Big positive holiday gap

Despite what were some clear signs of speculative activity last week, the news flow was apparently good enough over the weekend that traders are pushing pre-market futures to another extremely positive open to start the week.

We've been noting for months that given the unprecedented nature of the decline and rebound, it's unclear how much we can rely on price patterns, especially very short-term ones. So this is strictly FWIW, but a popular question is how markets trade after large gaps.

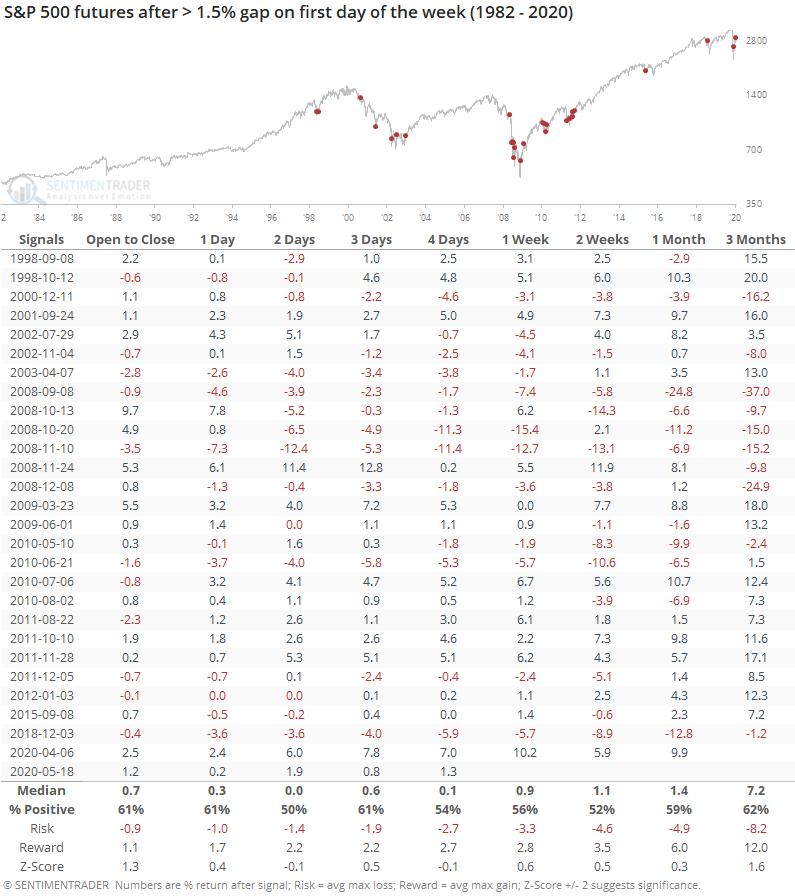

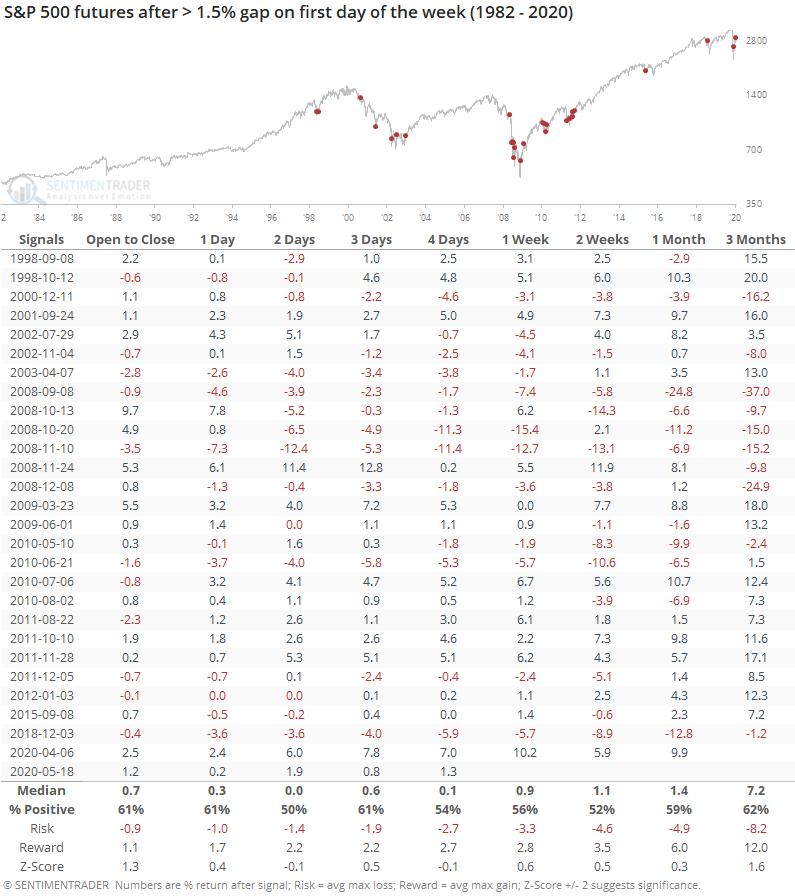

Below, we can see every time the S&P 500 futures have opened at least 1.5% higher than their prior close, looking only at the first trading day of the week. This is usually a Monday, of course, but includes Tuesdays when Friday was an exchange holiday.

This has a more positive skew than some other days of the week, and there wasn't a consistent pattern of immediate selling pressure. Until the last decade, most of the days saw a negative return at some point over the next week, but that hasn't happened lately.

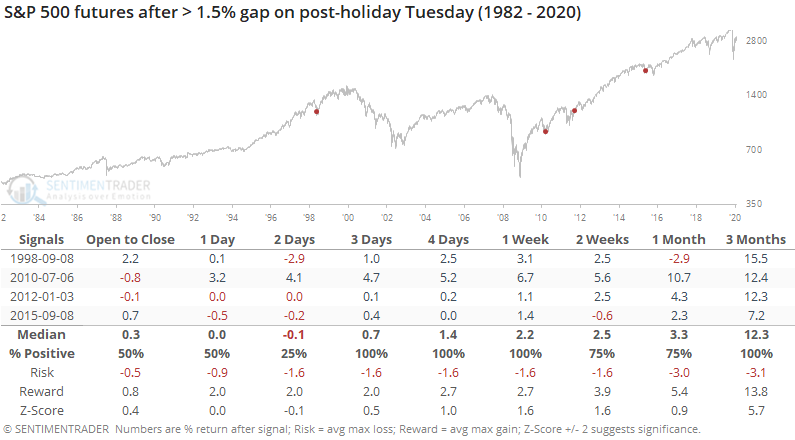

If we only look at times when Monday was a holiday, then we get the following.

It's only happened 4 times, but each of them saw a negative return from the open through either that day's close or over the next couple of days then rallied over the next 3-5 days.

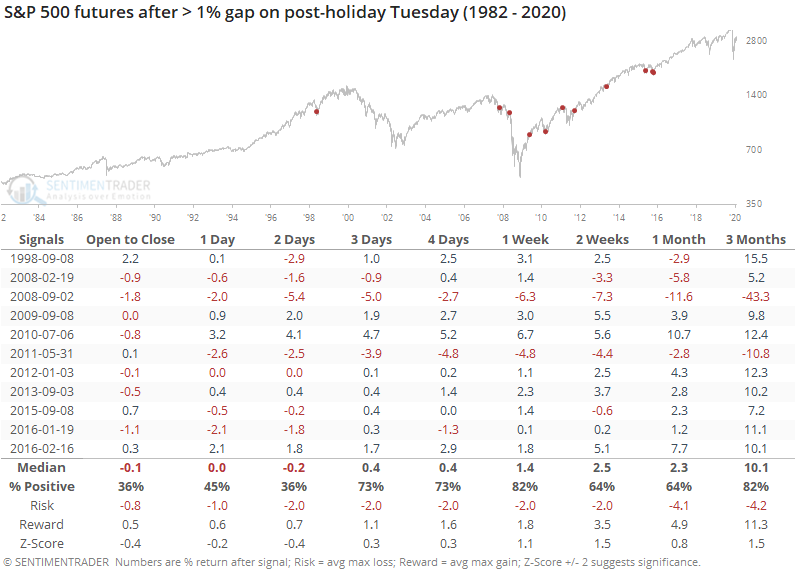

Let's relax the parameters to increase the sample size. The table below shows any gap of more than 1% on Tuesday following a holiday Monday.

This, too, showed a pattern of some weakness from the open through the next couple of sessions. The only one that didn't show a negative return at some point within the next two days was the last one, from February 2016. The weakness did have a tendency to be temporary, however, with 82% of them showing a gain over the next week.