Bear Market Roadmap; Pessimistic CFOs

This is an abridged version of our Daily Report.

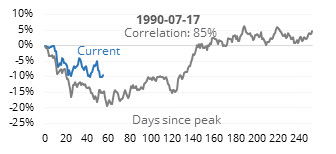

Bear market roadmap

There have been 20 bear markets in U.S. stocks since 1950. If we look at their average price path during the next year, the S&P’s performance since September shows a high correlation to 10 of them.

After those 10 bear markets were this far into their decline, they usually moderate their declines for a few months.

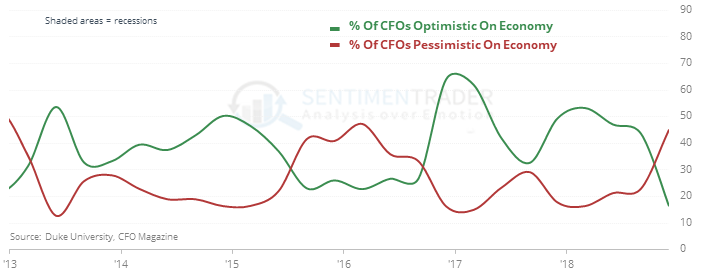

CFOs are pessimistic

A survey of 500 corporate CFOs shows that during the recent quarter, they have become the least optimistic on the U.S. economy’s prospects in 7 years. They were pessimistic heading into the financial crisis, a point in their favor, but had a couple of dud calls as well.

Mom & pop are, too

The latest survey from the American Association of Individual Investors showed a bit drop in optimism. The Bull Ratio dropped to 30%, the lowest since February 2016. According to the Backtest Engine, a reading this extreme led to a positive return in the S&P 500 three months later 88% of the time, averaging 5.9%.

Bank blahs

Several of the largest banks in the U.S. are down at least 7 days in a row and trading at 52-week lows. For the 2nd largest bank, BAC, it’s the first time since 2011. It’s happened 6 times in 25 years, leading to rebounds three weeks later 4 times, but the two losses were massive.