Backtest Engine Scans I Have Known and Loved - The Smart/Dumb Money Confidence Spread Edition

Please note that these scans are not necessarily presented on a "timely" basis. The goal is two-fold:

- To help you learn more about the Backtest Engine and its potentially powerful uses

- To help you build an arsenal of scans that may ultimately prove to be very useful at just the right time

One limitation to some of the articles in this series is that often the signal in question does NOT give signals very often. The bottom line is that:

- When signals do occur, they tend to be very useful

- But a trader cannot typically sit around and wait for a new signal

For this reason, users are encouraged to follow the steps farther down to save these scans to their "Favorites" and to sign up for the Evening Digest so that when a signal does occur, they will be alerted.

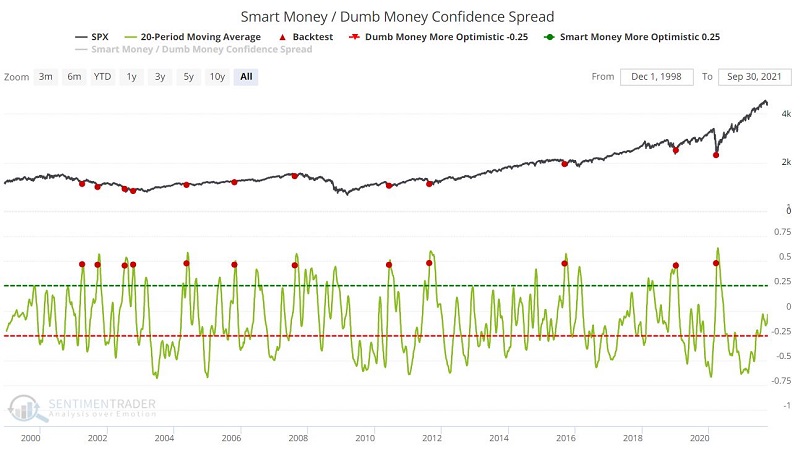

SMART MONEY / DUMB MONEY CONFIDENCE SPREAD

As the name implies, this indicator measures the daily difference between our "Smart Money" value and our "Dumb Money" value.

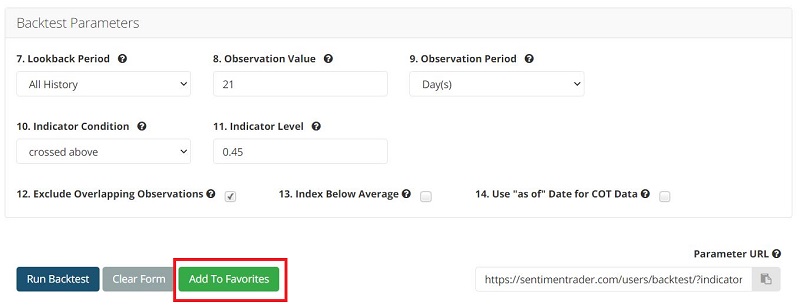

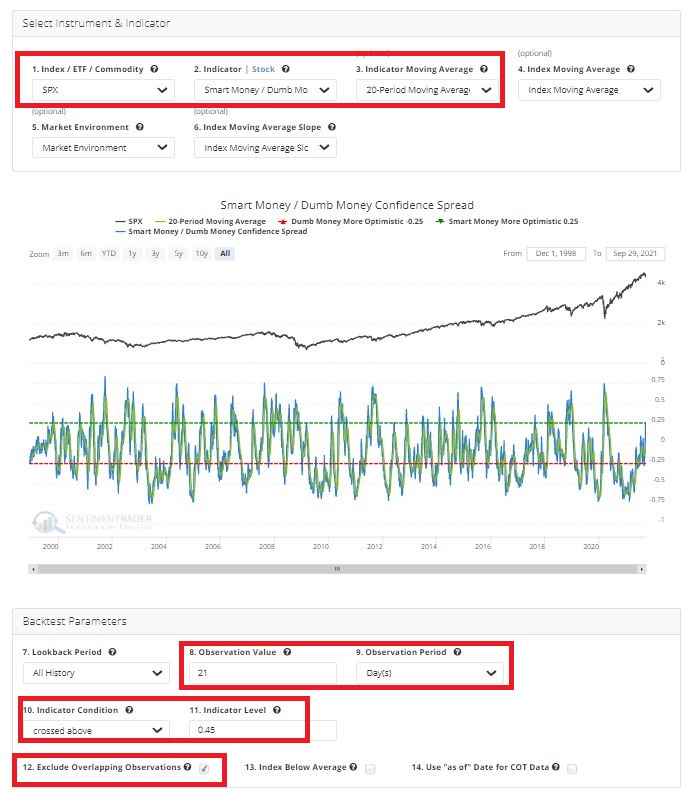

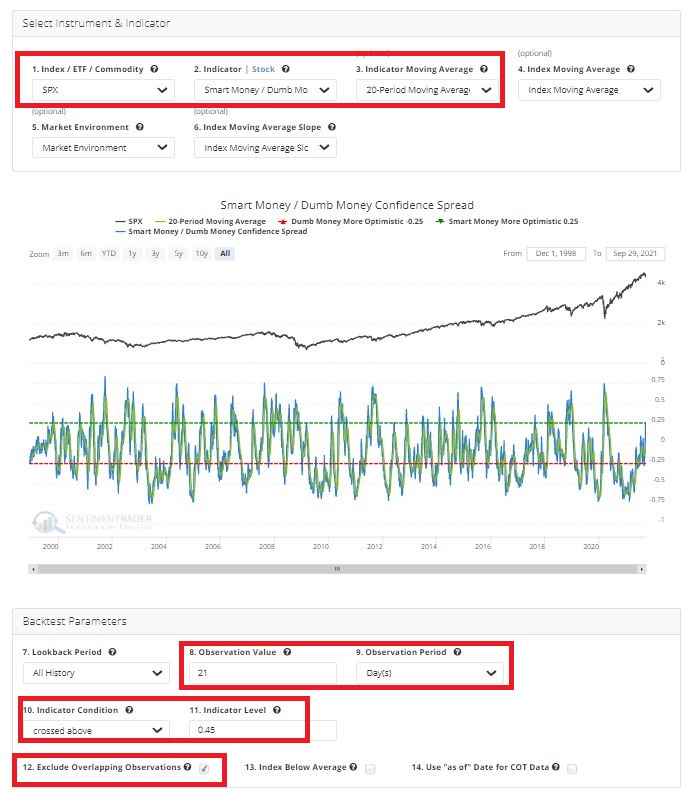

For this article:

A = (Smart Money value - Dumb Money value)

B = 20-day moving average of A

For our test, we will identify those days when:

- Variable B crosses above 0.45

- For the first time in 21 days

The screenshot below displays the input screen for this test (after you follow the steps below to Save this scan, anytime you recall it, the inputs will fill in automatically). You can launch this test by clicking here and then clicking "Run Backtest."

The chart below displays the signals generated by this test:

- The bad news is that this scenario occurs infrequently

- The good news is that when it does flash a signal, they tend to be quite useful - particularly for shorter-term traders

The screenshot below displays the summary of the results. The key things to note are:

- The high Win Rates

- And the robust Median Returns

- Over the shorter-term time frames

The screenshot below displays the full results for all previous signals.

The bottom line:

- Signals from this particular scan are infrequent (and unfortunately, not close to triggering anytime soon)

- But when they do occur, short-term traders appear to have an outstanding opportunity to play the long side of the stock market

SAVING THE SCAN

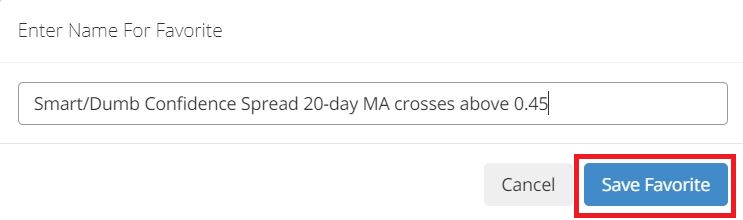

Now let's look at how you can save this scan (or any scan) so that you will automatically be alerted when it gives a signal.

You can do this by:

- Clicking "Add to Favorites"

- Typing "Smart/Dumb Confidence Spread 20-day MA crosses above 0.45"

Then click "Save Favorite"

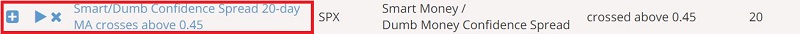

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will be listed at the bottom of the screen.

Finally, note that any Saved scan that is active is listed at the bottom of your Evening Digest email. You can go to My Website Preferences under My Account to ensure you get those (they are on by default).