Consumers Are Comfortable As Gold Drops Amid Smart Money Big Short

This is an abridged version of our Daily Report.

Signs of intense comfort

Another survey is showing a high level of confidence among U.S. consumers. The Conference Board, University of Michigan and Bloomberg surveys are now all near multi-decade highs. When the two oldest are taken together, the surveys have only been matched once in history, in 1998-2000.

Gold’s miserable streak

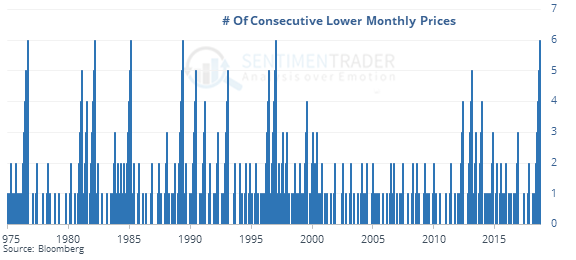

For the first time in 20 years, gold has declined for 6 consecutive months.

Since 1975, it has happened a handful of times, and while the sample size is small, it rebounded 1-2 months later every time, with a highly skewed risk/reward profile.

Smart money’s big short

Hedgers in major equity index futures contracts are now net short $65 billion worth of exposure. That’s among their largest positions in history.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers moved to another multi-year extreme long position in gold, as well as 30-Year Treasury and Ultra Treasury contracts, while establishing large short exposure to unleaded gas.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |