Bond investors start to price in more risk

The world is awash in debt, it's only getting worse, and many investors seem to think that this is where the next great crisis will arise.

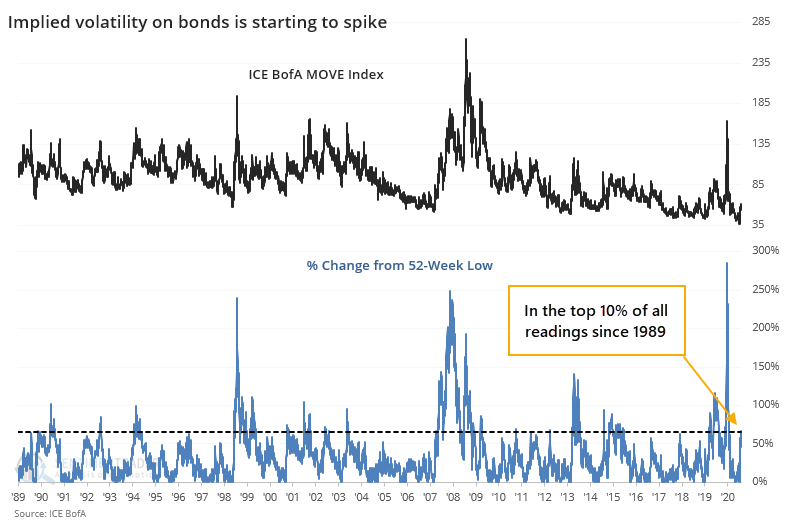

Within the bond market, it's been relatively smooth sailing. Volatility has been exceptionally low, and options traders were recently pricing in a record amount of calm.

But after the ICE BofA MOVE Index of bond implied volatility hit a record low on September 29, it has spiked more than 65%. That's a relatively large jump for this index in a relatively short amount of time.

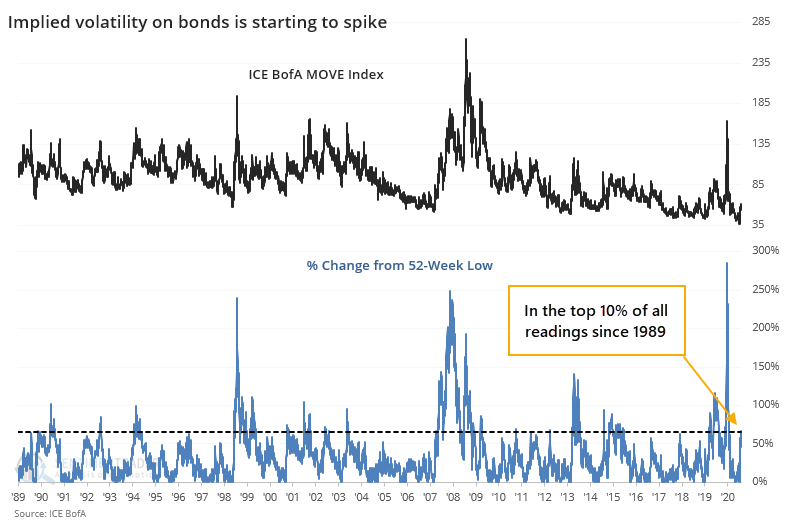

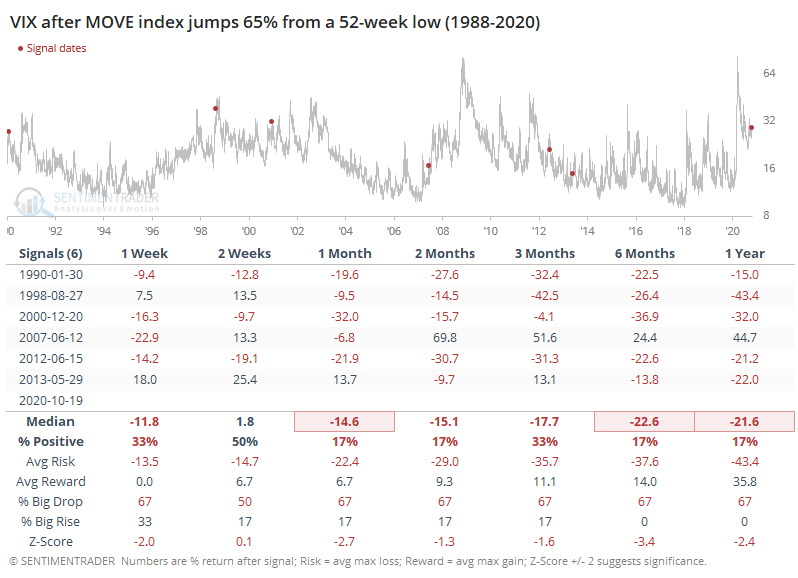

If we go back over the past 30+ years and look for other times when there was a sudden spike in bond implied volatility from a 52-week low, then we can see that it typically did not result in even higher volatility going forward.

Across all time frames, the MOVE index declined most of the time. On a shorter-term basis, there was a strong tendency for lower volatility to get priced in, as well as over the next 3-6 months. Only once, in June 2007, did an initial drop in the MOVE index precede a large, sustained rise in the months ahead.

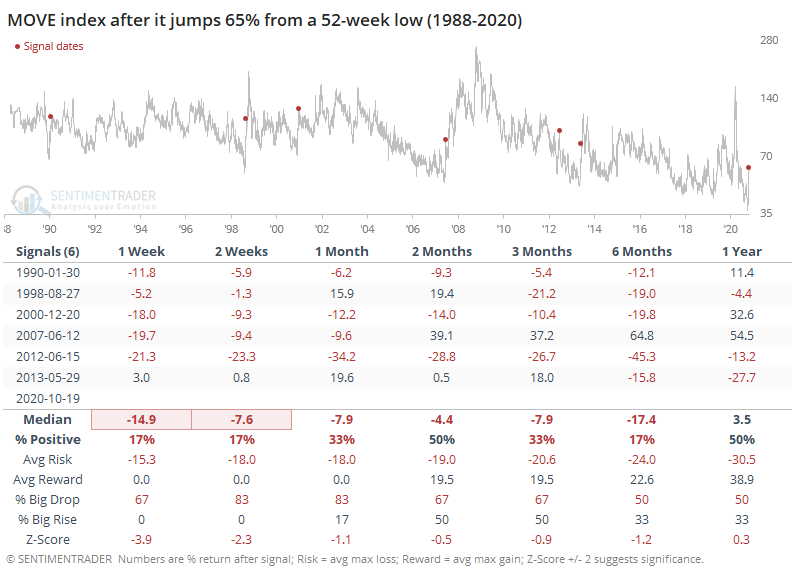

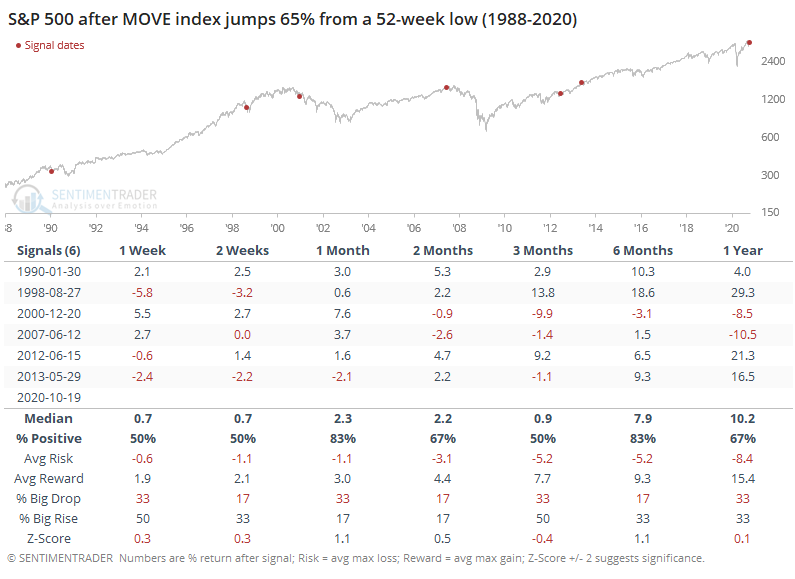

For bond prices, which move opposite to yields, it was a mixed sign.

Even though implied volatility tended to decline after these spikes, it didn't necessarily help bond prices to rise, at least not consistently. Over the next 2 months, there were only 2 gains and 4 losses.

These jumps in bond volatility almost never ended up bleeding over into implied volatility for stocks.

In some respects, when traders got nervous about renewed volatility in bonds, it ended up being even more negative for implied volatility in stocks. This is the exact opposite of the concern that's currently percolating.

These declines in the VIX were due in large part to a rising stock market.

While forward returns in the S&P 500 weren't dramatic, they were mostly positive. Either 1 or 2 months later, the S&P showed a gain every time. It's not like there was no risk, but it was relatively contained and was smaller than the reward.

Of course, this time is different from the others. It always is. And maybe the debt load will prove to be crushing, and this initial rise in bond volatility will give way to a total breakdown of the most important market in the world, ultimately freezing credit and crashing stocks. All we can say so far is that other times bond traders have suddenly woken up to the potential for increased volatility, it didn't lead to much.