Chinese tech stocks are doing exactly what they should

Key points:

- The slump in Chinese technology stocks equates with other major panics

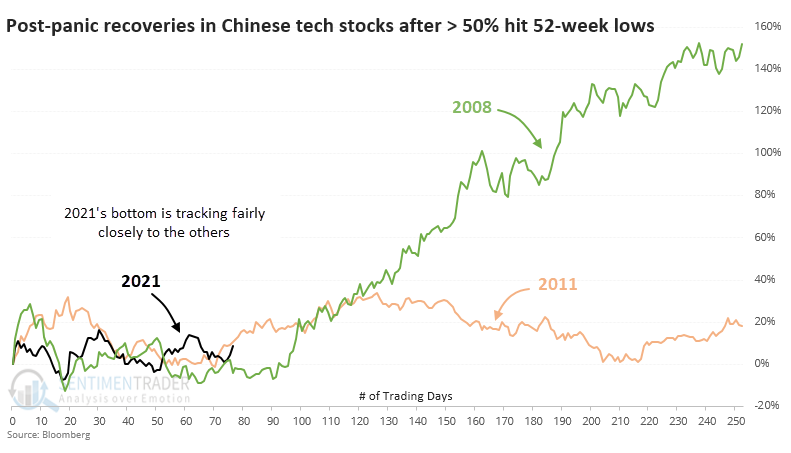

- Their price path in recent weeks has roughly followed the 2008 and 2011 bottoms

- Similar behavior led to the sector doubling over the next 1-2 years

The most hated sector is doing what it's supposed to

Chinese technology stocks have gone nowhere. And that's precisely what they should be doing.

In September, we looked at the selling cascade in these shares. There was perhaps no corner of the equity market that was more hated or washed-out.

So far, they've done exactly what they're supposed to do by doing nothing at all. Many of them are trading right around the same prices they were a couple of months ago...just like most other significant bottoms.

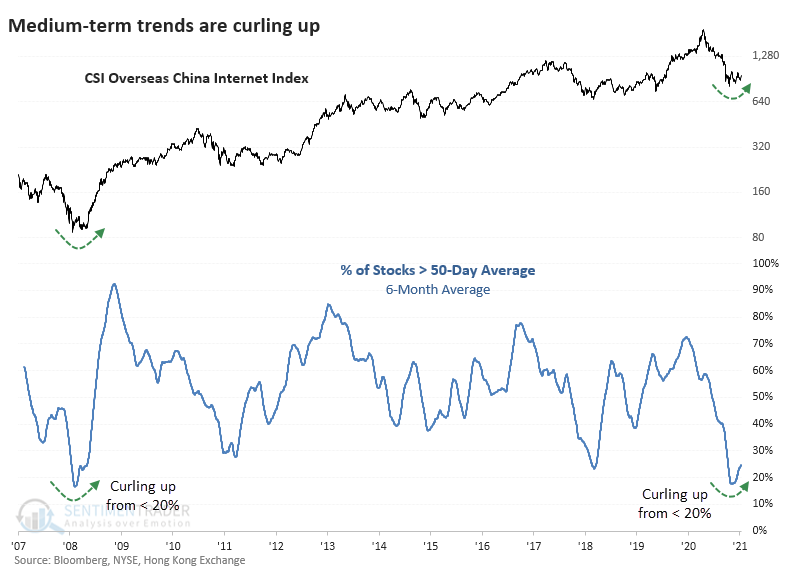

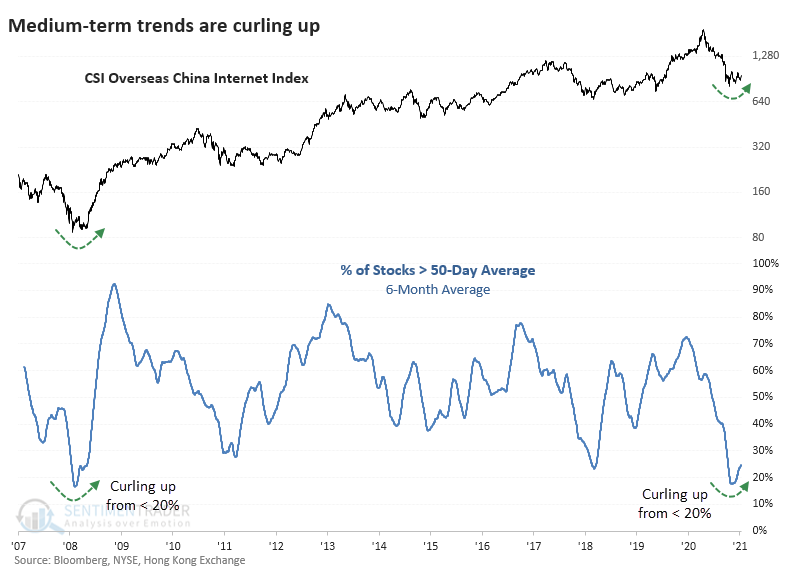

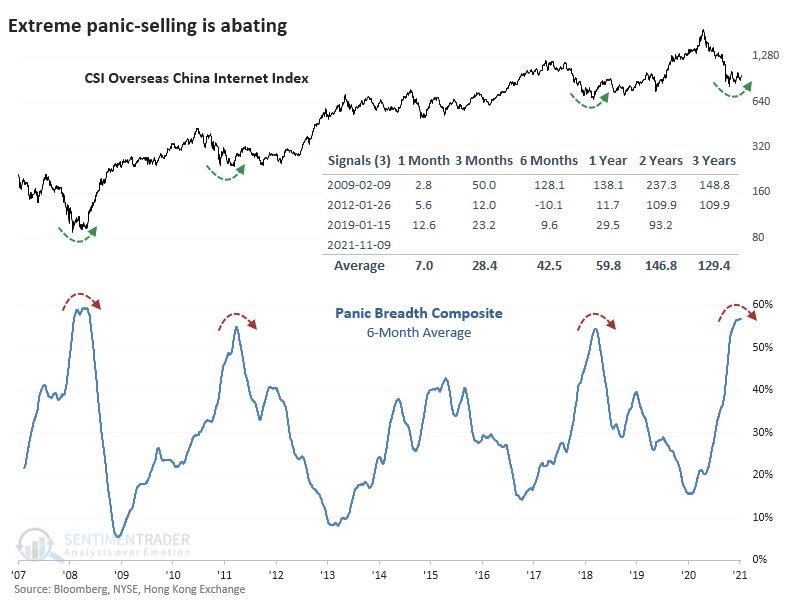

In September, we took a shorter-term view of several breadth metrics that showed the disaster within stocks in the CSI Overseas China Internet Index, upon which the popular KWEB fund is based. Now we can see that over the past 6 months, the selling pressure has been on par with one of the largest financial disasters of all time.

Over the past 6 months, selling pressure has been historically bad

On an average day over the past six months, fewer than 20% of stocks in that China internet index were trading above their 50-day moving averages. That has now started to curl higher as some of them have recovered. This same thing happened as the world emerged from the Global Financial Crisis.

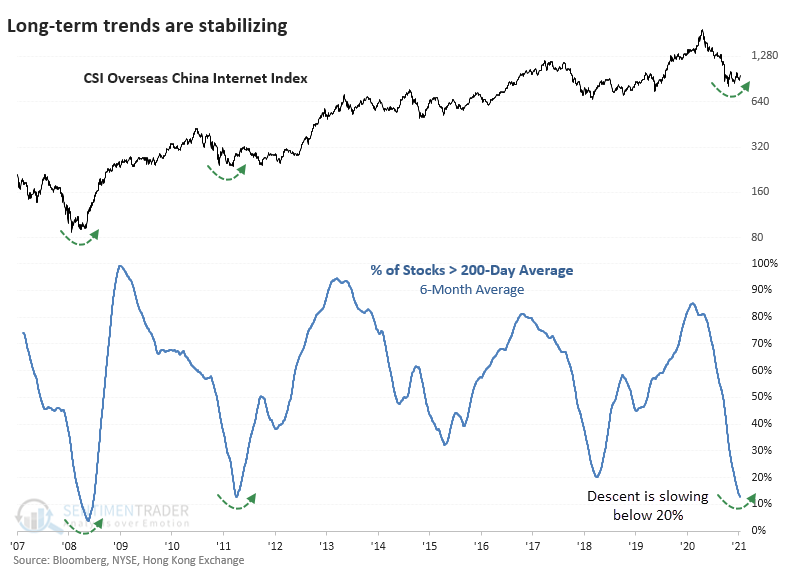

On a longer-term basis, fewer than 15% of the stocks have held above their 200-day moving averages. This average is just now halting its decline and starting to trough, as happened in 2008 and 2011.

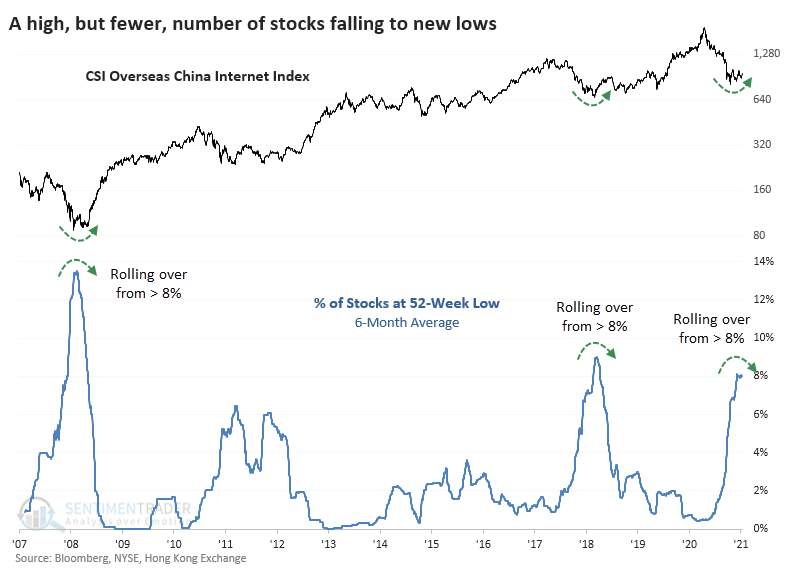

The percentage of stocks falling to a 52-week low never quite matched the extreme in 2008, or even 2018 for that matter. But now it's starting to peak, as it did at those other long-term bottoms.

Chinese tech doubled after other reversals

When we combined a number of these metrics into a single Composite, it's now rolling over from the 2nd-highest reading in 15 years. After each of the other reversals from similar extremes, the internet index doubled (or nearly so) within 2 years.

In September, we looked at the path the index took after the only times when more than half of the stocks fell to a 52-week low at the same time. If it followed a similar path this time, then we could have reasonably expected the index to chop around for another 1-3 months, which it has done. The important part was that it shouldn't make an appreciably lower low, which it hasn't.

After the 2008 plunge, the index formed its ultimate bottom within the next couple of weeks. After the 2011 crisis, it had already bottomed and was on a sustained track higher.

What the research tells us...

The selling pressure in Chinese technology stocks in July and August reached historic proportions. Since then, the sector has chopped around, with long-term breadth metrics on par with several major lows over the past 15 years. They have roughly followed the path after other major panic bottoms, suggesting rising prices over the next 1-2 years.