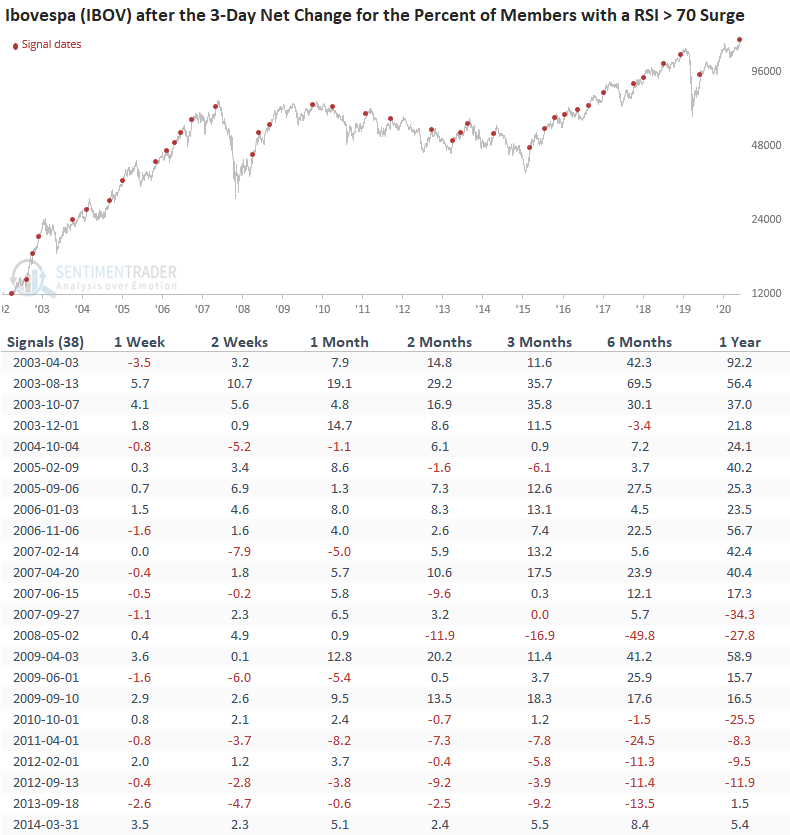

Brazil - Ibovespa Index (IBOV) - Percentage of Issues with RSI > 70 Surge

The percentage of Ibovespa (IBOV) members trading above a Relative Strength Index (RSI) level of 70 registered a momentum buy signal on the close of trading on 6/2/21.

THE CONCEPT

The RSI momentum signal identifies when the 3-day net change in the percentage of Index members trading above an RSI level of 70 surges above a user-defined level. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- The 3-day net change for the percentage of members with an RSI > 70 crosses below 0%. i.e., the reset to screen out duplicate signals

- The 3-day net change for the percentage of members with an RSI > 70 crosses above 13%.

Let's take a look at the current chart and historical signal performance.

CURRENT DAY CHART

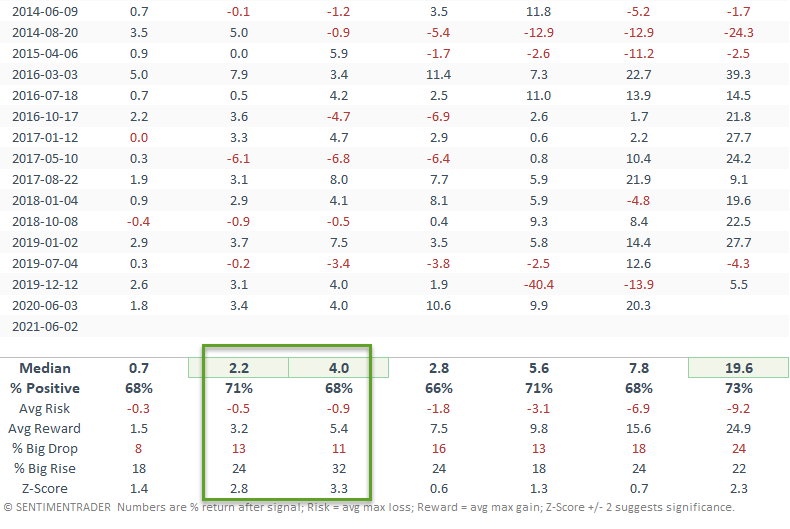

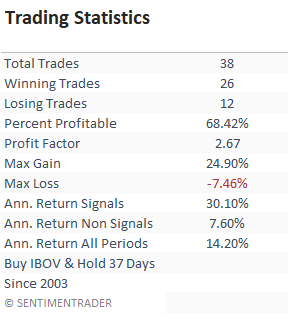

The trading statistics in the table below reflect the optimal days-in-trade holding period of 37 days. When I run optimizations for trading signals, I cap the max number of days at 42.

HOW THE SIGNALS PERFORMED

The 2-4 week timeframe looks good with a favorable risk/reward profile. I would classify this momentum signal as a good overbought condition whereby strength begets strength.