Consumers are buying the dip

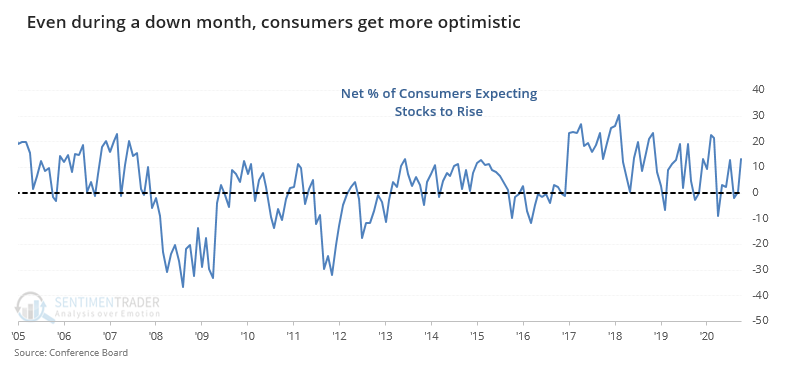

The worst performance in months didn't deter consumers. Even though the S&P 500 lost several percent in September, there was an increase in the net percentage of consumers who expect stocks to rise according to the monthly Conference Board survey.

There is a modest contrary bias to this data. When more consumers expect stocks to rise than fall, the S&P 500's annualized return is more than double when it is when consumers are less confident.

There is a tendency to think everything is a contrary indicator, especially when it comes to surveys of laypersons. That's not always the case, however, and knee-jerk contrarianism can be a deleterious habit. That's why we test things to the extent that we can. When we do that here, we can see that a jump in confidence during a down month isn't necessarily a bad thing.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Full signals showing returns following rising confidence in a down market

- What happens when a lot of energy companies cut their dividends

- And when they announce massive job cuts

- Despite headlines, the volatility in oil has plunged

- Sentiment toward many soft commodities has heated up