Biggest panics

There's a whole lot of hysteria out there right now, and frankly some of it is justified. When the largest players in markets are calling the others "crazy," it's hard to use any historical precedents.

We went over most of the extremes that have popped up on our radar on Saturday, so there's no use in going over even more. The main question this morning was what's happened after other times that stock futures were frozen overnight.

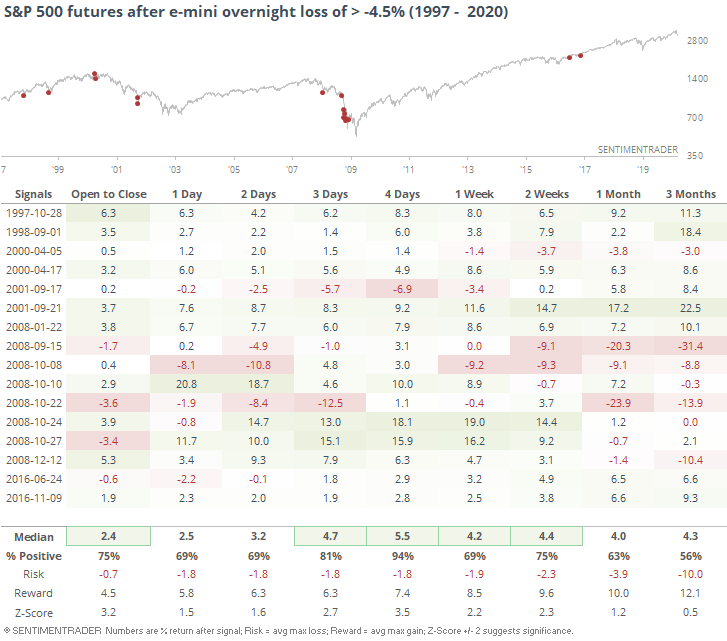

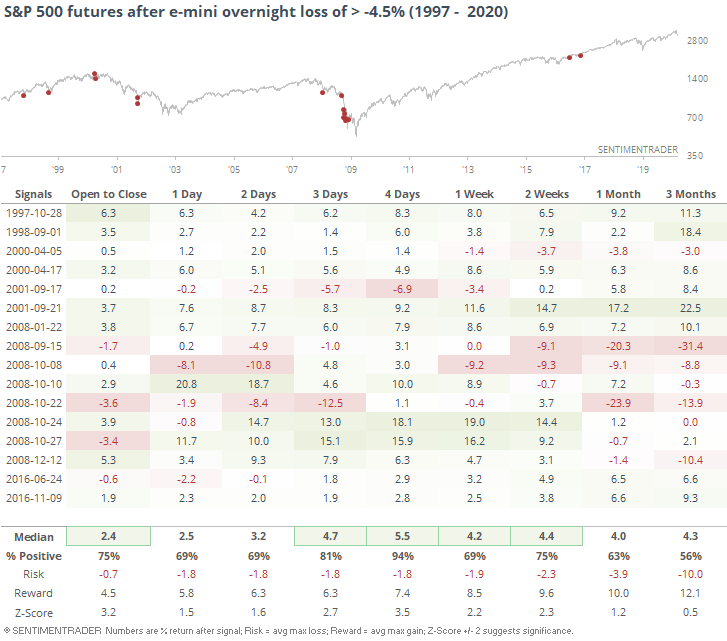

That's a surprisingly difficult question to answer because of how different data providers handle their data. It's not perfect. As a proxy, let's look for any time the e-mini S&P 500 contract fell at least 4.5% overnight. This captures some dates when the market didn't freeze, but also didn't exclude times when it did.

There were some hefty losses in there, with massive swings both ways. Still, the S&P rose over the next 4 sessions every time but once, which is saying something given when most of these dates triggered.

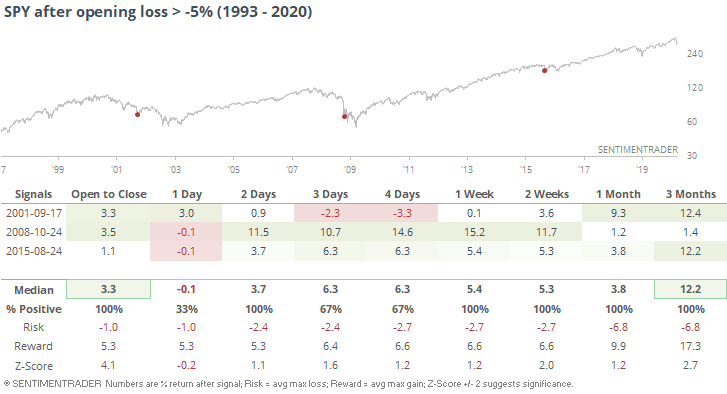

The largest ETF in the world is currently indicated to suffer one of its largest opening losses since inception. The only dates with larger losses would be after markets re-opened following 9/11 and on October 24, 2008 after Alan Greenspan noted that markets were suffering "a once-in-a-century credit tsunami." Thanks, buddy. SPY also dropped more than 5% in August 2015 on the morning of the "flash crash."

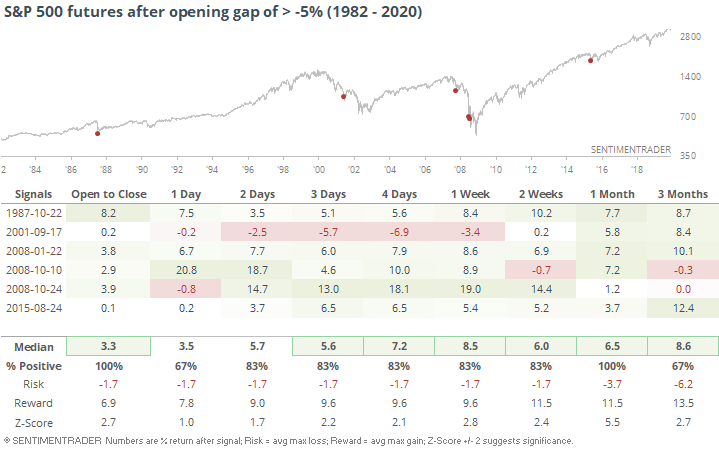

Using the futures market, the S&P added a few other dates. The morning of Black Monday in 1987 didn't qualify since Bloomberg front-month futures data shows that morning's gap down at "only" a little over -3%. Futures gapped down almost 10% a few days later.

All of these strongly suggest the probability of a bounce once regular trading begins and large funds are able to step in. Volatility is assured to be massive, and who knows - if this is a true Black Swan, then all bets are off because nobody knows nothin'. There will be a cascade of fund failures and bankruptcies. That might already be a possibility given the unprecedented gap in oil futures this morning.

So, once again, the bottom line comes down to whether this is your run-of-the-mill, cheeck-clenching-but-manageable, once-in-a-decade panic, or something truly unprecedented. Almost everything points to the former - it's the risk of the latter that's causing the stress.