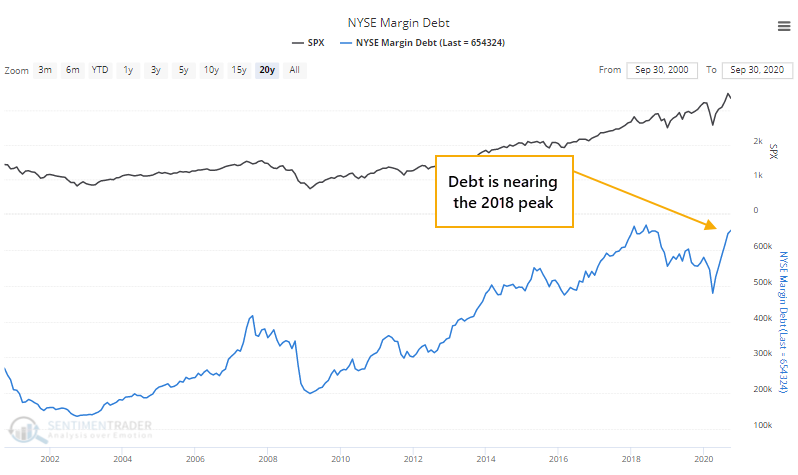

Despite losses, investors borrow more against stocks

Investors have become pretty willing to borrow against the value of their brokerage accounts.

The latest margin debt figures show that investors have pledged more than $650 billion against their stock holdings as of September. That's up more than 35% from the low in March and is nearing a record high.

This is unusual because in September stocks fell and yet borrowings against those holdings increased. Over the past 70 years, it has been unusual to see the monthly percentage change in the S&P 500 differ much from the change in margin debt. There's a fairly high positive correlation (+0.4) between the two, which September violated.

A knee-jerk contrarian would assume this is a bad thing. It suggests that investors are complacent, too willing to increase their leverage despite a market that's not going their way. But it hasn't really proven out that way, with stocks mostly rising in the months ahead.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Forward returns when the S&P 500 falls 3% or more while margin debt rises 1% or more

- What happens when debt rises at least 25% from a multi-year low

- Mergers & acquisition activity in the Oil & Gas sector is at a 17-year low

- Traders are betting heavily against a sustained rise in the VIX

| Stat Box On Tuesday, the most important ETF in the world, SPY, fell to a 2-week low on the smallest intraday range in at least 7 sessions, suggesting a drying up of selling pressure. When it's done this on other days since 1993, it rebounded over the next 2 weeks after 16 out of 18 signals. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

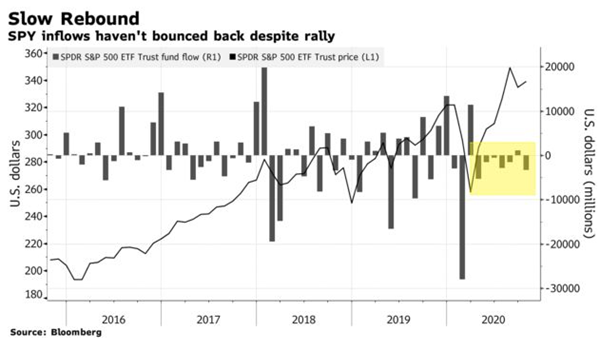

1. The largest ETF in the world is losing assets even as it rises in price (not necessarily sentiment-related) - Bloomberg

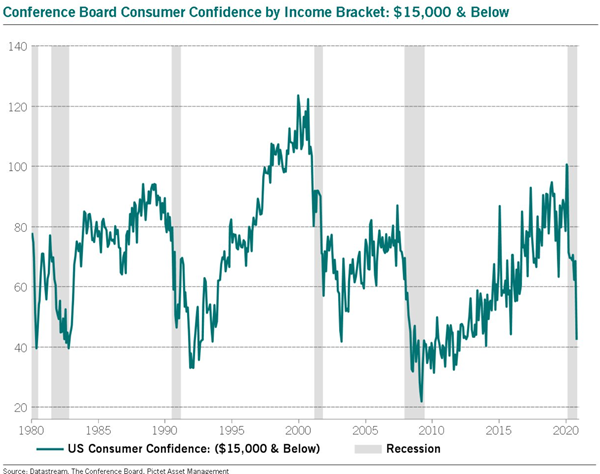

2. Confidence within the lower income bracket has plunged - Pictet

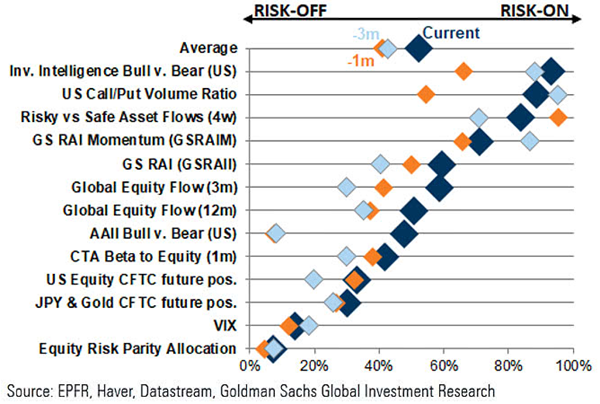

3. Most sentiment indicators are barely changed from 3 months ago - Goldman Sachs