Bulls Double Bears Even As Lumber Tumbles

This is an abridged version of our Daily Report.

Bulls continue to double bears

Bulls among newsletter writers in the Investor’s Intelligence survey are more than twice as numerous as bears. This is the 98th straight week, by far the longest ever, showing a historic faith in the uptrend. The survey’s 52-week average Bull Ratio is also more than 10% above its trend, which has led to a poor return in stocks.

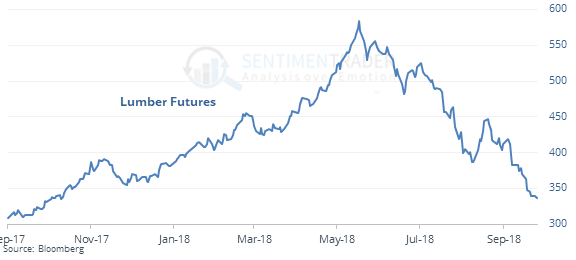

Lumber is taking some lumps

Lumber futures keep hitting new lows even as stocks rally. The former is near a 52-week low while the latter is near a 52-week high.

Similar divergences preceded several peaks in stocks but was too inconsistent. It was a negative for homebuilding stocks, though.

Miner trouble

The GDX fund of gold miners lost more than 2% on a day the FOMC announced its policy on interest rates. This has happened 16 other times, and it wasn’t a good sign for the sector.

Bonds bounced

Meanwhile, the TLT bond fund rallied 0.7% on FOMC day. That has led to further gains 61% of the time (out of 28 trades) during the next week.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |