Cancelling Dow Theory Sell Even As Volume Declines

This is an abridged version of our Daily Report.

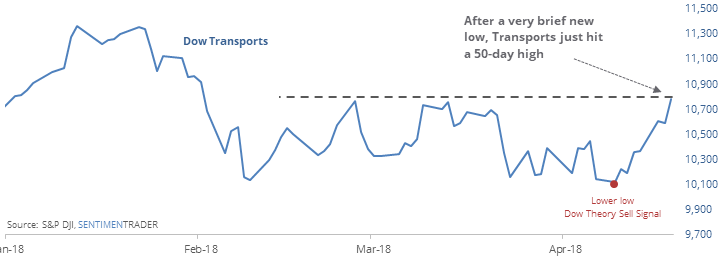

Cancelling the Dow Theory sell signal

After the Dow Industrials and Transports fell into a Dow Theory sell signal, Transports have caught fire. They just hit a 50-day high, which technically doesn’t cancel a sell signal but it might as well.

Forward returns in both indexes were very good when one of them rebounded so much so quickly after a sell signal.

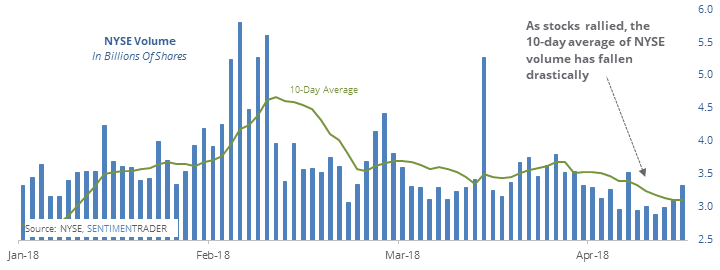

A low volume rebound

As the rally in stocks progresses, volume has been tepid compared to when stocks were dropping.

That’s typical for how declines and rebounds work, and not a sign of a “low grade” rally. Future returns were about equal after high-volume rallies vs low-volume ones.

Negative pattern

Major index funds like SPY and IWM carved out a short-term negative pattern on Wednesday by gapping up then weakening while forming a tight intraday range.

Oil risk rises

The risk level for crude oil has hit 8 again, an area that suggests high risk. According to the Backtest Engine, when the reading was 8 or higher, over the next month, oil rallied 42% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |