Consumers are feeling increasingly positive about the future

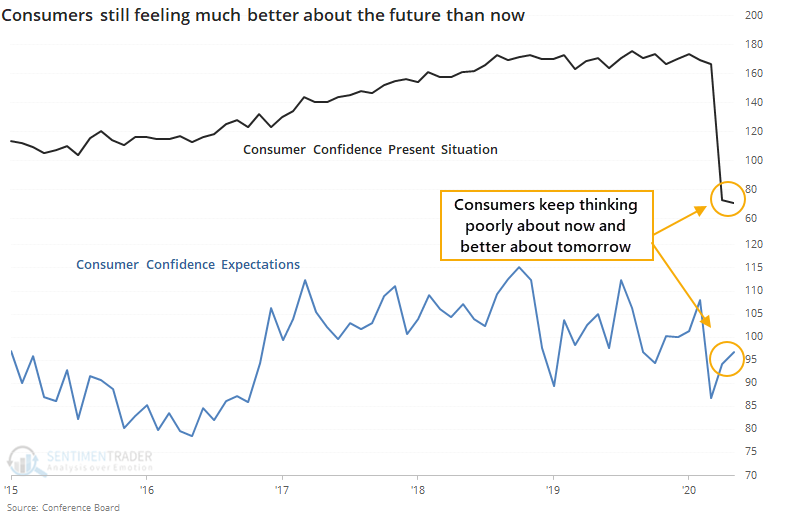

The latest release on consumer confidence from the Conference Board shows further evidence that Americans are feeling much better about the future than they are about the here-and-now.

Responses for May show that consumers' attitudes about their present conditions dropped again and are the lowest since 2013. Meanwhile, their expectations about the future rose from where they were in April.

There is always a tendency to think that this has to be a contrary indicator, and stocks can't form a true bottom unless consumers totally give up about the future. We've seen repeatedly in the past that this isn't the case.

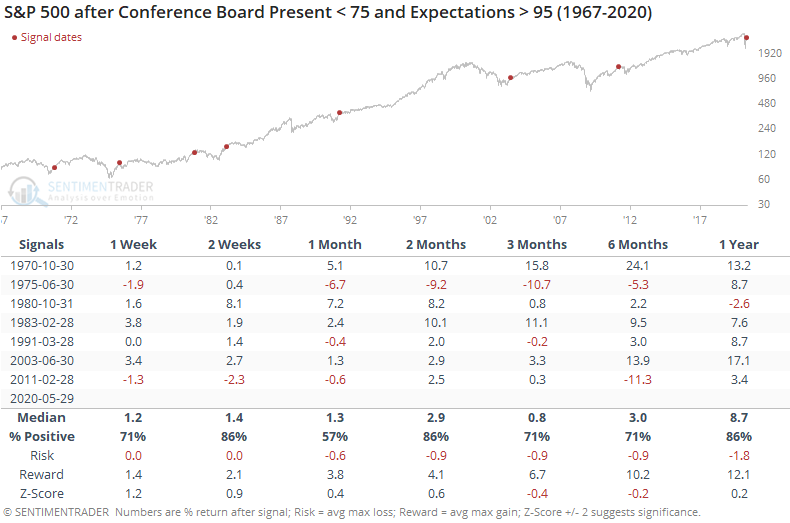

Below, we can see every time since 1967 when confidence about present conditions was below 75 while confidence about the future was above 95.

These are consumers, not necessarily investors, so it didn't always follow the stock market. A couple of times (1970, 2003), we saw this as stocks were emerging from bear markets and consumers were just starting to feel optimistic about their futures again. A few times, it triggered after stocks had already rallied, and future returns were flat or negative.

The overall risk/reward was good, even if average returns were in line with random. Out of the 7 precedents, 5 of them saw flat or negative returns in the S&P 500 over the medium-term, with only 1970 and 1983 taking off to the upside and enjoying double-digit gains over the next 2-3 months.

Because of that tendency to see iffy returns over the medium-term, it's not a strong buy signal. The risk/reward is good even up to a year later, though, so it's certainly not a reason to sell. Opinions will vary on whether the confidence figures favor bulls or bears; the evidence suggests it's a very slight tailwind for the former.