Breakouts & sector rotation

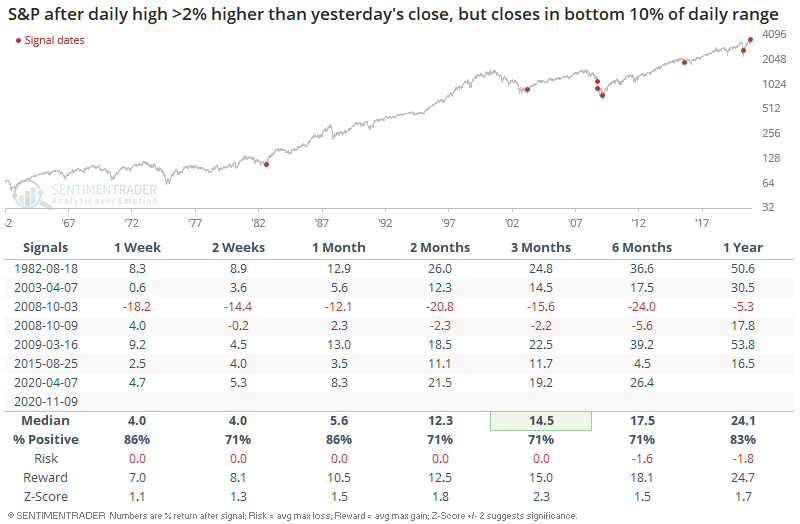

Yesterday's price action was interesting, to say the least. Tech stocks had been outperforming for months before yesterday's vaccine news. But on the vaccine news, tech stocks significantly underperformed non-tech stocks and the Dow Jones Industrial Average made a new intraday all-time high. But as the day drew to a close, stocks slipped, resulting in what some technical analysts may consider to be an ugly candlestick bar:

But that's the problem with most candlestick patterns: they aren't much better than a 50/50 coin toss. When the S&P gapped up and then closed near the intraday low, you would assume that it's a bearish sign for stocks. Historically, that was not the case:

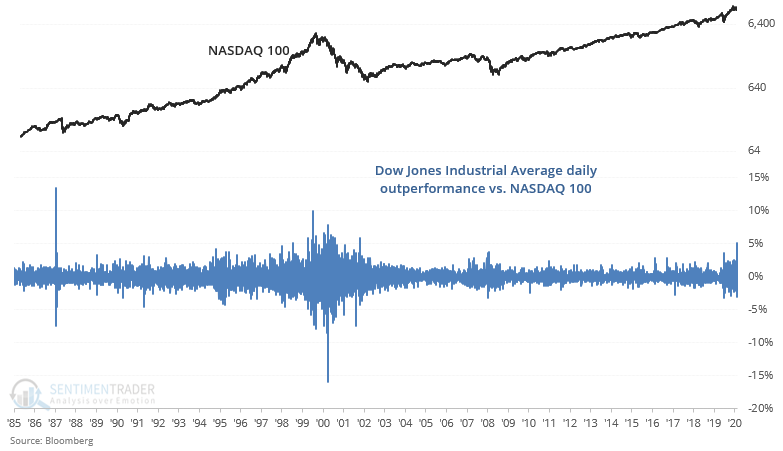

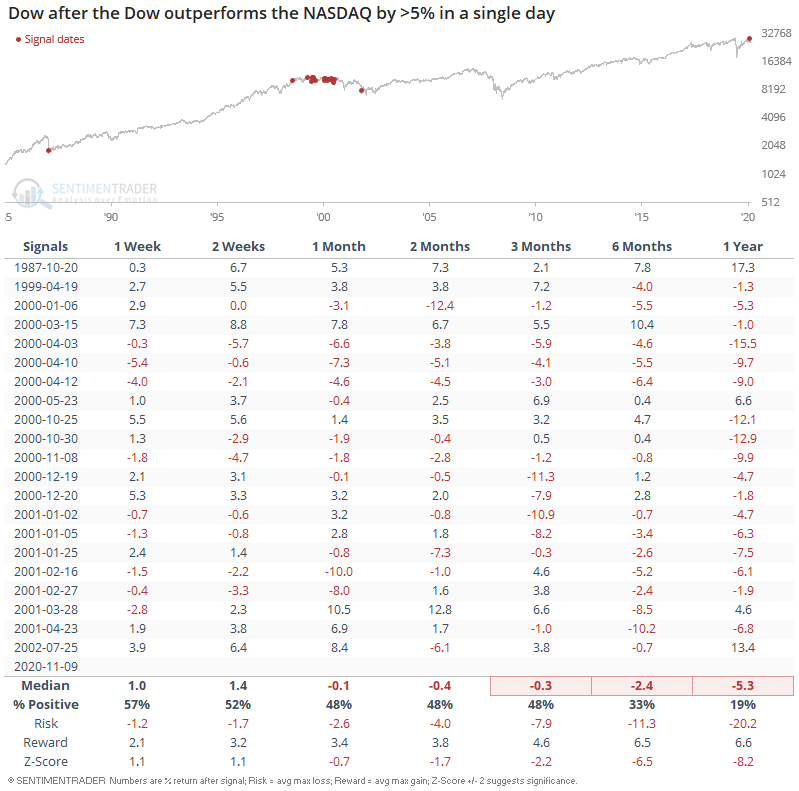

More importantly, the massive sector rotation from stocks that were aided by the pandemic (e.g. tech) vs. stocks that were hurt by the pandemic (e.g. airlines, banks, travel & tourism) saw the Dow Jones Industrial Average outperform the NASDAQ 100 by more than 5%.

Outside from 1987 (which occurred after a market crash), this only occurred in 1999-2002. The 2000 cases are particularly interesting because we can draw some parallels to today. Tech surged in 1999 while "old economy" Dow stocks lagged. Subsequently Dow stocks outperformed in 2000-2001 as tech stocks cratered. This could be seen through the returns of legendary investors such as Warren Buffett, who lagged from 1998-1999 and outperformed from 2000-2002.

The last 7 months saw tech stocks surge while many other stocks languished. Could this be the start of a great sector rotation out of tech?

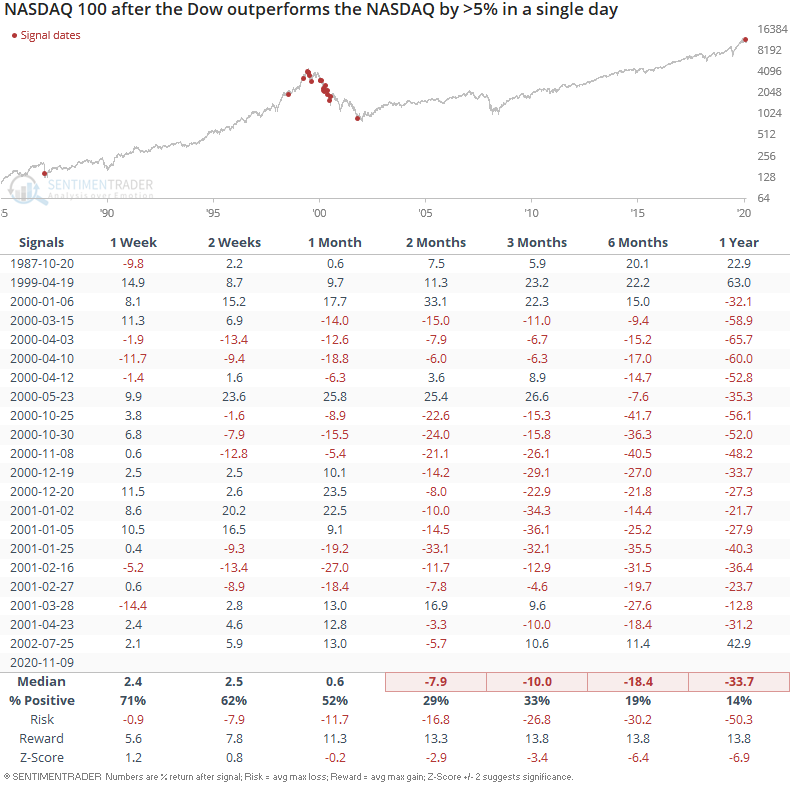

The following illustrates what happened next to the Dow:

*clearly not as bad as what happened next to the NASDAQ

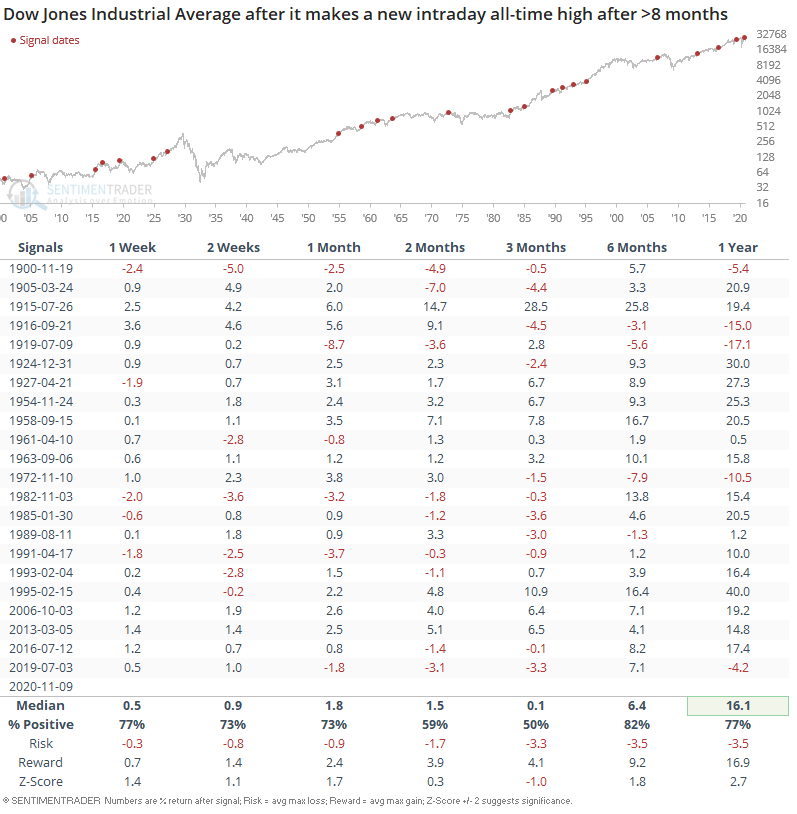

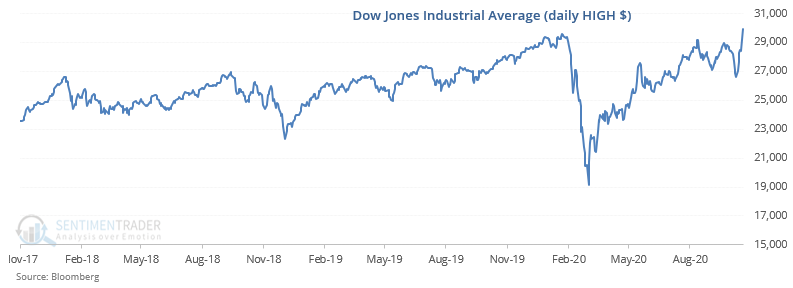

And finally, the Dow Jones Industrial Average broke out to a new intraday all-time high:

Such breakouts have historically been bullish for stocks over the next year. The main bearish breakouts occurred in the early-1900s, and that's primarily because dividend yields pre-1958 were much higher than dividend yields post-1958. So while it looks like stocks went nowhere in the first quarter of the 20th century, total return analysis states otherwise.