Consumers and experts think the future will be better

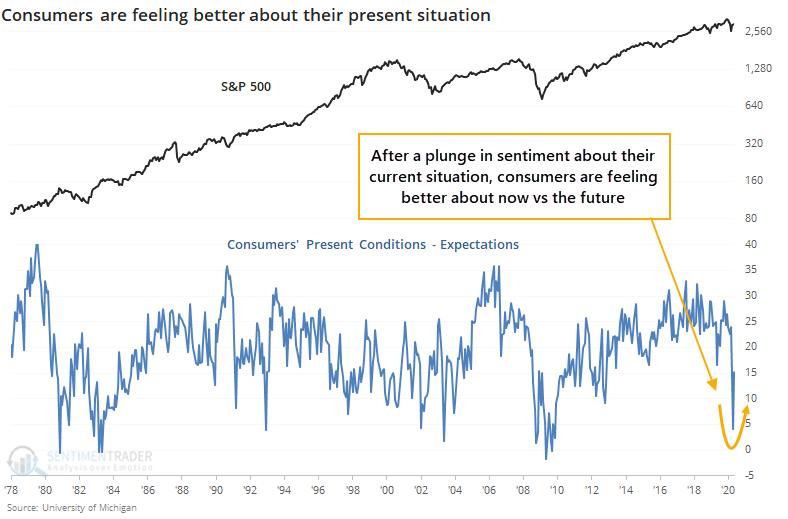

In March and April, the average consumer got hit hard. As a result, sentiment about their present conditions plunged, even though they remained hopeful about their futures.

With the recovery in stocks and re-opening of the economy, they're starting to feel better about now vs the future. This is similar to what happened during and after the financial crisis. In times of panic, peoples' time frames tend to shrink, with their immediate worries taking the forefront.

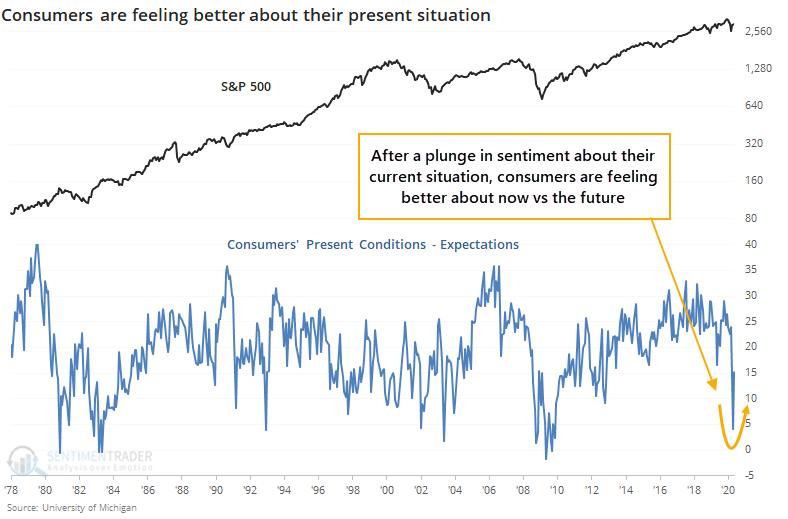

While the recovery is similar to the financial crisis, the issue is that there was a fakeout first. They started feeling better about the present versus the future by December 2008, which was not the end of the stock market slide.

There was a fakeout in 2002, too.

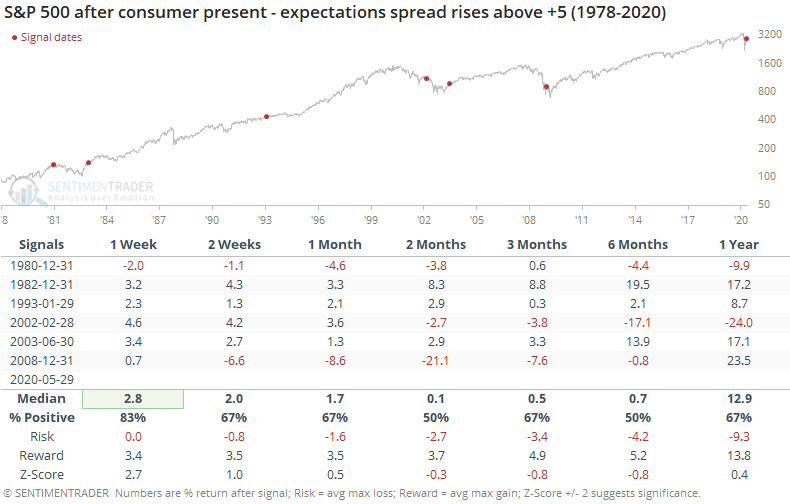

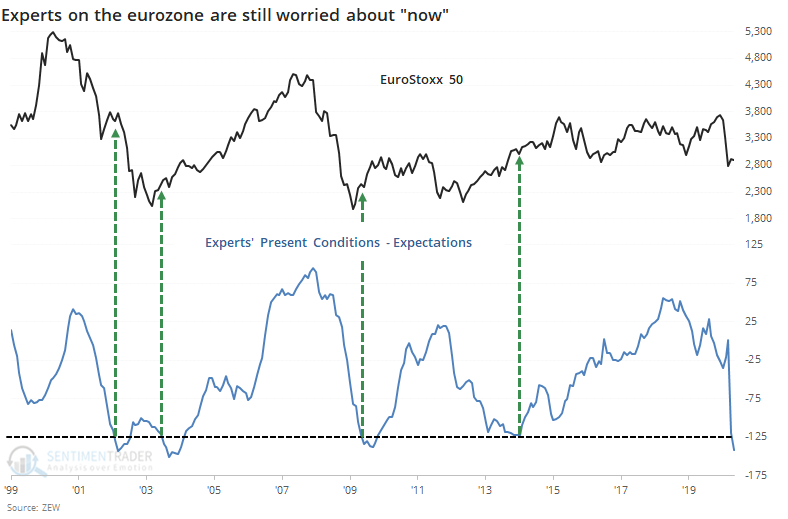

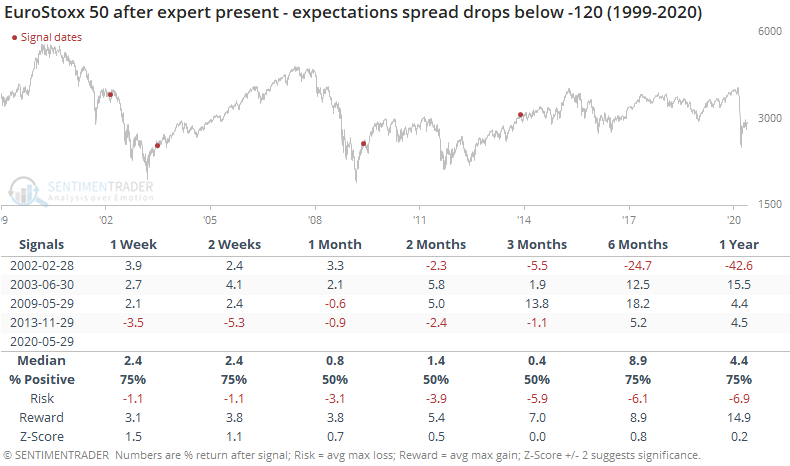

The drop in sentiment about current conditions wasn't (and isn't) just limited to consumers, or just those in the U.S. The ZEW organization's survey of experts in the financial industry shows a continued plunge in their evaluation of current conditions versus those they expect in the future.

These professionals are still much more worried about the present as opposed to the future, and it's nearing a record spread. That has tended to occur soon after major turning points, with a major exception in 2002.

We can see how mixed the forward returns were, with all four of them showing losses or only moderate gains over the next 1-3 months, but then all but one showed good gains longer-term.

Depending on how this is framed in the media, we might think that consumers are too optimistic about the future, and stocks are doomed to fall. More likely, it's the opposite on a long-term time frame. By the time consumers (and experts, for that matter) get this despondent over their current conditions versus their expectations about the future, stocks have already priced in the worst.