Consumers Can't Lose As Oil Ratchets Up New Highs

This is an abridged version of our Daily Report.

That can’t-lose feeling

Consumers in the U.S. have almost never felt as ebullient as they do now. They are comfortable and confident to a degree rarely, if ever, seen before. The few times in 50 years they’ve been as confident according to the Conference Board, stocks slid over the next 2-3 years amid soon-to-hit recessions.

Oil keeps hitting new highs

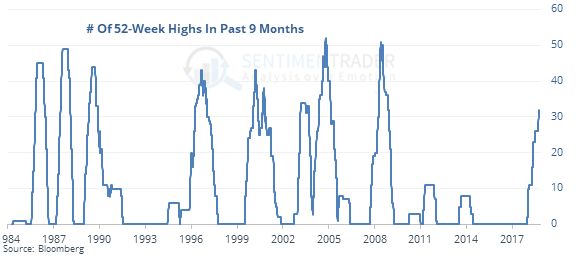

Crude oil has notched more than 30 days with a 52-week high so far this year.

That’s the largest cluster in a decade. Similar clusters of new highs over a 9-month period during the past 30 years has preceded continued upside momentum.

Fed fade

There has been a generally positive bias to “Fed days” when the Federal Reserve announces its policy on interest rates. That has changed since the end of QE in October 2014.

More warnings

Over the past 3 weeks, the NYSE has generated the 2nd most Hindenburg and Titanic technical warning signals in 30 years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |