Cash is king

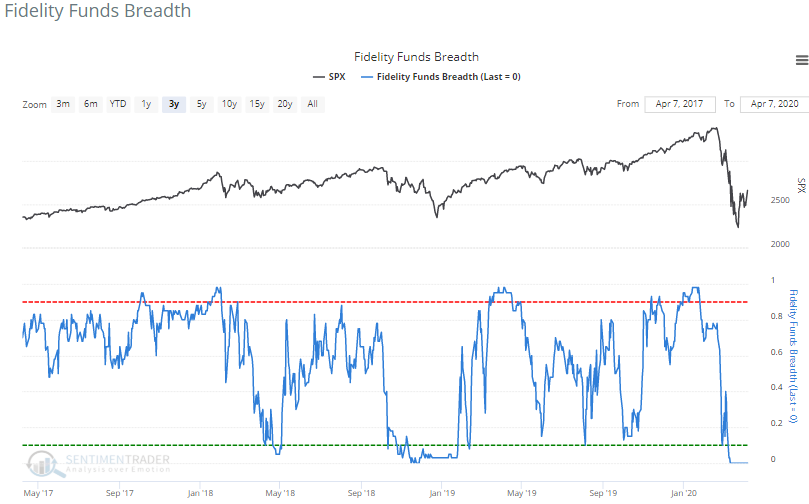

Our Fidelity Funds Breadth indicator, which tracks the % of Fidelity Select mutual funds that outperformed short term Treasury Bills over the past quarter, is at 0%. This means that not a single fund has beaten cash, which isn't surprising given the epic market rout we've seen over the past 2 months.

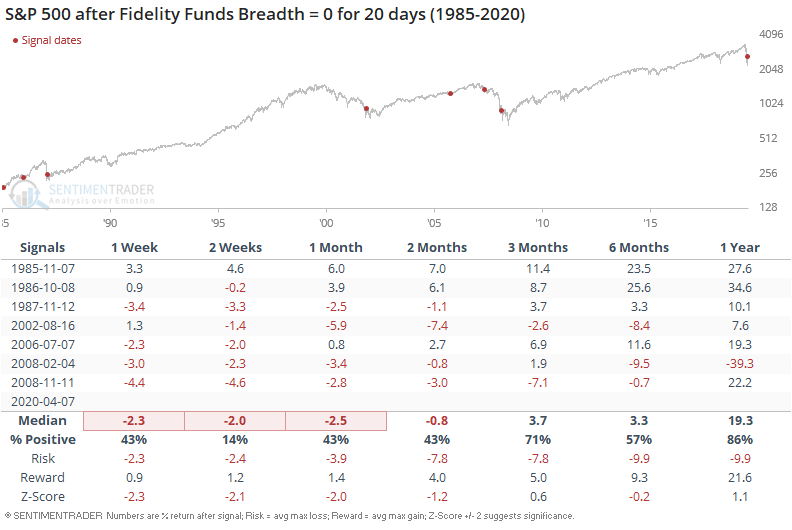

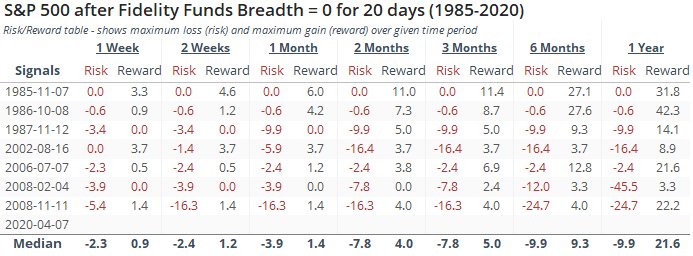

This breadth indicator has remained at 0% for 20 days, which is a rather long streak. Similar long streaks were usually bullish for stocks over the next year, with the exception of February 2008 when the 2007-2009 bear market just began.

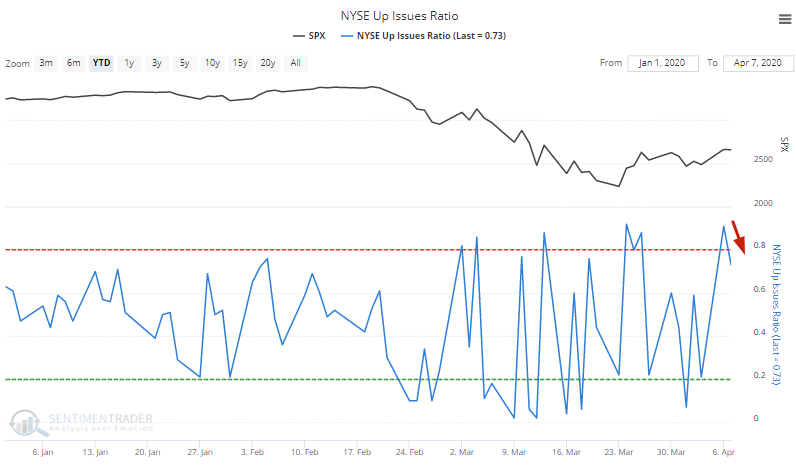

While the above stat was mostly short term bearish for stocks, I don't have a lot of confidence in short term predictions. Anything can happen in the short term, and it's easy to find bullish or bearish data to support a short term case. For example, more than 70% of NYSE issues rallied yesterday even though the S&P closed the day slightly lower than the previous day.

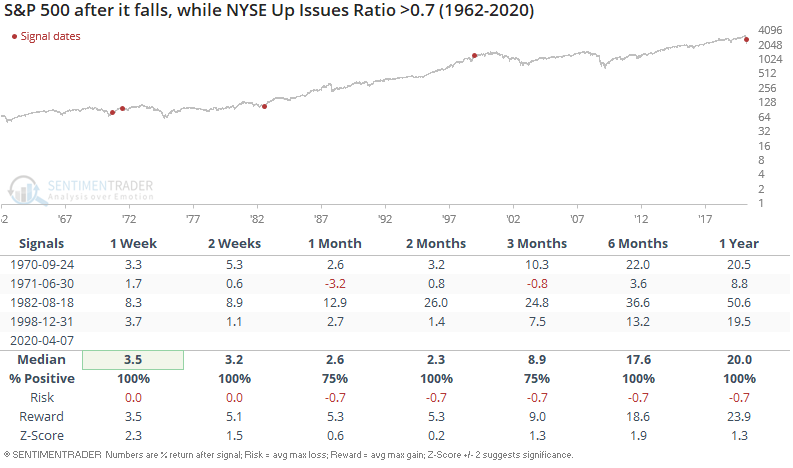

This has only happened 4 other times from 1962-present, all of which saw the S&P rallied over the next few weeks. Notice how this directly conflicts with the previous stat:

With that being said, this once again led to gains over the next 6-12 months.