Strategists' 2018 Estimates; S&P's Relative Strength

This is an abridged version of our Daily Report.

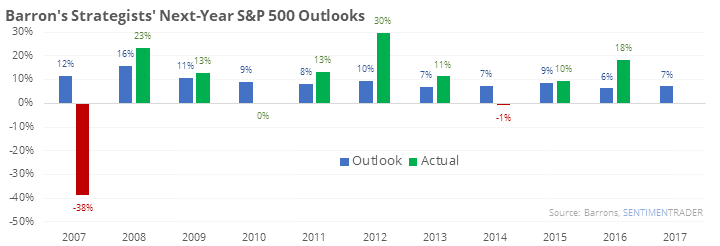

Another 7% gain for 2018

Wall Street strategists are looking for a 7% gain for the S&P 500 in 2018. That’s slightly more optimistic than the Big Money poll a couple of months ago, and it’s about what they estimate every year. Actual results vary greatly, so using the average estimate for next year’s returns is next to useless.

It’s all relative (strength)

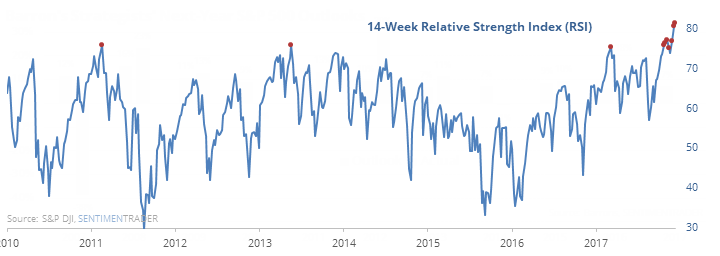

The weekly Relative Strength Index has reached its highest level in two decades. It has surpassed other readings since 2010, which led to immediate pullbacks. Similar readings led to a gain 6 months later 100% of the time.

It’s not just a weekly time frame, either – the RSI is in extreme territory on a daily, monthly, quarterly, and yearly time frame, too, for only the 3rd time in history.

Federal Reserve interest rate decision on Wednesday

The pattern over the past several meetings has been a drift higher in stocks into the release of the statement, then some quick weakness immediately after in the day(s) following.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.