Change in short term trend

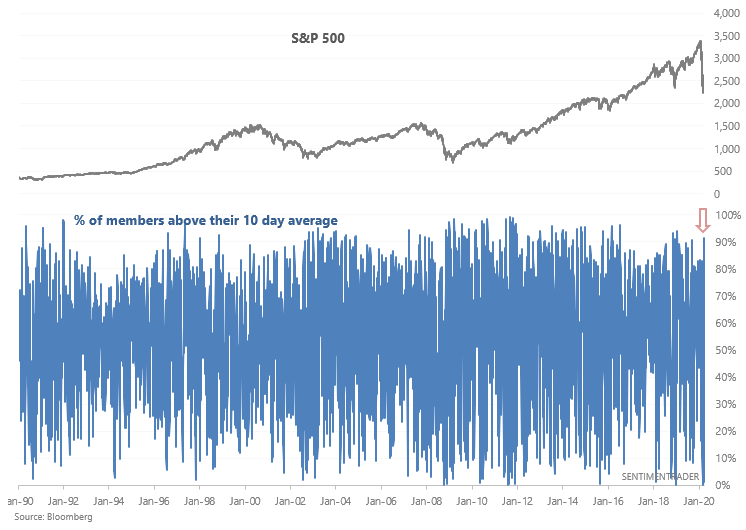

While the past few weeks saw atrocious breadth, that condition is starting to change with the stock market rebounding. More than 91% of the S&P 500's members are now above their 10 day moving average (short term trend).

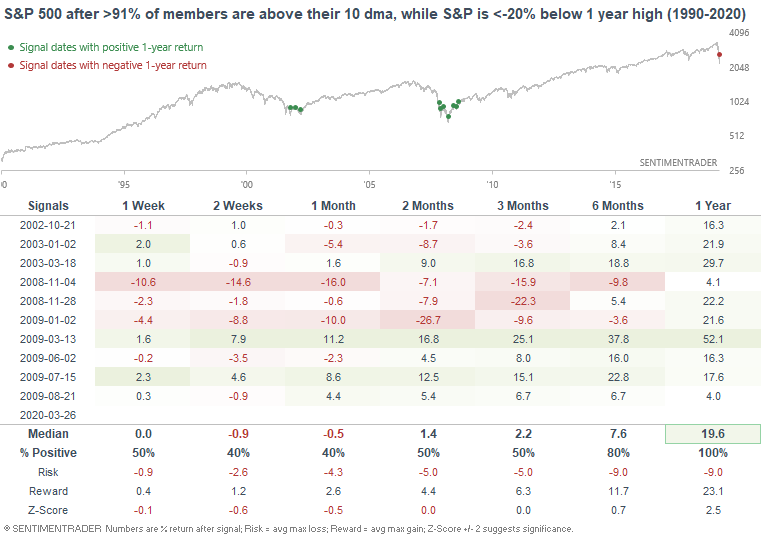

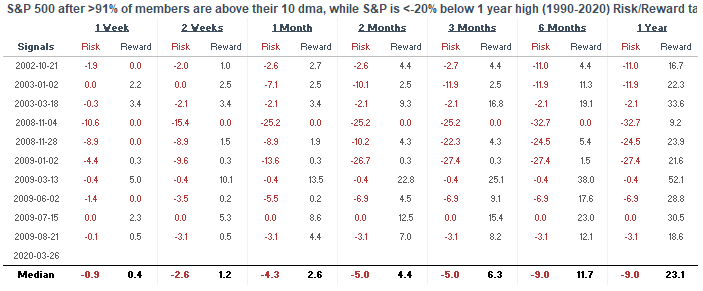

This isn't an extremely large figure and could certainly go higher over the next few days if the S&P continues to rally. But this isn't very common when the stock market is still in bear market territory (more than -20% below a 1 year high). For the bulls, there weren't this many stocks in a short term uptrend during many of the failed 2000-2002 bear market rallies.

The S&P's returns over the next few weeks were mixed when this happened in the past. With that being said, the S&P rallied vigorously over the next year. This occurred as the S&P made a triple bottom in 2002 and also occurred as the S&P was trying to form a bottom from 2008-2009.