Big money managers ease their pessimism

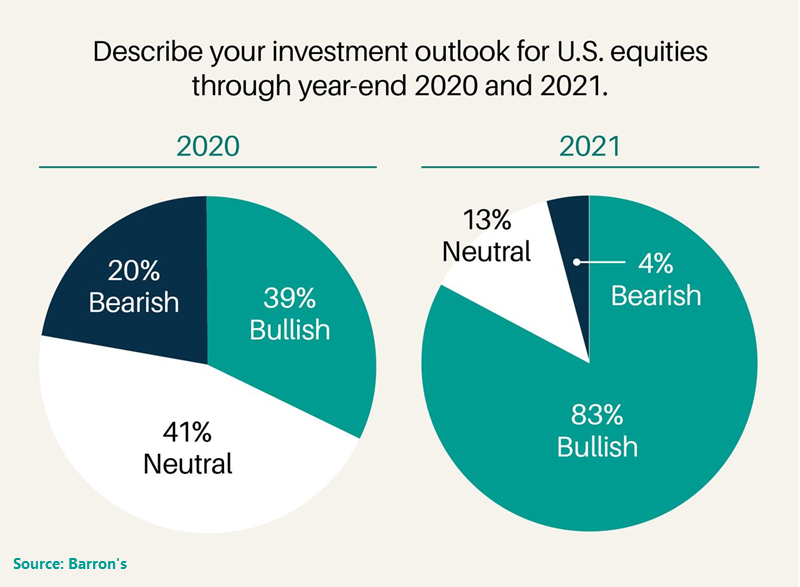

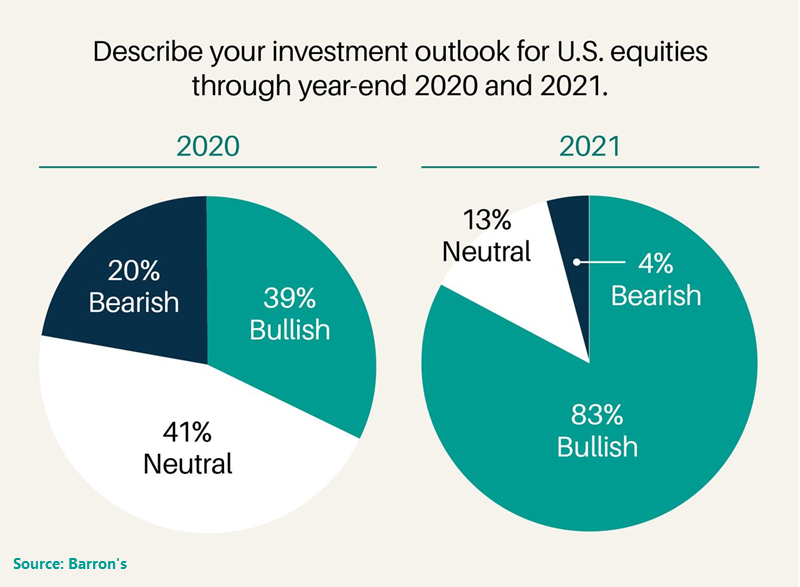

Last fall, the "big money" was not optimistic. According to the semiyearly poll of more than 100 major money managers by Barron's, never before had they been so negative on stocks.

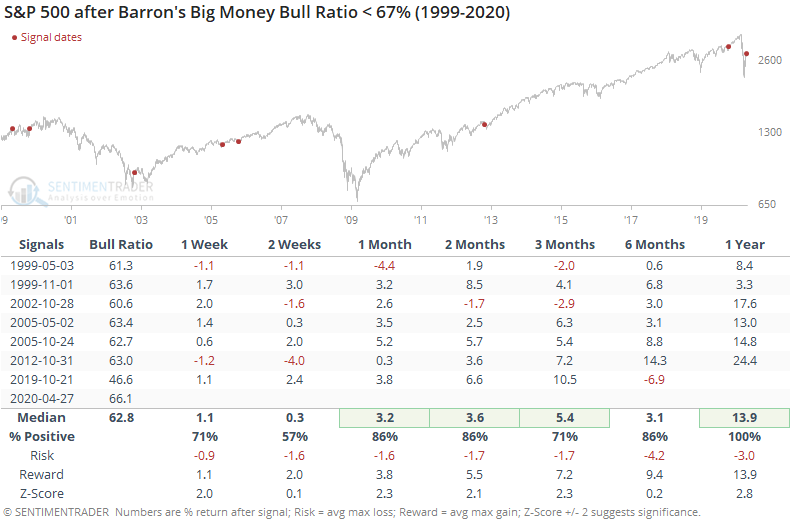

When we looked at it in the October 28 report, it suggested a modest positive bias for stocks. Other times the big money had been relatively downbeat, stocks did well in the months ahead. Like many of these kinds of surveys, though, it wasn't a huge edge. Assuming that big money is a contrary indicator isn't that easy.

While stocks climbed for the next four months, proving the big money was way too conservative, the plunge in March perhaps justified some of that conservatism. Some of the managers took advantage of the lower prices by becoming more constructive.

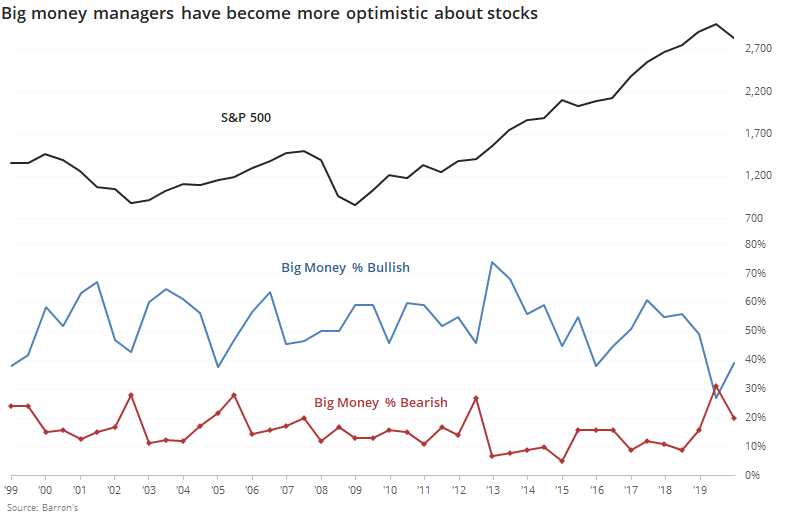

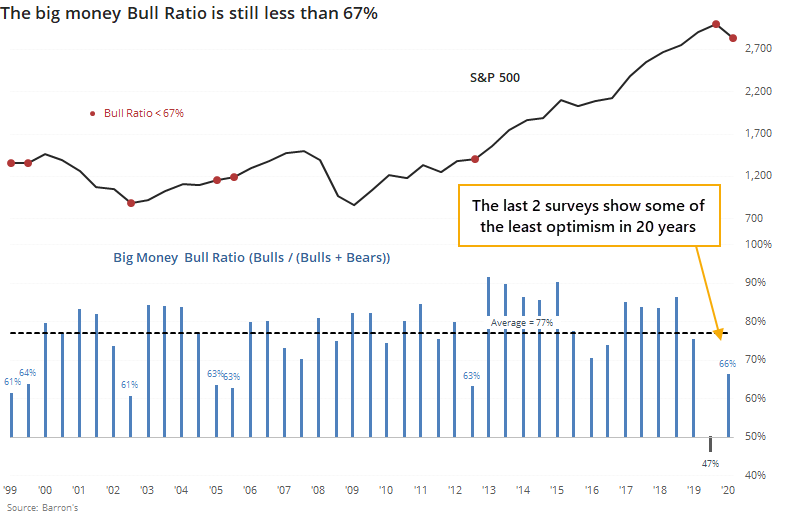

Below, we can see that compared to other readings over the past two decades, these managers are still less optimistic than usual.

If we look at it in terms of a Bull Ratio (Bulls / Bulls + Bears)) then the current ratio of 66% means that fewer than two-thirds of the managers are optimistic. That's well below the long-term average of 77% and still ranks among the lowest in more than 20 years.

The S&P mostly rose after similarly low ratios, though technically we're still on this signal since it triggered last October. If we look at returns following any survey when the Bull Ratio was less than 67%, they were above average, with a decent risk/reward ratio over the medium-term.

It's a small sample, but should be a small positive going forward.