Bond Spread Divergence As Bitcoin Halts Slide

This is an abridged version of our Daily Report.

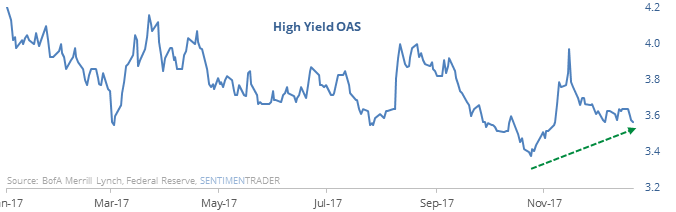

A tale of two spreads

The spread for investment-grade bonds has dropped to a new low, while high-yield spreads remain above their lows, suggesting some hesitation among bond investors to embrace the highest-risk issuers.

That divergence has led to some short-term weakness in stocks, but only one major decline. Other markets were mixed with no clear pattern.

Bitcoin recovery

Bitcoin just ended a 5-day losing streak, tied for its longest when coming off a high. After the other similar streaks ended, it soared twice and crashed once, with a binary outcome each time, with two immediate and large rallies, and one immediate and substantial decline.

Commitments of Traders report

The latest report showed that “smart money” hedgers added aggressively to long positions in sugar, nearing record long exposure. That helped move their position in the contracts that make up the DBA fund to a new record high, even including contracts like cotton where they’ve sold aggressively for the past month.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.