Breadth Momentum Picks Up As Value Lags Growth And Homebuilders Turn Up

This is an abridged version of our Daily Report.

Momentum is picking up

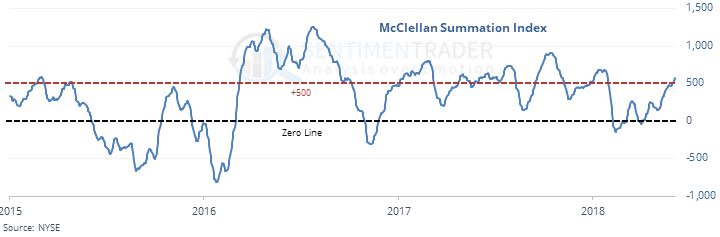

Momentum in breadth figures is returning, with the McClellan Summation Index climbing. When it reaches 500 for the first time in months, it has led to an excellent risk/reward skew for stocks.

The S&P 500’s annualized return when the Summation Index was above 500 has been impressive.

Value trapped

The Russell 1000 Growth Index reached a 52-week high on Wednesday, while Value is nearly 7% below. That’s the most Value was down since 2010. Previous signals led to continued outperformance in Growth, though its lead plateaued.

Builders getting bid

Homebuilders have been one of the few industries that has struggled to hold above its 50-day average. For the first time in 4 months, one of its longest streaks ever, the industry has moved into a medium-term uptrend.

VIX smash

The VIX “fear gauge” closed below 12 for the first time in months. The 11 other times it first closed below that level in at least three months, the S&P 500’s worst performance going forward was over the next 6 sessions, when it saw a gain 4 times and an average return of -0.4%.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |