Breadth Divergences Not Much Of A Concern As Staples Recover

This is an abridged version of our Daily Report.

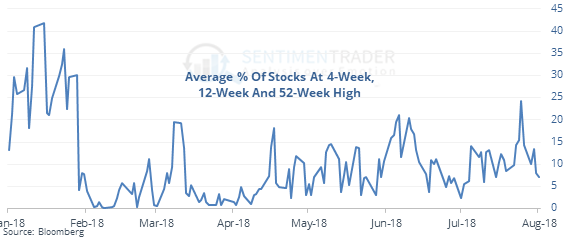

Few highs as indexes rally

The S&P 500 has rallied close to its prior highs, but there is a divergence. Relatively few stocks are registering 4-, 12-, and 52-week highs as the index rallies.

It’s a concern among technicians but has not been a reliable warning sign.

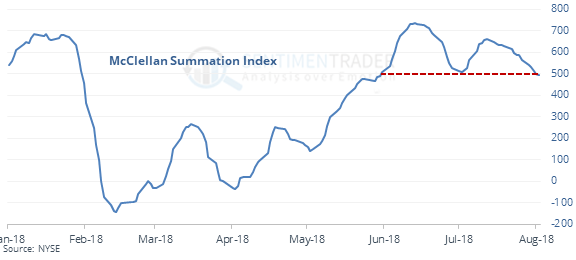

Momentum is rolling over

The McClellan Summation Index dropped below +500 for the first time in months.

Similar bouts of waning breadth momentum led to weak short-term returns.

Staples continue to recover

The Staples sector has rebounded more than 10% from its low point. Similar rallies led to some shorter-term profit-taking, lasting up to a couple months.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers have been aggressively adding to already record longs in 5-year Treasuries. They now hold more than 25% of the open interest net long, the most since 2005. Those Treasuries have rallied each time hedgers held so much of the open interest, though in 2005-06, those rallies were short-lived.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |