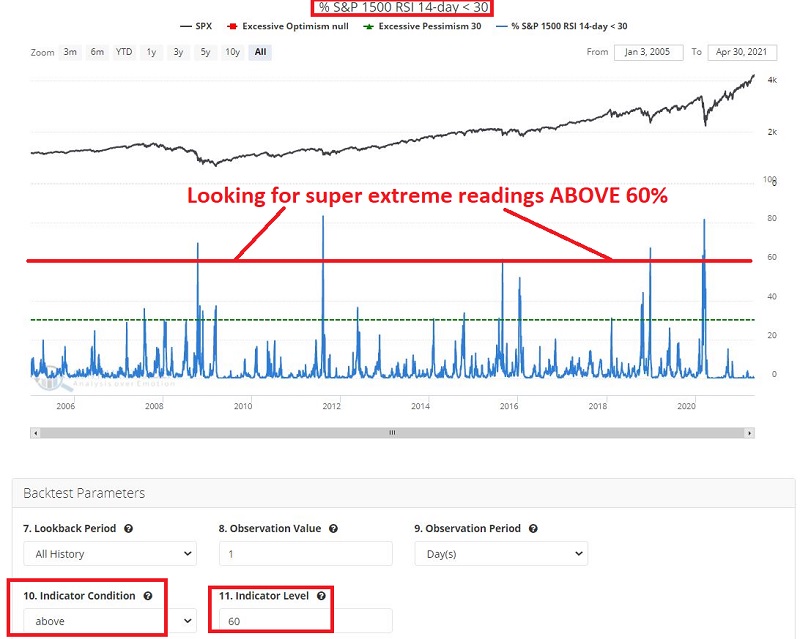

- We look at % S&P 500 1500 RSI 14-day < 30

- We look for a value of 60 or higher

In plain English, we are looking at 1,500 stocks, and we are identifying those times when at least 60% of those 1,500 stocks have a 14-day RSI reading of 30 or lower on the same day. This is one objective way to designate a severely oversold market.

- The bad news is that this signal does not happen very often

- The good news is that when it does, it strongly suggests that the worst is just about over and that a significant bull market is in the offing

% S&P 500 RSI 14-day < 30 ABOVE 60

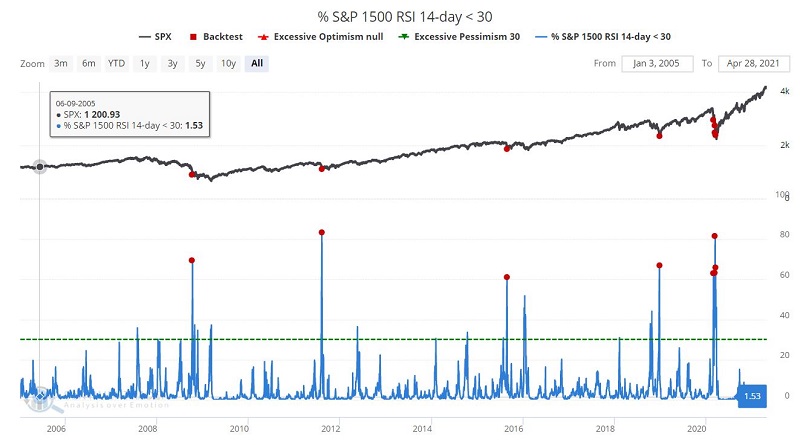

The chart below displays the signals.

The figure below displays a summary of results 1 week to 1 year after each signal in the chart above. The results are exceptionally bullish.

Note that:

- The average and median returns increase with each passing timeframe

- The Win Rate also trends higher the more time that goes by

- The 1-year Win Rate is 100%

- The 1-year Median return is a terrific +34.59%

As I said, the only problem with this particular signal is:

- It doesn't happen very often

- The market typically needs to experience some significant pain before a signal occurs

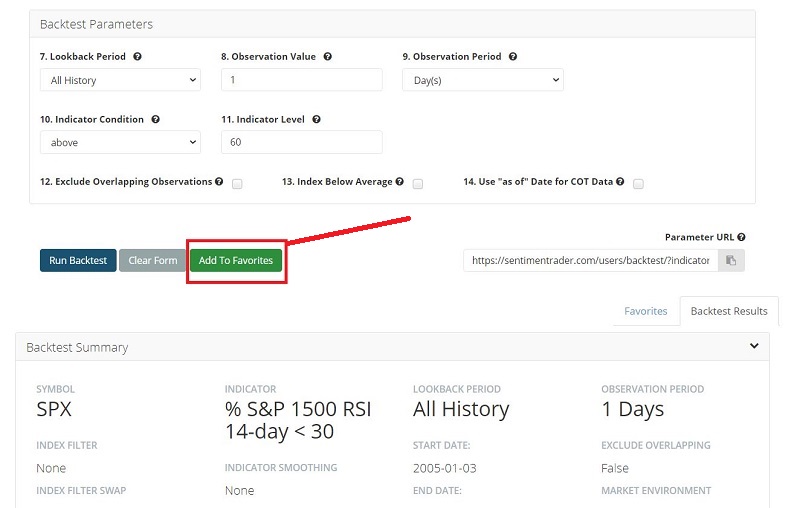

SAVING THE BACKTEST SCAN

This one is definitely worth adding to the archives. You can do so by:

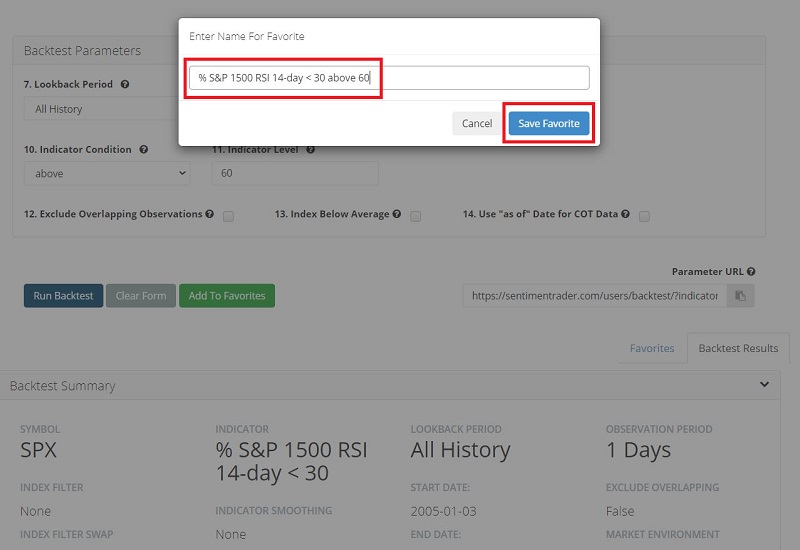

- Clicking "Add to Favorites"

- Typing "% S&P 1500 RSI 14-day < 30 above 60"

- Then click "Save Favorite"

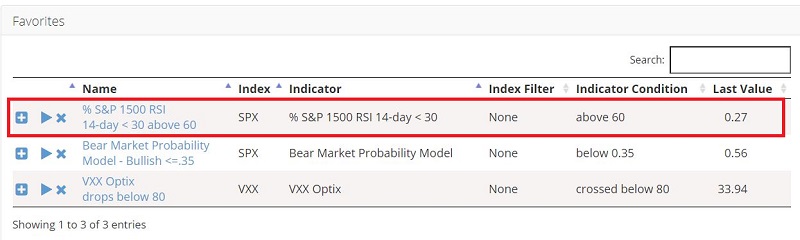

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will appear at the bottom as per below.

For premium users, the Evening Digest emailed at the end of each day will include a section at the bottom that highlights any of your Favorite Backtests currently active.

SUMMARY

The signal detailed above does not occur very often. But when it does, it certainly appears to be worth knowing about. The steps above can automate your ability to be alerted when the next signal occurs.