Confidence in stocks pulls back from record

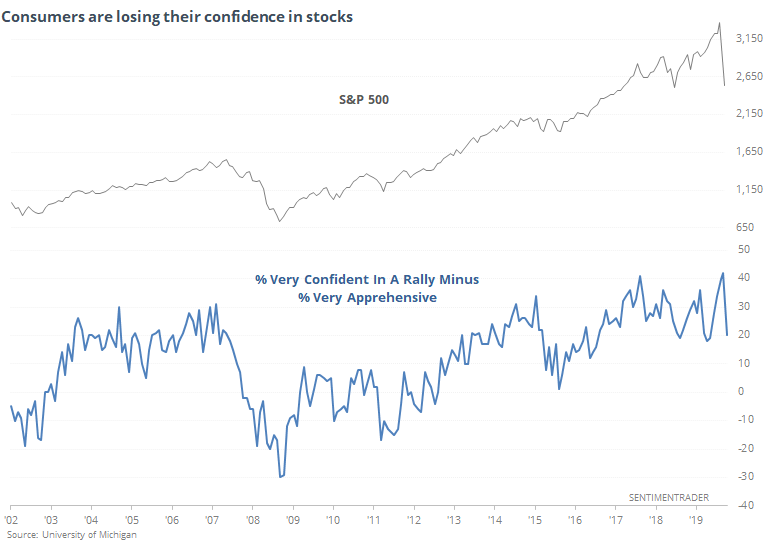

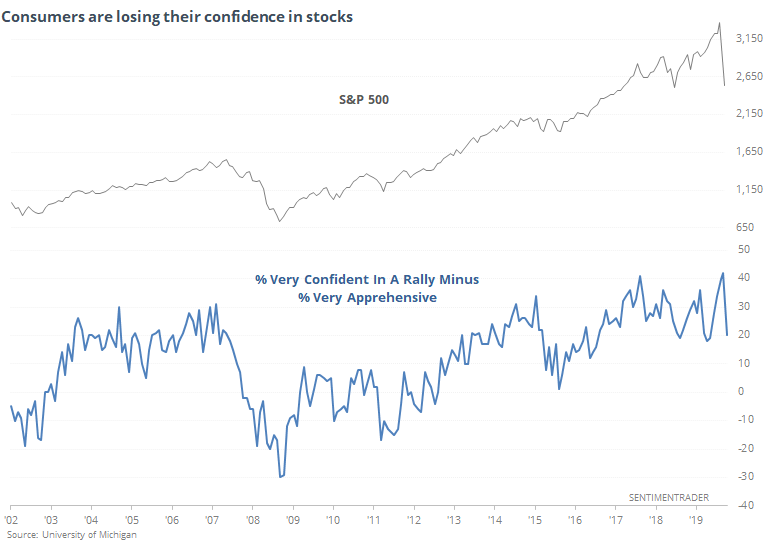

In mid-February, one of the many troubling signs was the absolute confidence that the average U.S. consumer had in the stock market. The percentage that were very confident in a rising market was at a record high versus those who were apprehensive.

One of the worst tumbles in Wall Street history should put a damper on that kind of attitude, and it did. But not as much as we might expect.

In February, the spread between very confident and very apprehensive consumers was +42%. This month, it narrowed to 20%.

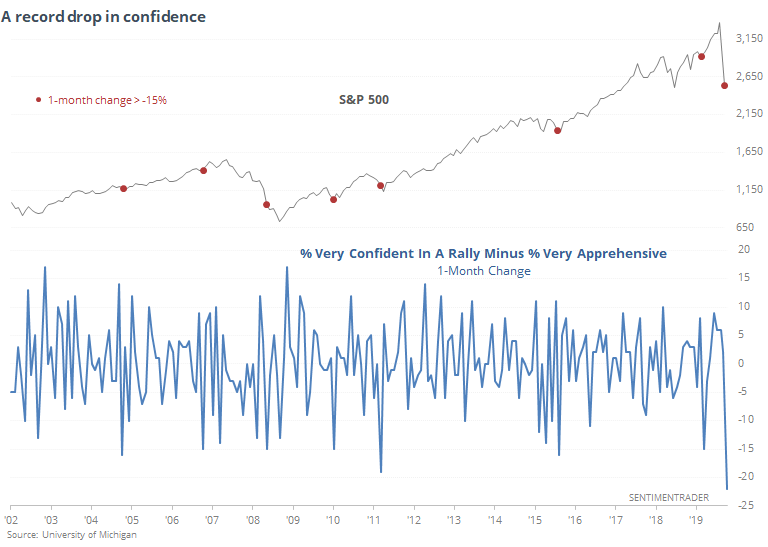

If there's a silver lining, it's that the change this month was the most severe on record. Other times when consumers pulled in their horns by 15% or more were typically a good sign for stocks.

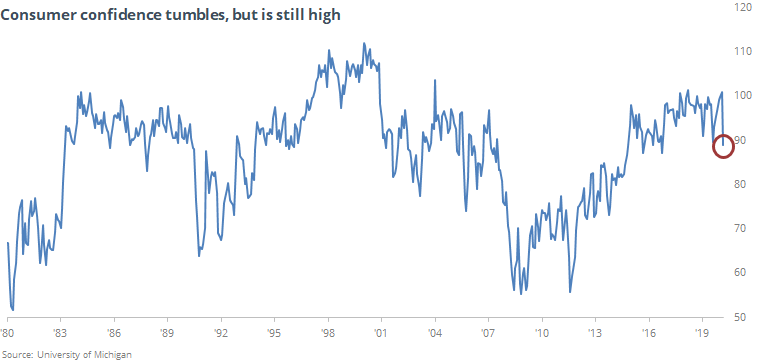

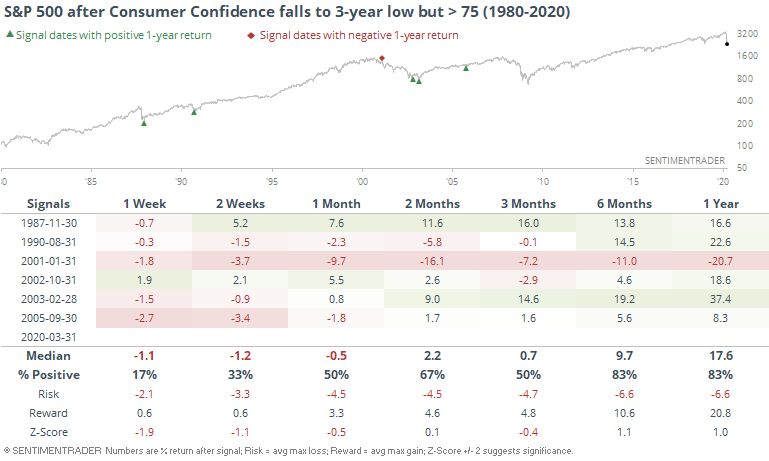

Overall confidence levels - in the economy, not just the stock market - tumbled to a 3-year low, but still remains relatively high given that it was over 100 heading into the pandemic.

This has been a near-term negative for stocks, with mixed returns after that. It about marked the low in confidence (and stocks) several times, but also triggered early in the 2001-02 bear market.

Contrarians prefer to see a complete washout in sentiment, and this month's confidence readings is not that. It showed a big drop, which is fine, but still remains relatively high. That hasn't necessarily been a reason to believe that stocks have to keep declining, it just gives us less of a reason to believe they will rally in the shorter-term.