Buyers' 1-2 Punch For Stocks

A one-two rally

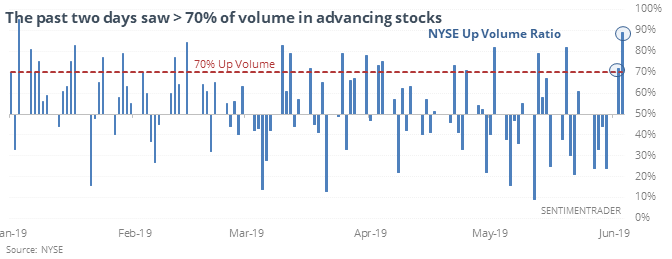

The S&P 500 fell to a 50-day low on Monday, and the charts didn’t look good, but they hid a lot of underlying potential. Both Monday and Tuesday saw eager buying pressure under the surface, and Tuesday’s one-day jump in the S&P was the largest in nearly six months.

When the index saw such a big jump, and / or buying pressure was widespread, gains had a strong tendency to continue. Returns over the next 2 months were particularly impressive, especially the risk vs reward.

A crude bear

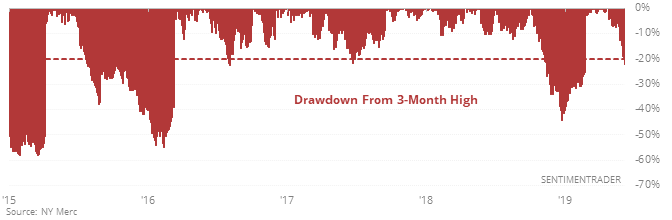

According to media reports, crude oil has dropped into a bear market. Ignoring the semantics, it has dropped 20% from a multi-month high that was less than 50 days ago.

Other times it quickly dropped 20% from a peak, it tended to keep dropping. But it was an inconsistent signal, at best, for stocks, the dollar, and bonds.

Emerging market recovery

The McClellan Oscillator for emerging markets has risen above 30 for the first time in months, after falling to a very low level. This kind of change in momentum in the stocks underlying those markets has led to further upside over the next month 7 out of 8 times.

Speaking of momentum

The 20-day Oscillator for the Nasdaq 100 fell to -60. The Backtest Engine shows only 19 days since 1999 have matched this, leading to a 6-month gain all 19 times.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.