Big money managers come back

On Wednesday, we saw that institutional investors were pulling money out of cash, the start of a potential reversal in a historic rush into money markets.

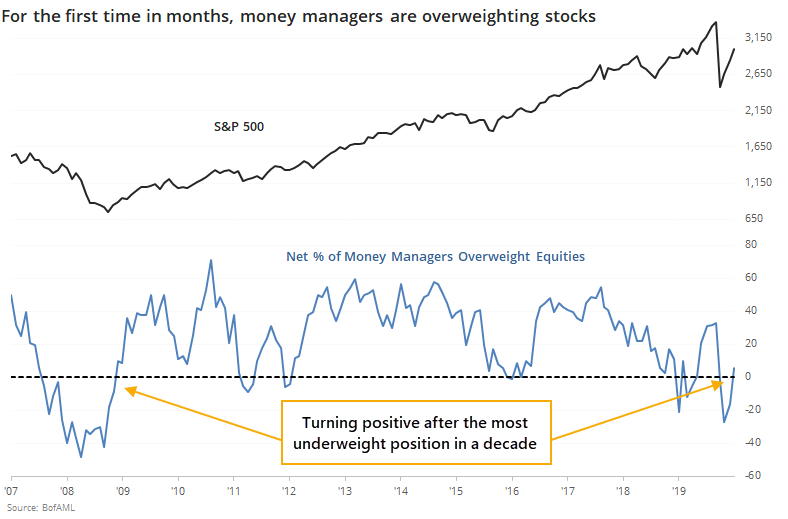

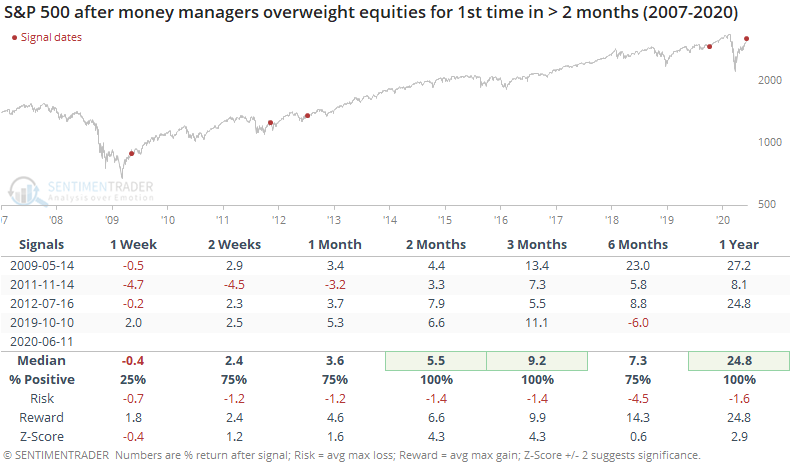

According to the latest Bank of America poll of large money managers, some of that cash is likely finding its way into stocks. For the first time in months, managers are net overweight equities.

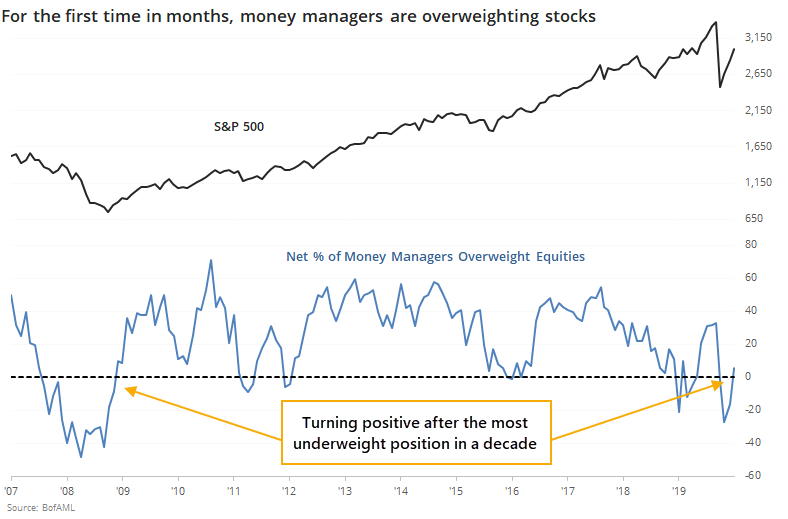

Surprisingly, the streak of three months of being underweight is tied for the 2nd-longest in 13 years.

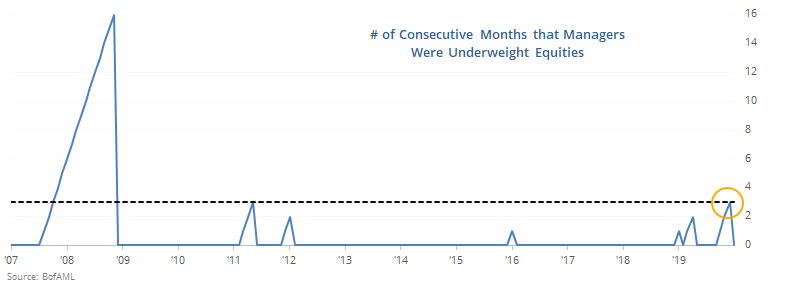

The sample size is ridiculously small, but the other two times when managers went overweight for the first time in 3 or more months, they were the beginnings of longer-term recoveries.

When managers returned to stocks after even two months of being underweight, it was also a good sign.

Granted, the study period is dominated by a historic bull market, or multiple bull markets depending on the definition, so results will tend to be skewed to the upside. Even so, the returns following these return-to-optimism signals were well above random. With a small sample size, the z-score requires that results not only be markedly different than random, but consistent, too, and these were, especially over the next 2-3 months.

We're not including it in the Active Studies due to limited history and the small sample, but it's one of those "environmental" indicators that suggest a tailwind. There is quite a battle over that time frame, with signs of speculation and extreme optimism indicating a subdued summer, versus breadth thrusts and recoveries having an almost unblemished record at preceding higher prices, but more consistently over a 6-12 month time frame. This renewed optimism among money managers likely isn't enough to overcome the overhang of speculative activity and potential for a change in the White House.